Succession planning does not contribute directly to growth, but it is critical for retaining assets and scaling the practices of the next generation of advisors. Currently, 32% of investors switch firms when their existing advisor leaves for retirement or other reasons, according to McKinsey’s 2024 Affluent and High-Net-Worth Consumer Survey of U.S. investors.

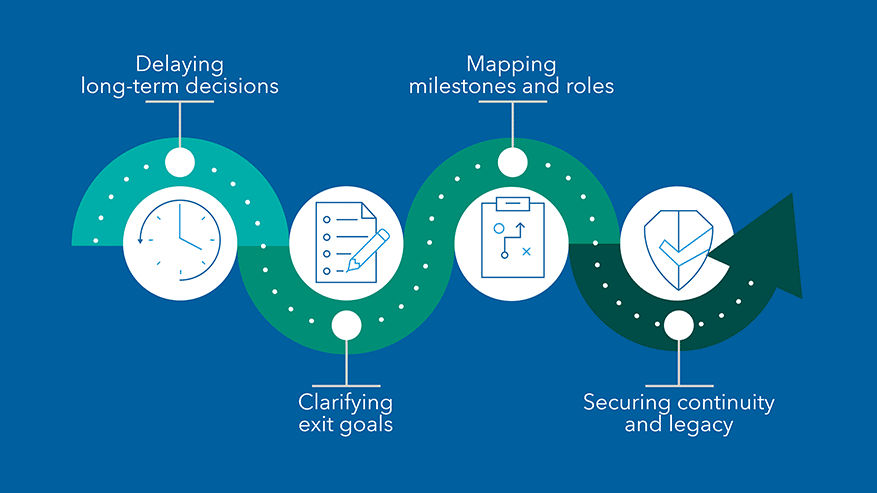

A well-crafted succession plan can help secure your practice’s legacy and inspire client confidence today. That’s why succession planning is more than a final act. It’s a strategic process that ensures continuity, protects client trust and helps create long-term enterprise value.

On this page

“I encourage advisors to start thinking through succession planning almost as soon as they launch their firm.”

— David DeVoe, Founder and CEO at DeVoe & Company

What does a smart plan look like? Walk through key considerations in choosing your ideal succession path — internal transfer, sale or merger. You’ll clarify your timeline, understand strategic milestones and use the step-by-step tool in this lesson to:

- Evaluate options, like transfers, sales and mergers.

- Input your criteria.

- Generate a personalized action plan for succession.

Then look through the accompanying timelines, advisor insights and planning templates to help socialize and implement your strategy with confidence.

INSIGHTS

Planning your succession

In this video, David DeVoe talks about succession planning and how it’s instrumental to the enduring value of your practice.

David DeVoe

Founder and CEO, DeVoe & Company

3MINVIDEO

Data snapshot

Start planning for succession

Advisors who take a proactive approach tend to experience smoother transitions and stronger results. Take a look at how advisors planning to transition in the next decade are approaching succession.

INSIGHTS

Leaving your legacy with Shaun Tucker

In this video, Richmond Wolf discusses the value of a strong succession plan for creating continuity — and cementing your legacy.

Richmond Wolf

Portfolio Manager

Shaun Tucker

Director of Practice Management

3MINVIDEO

Succession path planner

Set succession milestones

Download this PDF to choose a timeline based on how long a transition period you’re planning.

Other modules to choose from

Other lessons in Develop your team

Case studies

See what the theories above look like in real-world practice. Find insights, ideas and inspiration that make it easier to visualize your next move.

Tools and takeaways

What are your next steps to consider? Eliminate the guesswork with these action items that help you build and maintain momentum.