Defined Benefit

- The number of overfunded corporate pension plans has grown steadily in recent years and many of these plans have reached a point where they have sufficient funding to terminate without additional contributions.

- This enviable position has created a new set of decisions for these plan sponsors: Should they terminate the plan? Should they reopen the plan? Should they re-risk the plan investments?

- This paper explores all three choices that are offered primarily to substantially overfunded plans, including key considerations and potential outcomes for each.

An increasing number of corporate pension plans in the United States are overfunded. Certainly not all plans are in this position, and recent market volatility has offered some financial tests, but still, many plans have achieved and maintained full- or over-funded status in the past few years.

A subset of these plans has achieved an even more desirable state of financial independence. For an individual, financial independence is achieved if that person has sufficient assets that they could retire immediately, partially or fully, if they wanted. For a defined benefit (DB) plan, we’ll define financial independence as a state of having achieved a level of funding sufficient to terminate the plan immediately and without additional employer contributions, if the sponsor wanted.

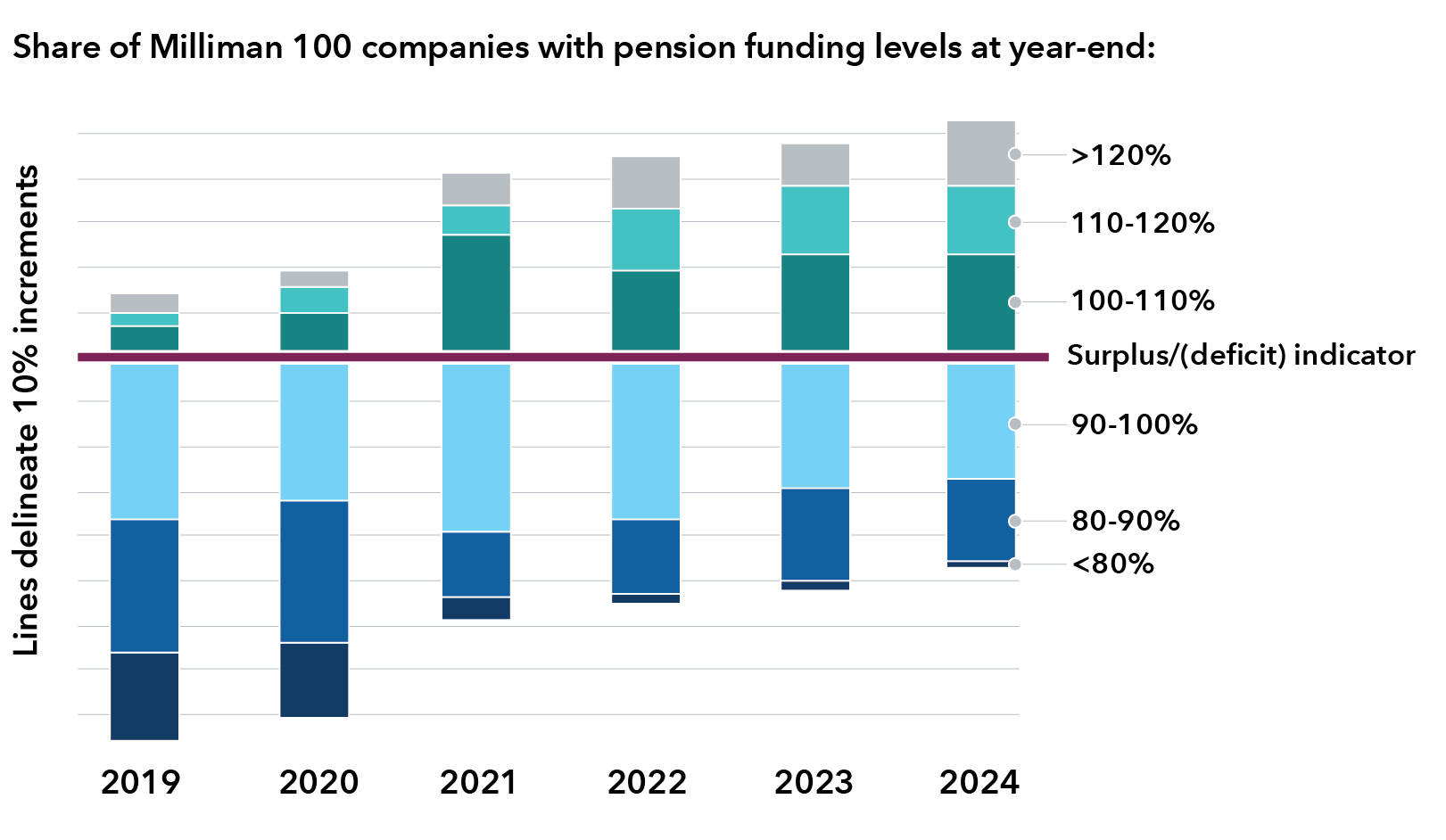

Growth in corporate pension plans with a surplus

Sources: Capital Group, Milliman Corporate Pension Funding Study (2020-2025 editions). Chart shows the distribution of funded ratios for all plans in the annual studies of the 100 U.S. public companies with the largest DB pension plan assets, as of the end of the applicable fiscal years. Some companies in the Milliman studies had fiscal years that differed from the calendar year.

A number of sponsors have now grown accustomed to a state of sustained overfunding and even financial independence, and many are coming to appreciate having a financially independent plan. Those that have taken steps to de-risk plan designs and investment strategies have minimized the chances of revisiting onerous requirements related to employer contributions, variable rate premiums from the Pension Benefit Guaranty Corporation (PBGC) and potentially booking pension expense.

At the same time, a new crop of considerations has sprung up from the abundance of options that accompany financial independence, including three key decisions: Terminate the plan; reopen the plan; re-risk the plan investments. Below we explore the considerations and potential outcomes for each one.

The choice of whether to terminate the plan

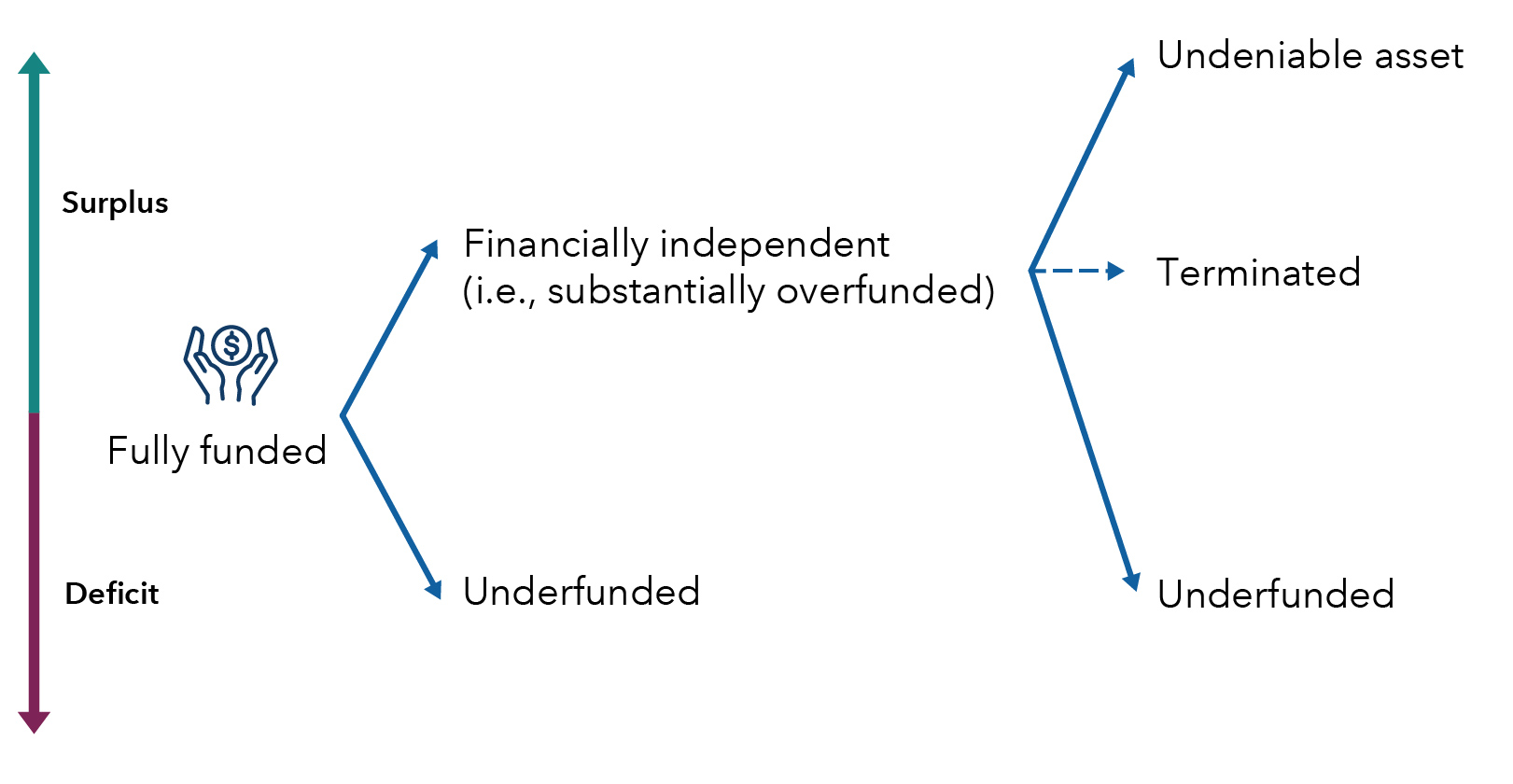

At some hypothetical level of funding, most sponsors would prefer the existence of the plan to its non-existence. It might be as high as 200% funded, to use an extreme example, but at some point an overfunded pension plan becomes what we’ll call an “undeniable asset,” meaning that any reasonable observer would see big picture plan-related benefits outweighing costs, to sponsor and participants alike.

When a sponsor is assessing whether to terminate its plan, it should consider the relative likelihood of a financially independent plan improving to the status of undeniable asset in relation to the risk of its funding falling into painful underfunded territory, and apply a bit of backward induction.

Backward induction framework for assessing plan termination

Source: Capital Group, illustrative and hypothetical only.

The more common framework of comparing a future-cost-and-risk-adjusted economic liability to a termination liability tends to steer sponsors towards the faulty perception that they may terminate if they are fully funded. A fully funded plan may choose to borrow/contribute money or invest its way to financial independence, but may typically not directly terminate.

A more robust exercise involves assessing whether the sponsor would terminate if the plan were financially independent and then strategically weighing how to go about pursuing financial independence. Sponsors are often surprised by how achievable the state of undeniable asset becomes from a starting point of financial independence. Using this forward-looking analysis in reverse, a sponsor may assess the desirability of terminating and/or establish a suitable degree of liability-relative investment risk.

More generally, sponsors should review major or irrevocable decisions such as termination from a diversity of perspectives. They should also take a long-term view and seek to appropriately value flexibility and optionality, which are promoted by retaining an overfunded defined benefit plan on the balance sheet.

The choice of whether to reopen the plan

On the opposite end of the spectrum from terminating, sponsors seeking to derive economic benefit from a pension surplus may explore granting benefit accruals partly or fully in lieu of other employee rewards. For example, a sponsor may reduce employer contributions to a 401(k) plan while simultaneously granting new or increased cash balance pay credits from an overfunded DB plan, as several employers have done in recent years.

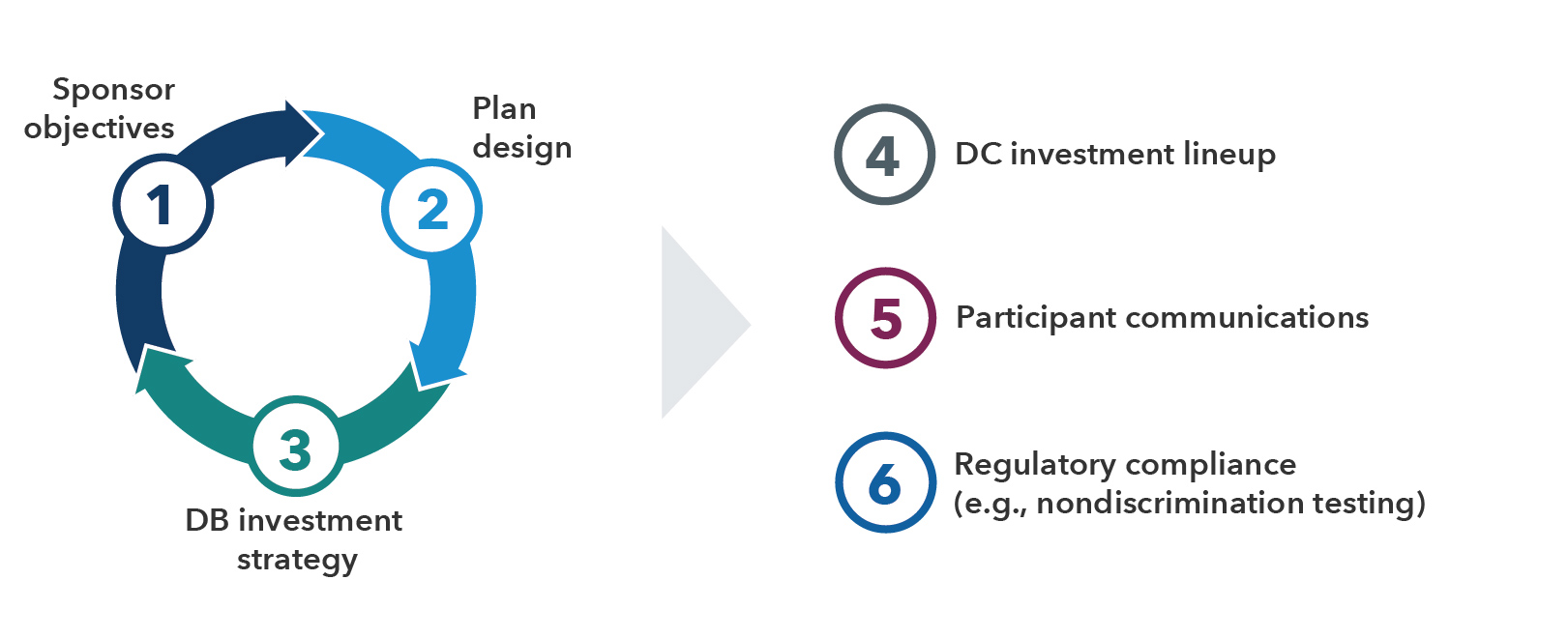

To adequately assess whether reopening is the best choice, a plan sponsor must consider what the reopened plan would look like, at a high level. Three key and interdependent factors should be considered together, iteratively if necessary. An additional three important factors are also depicted below:

Key considerations when assessing potential DB plan reopening

Source: Capital Group.

While not the only means of productively utilizing a pension surplus, plan reopening may be the most efficient and broadly implementable of the current options. Importantly, potential regulatory evolution and creative solutions suggest the opportunity set for recapturing pension surplus on behalf of plan sponsors may still be developing.

The choice of whether to re-risk the plan investments

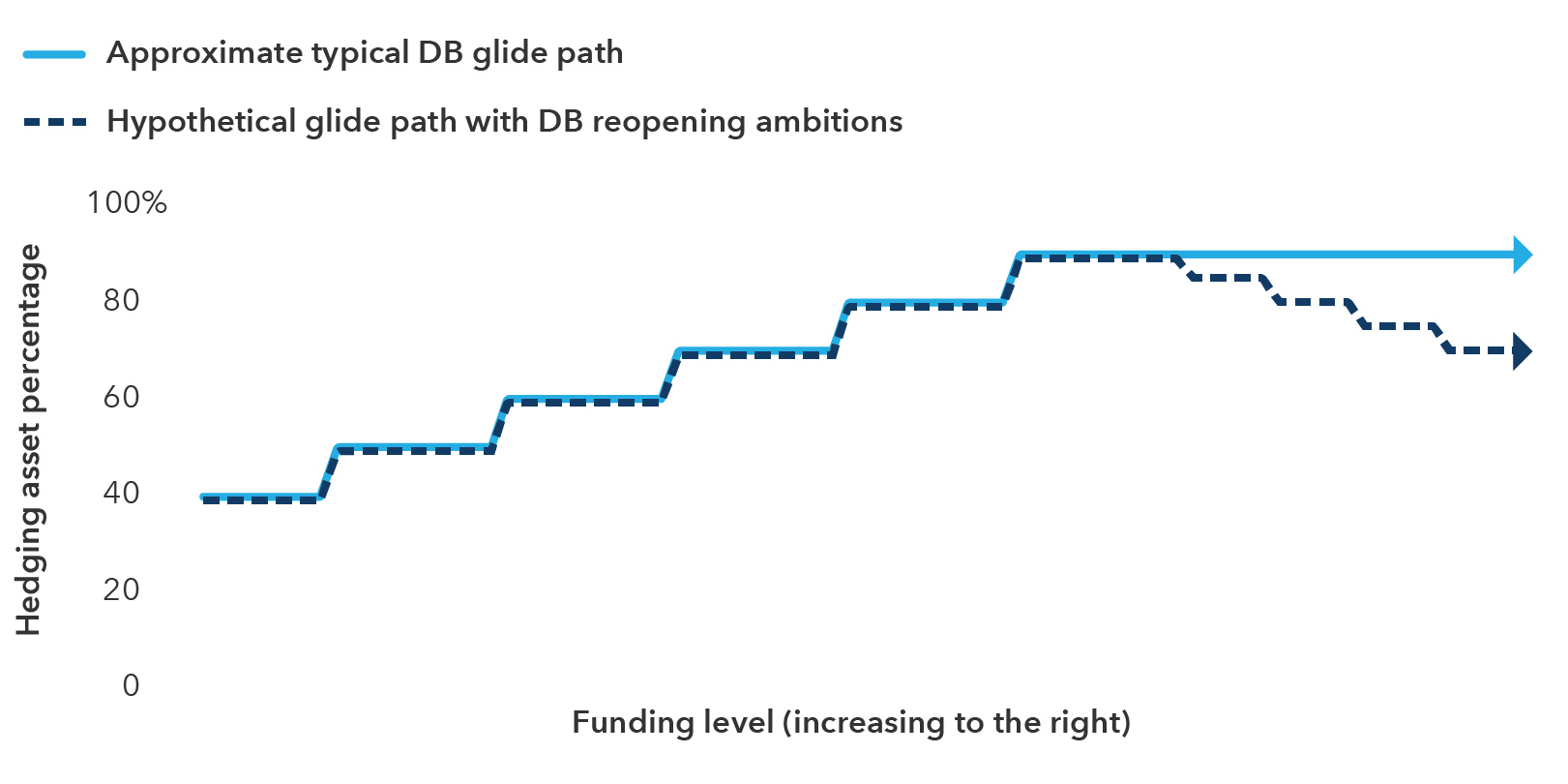

As DB funding levels rise, in some cases above full funding, many DB sponsors will find they have outgrown their de-risking glide paths. These investment governance tools often do not contemplate the state of financial independence, or of funding much beyond 100%. The issue is reminiscent of the defined contribution debate on glide paths de-risking ‘to’ versus ‘through’ retirement, partly driven by the lack of having previously contemplated asset allocation much beyond age 65.

In the case of DB plans, at some point there may be an ability to re-risk plan investments, as the surplus grows to comfortably wide margins, all while remaining mindful of fiduciary obligations. This can help plans achieve the status of becoming a truly undeniable asset, the economic benefit of which may be at least partially recapturable by the sponsor through actions such as plan reopening. A hypothetical risk-dynamic glide path is depicted below:

Hypothetical DB glide paths illustrating ‘to’ versus ‘through’ full funding

Source: Capital Group, illustrative and hypothetical only.

Overfunded plans may also find investing according to a reserve/surplus approach to be intuitive and helpful. In other words, investing a portion of assets equal to liabilities in hedging assets, and investing the remaining surplus assets in a more return-oriented fashion. This approach can be implemented effectively, though care should be taken to step back and assess the entirety of the asset allocation holistically, and in the context of the liabilities.

Plot a course, whether a formal glide path or a looser plan, for what the investment strategy might do if assets achieve and exceed the level of financial independence. Of course, the investment strategy largely depends on the sponsor’s appetite for other key decisions, such as plan termination or reopening.

Don't miss our latest insights.

Our latest insights

-

Liability-Driven Investing

-

Liability-Driven Investing

-

Portfolio Construction

-

Defined Benefit

-

Defined Contribution