Economic Indicators

outlook

As tariffs, trade wars and real wars upend the global economy, the path of equity markets remains uncertain heading into the second half of 2025.

Early progress in tariff negotiations with the U.K., China and India helped calm some of the market turbulence, but with the contours of the global trade landscape still evolving and growth slowing in the U.S., investors should brace for further bouts of volatility.

“I expect stock markets to be noisy in the coming months, because many companies are frozen in place until they have more clarity on where global trade is headed,” says Cheryl Frank, an equity portfolio manager for American Mutual Fund® and CGCV — Capital Group Conservative Equity ETF. “But as the new trade landscape comes into focus, I expect markets to stabilize and a new set of investment opportunities to emerge.”

History doesn’t repeat, but often rhymes

Investors may take comfort in remembering that markets endured tariff-induced volatility in the not-so-distant past. During President Trump’s first term in office, a series of tariffs launched in 2018 sparked a trade war with China that whipsawed markets and dominated headlines, much like today. The S&P 500 Index reacted by falling 4.4% for the year. But as the administration worked out trade deals and consumer spending remained steady, the index recovered sharply in 2019, rising 31.5%.

Markets recovered from trade uncertainty in Trump’s first term

Sources: Capital Group, Bureau of Labor Statistics, Peterson Institute for International Economics, Standard & Poor’s. Value of investment in the S&P 500 reflects the total return of the index over the period from January 1, 2018, to December 31, 2019.

Of course, past results are not predictive of future outcomes. The global economy is much different than it was in 2018, and today’s trade war is on a much bigger scale. But as Mark Twain wrote, “history doesn’t repeat itself, but it often rhymes.” And any further progress with negotiations could provide a strong tailwind for stocks.

“Trump’s first term shows the outcome can vary significantly from the initial headlines,” says Martin Jacobs, an equity portfolio manager with AMCAP Fund® and CGDV — Capital Group Dividend Value ETF. “As someone who believes the market tends to go up far more than it goes down, I am not discouraged by this year’s volatility. I view the dislocation as an opportunity to invest in great companies and multiyear investment trends where I have conviction, setting up the portfolios I manage for years to come.”

2026 Outlook webinar

Thursday, December 18 | 11 AM PT/2 PM ET

CE credit available

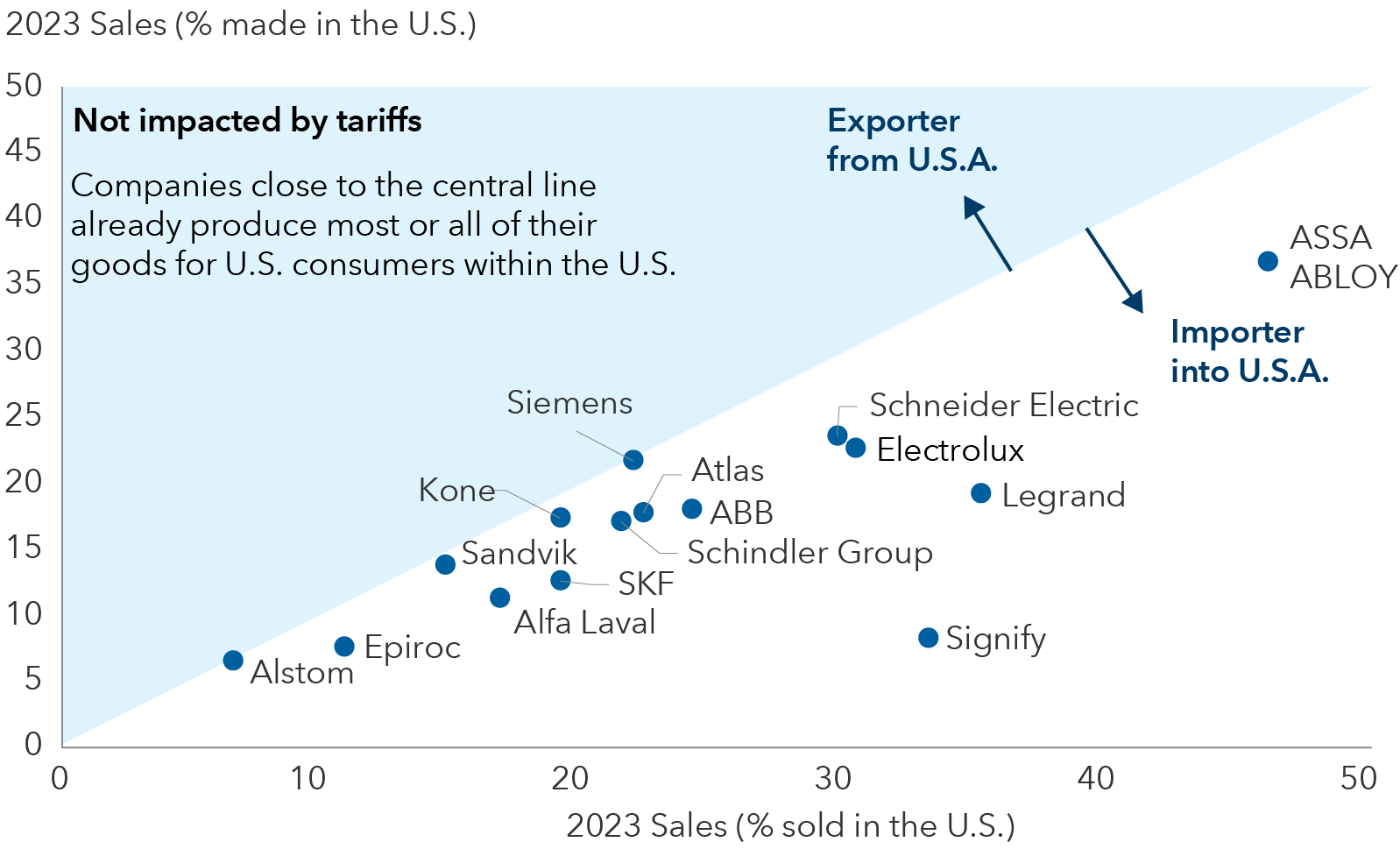

Multinationals go multi-local

Just as markets have proven resilient, well-run companies have been able to adapt to even the most challenging circumstances. Multinational companies, for example, may appear to be among the most vulnerable to the current trade headwinds. On the contrary, many are well positioned because they’ve navigated choppy trade waters for years.

“Many multinationals are developing a ‘multi-local’ approach to business, moving closer to customers in the countries where they operate,” says Jody Jonsson, an equity portfolio manager with New Perspective Fund®.

In the latest example, German industrials giant Siemens opened a $190 million manufacturing plant this year in Fort Worth, Texas. U.S. companies known for building their products overseas are taking the same approach. Apple recently announced it would spend $500 billion on new U.S.-based facilities over the next four years.

That’s one way to get around U.S. tariffs. “We’ve seen that globally diversified, multinational companies have the flexibility, resources and management expertise to compete very effectively, even when the ground is shifting beneath their feet,” Jonsson explains.

Many multinationals have already shifted some production to the U.S.

Sources: Capital Group, Redburn. Data based on internal company estimates as of 2023 sales. As of December 31, 2023.

Multinationals aren’t the only potential winners in today’s environment. Some domestic companies may also be positioned to weather today’s uncertain environment. For example, the once stodgy utilities sector has recently been flexing new growth potential. What’s more, domestic utilities are not subject to tariffs and have historically provided a measure of stability during down markets. “A number of trends, including the wider adoption of electric vehicles, the expansion of data centers and the onshoring of some manufacturing, are driving growth of the power grid that we have not seen in two decades,” Frank says.

For example, Constellation Energy, a provider of nuclear power, forged an agreement in June with tech giant Meta to supply power to its data centers in Illinois for the next 20 years. Similarly, electric and natural gas utility CenterPoint Energy is seeing demand for services rise with population growth in Texas and the construction of data centers.

Frank, who expects market leadership to broaden beyond the U.S. tech giants that dominated market returns through 2024, has also been looking for opportunities to invest in select energy, industrials and defense companies that could benefit from developing tailwinds.

New catalysts for growth outside U.S.

Just as companies have sought to adapt to a changing global order, so too have governments. German chancellor-to-be Friedrich Merz in March declared this to be a “whatever it takes” moment for Europe as Germany, known for fiscal austerity, announced a large fiscal stimulus package focused on defense and upgrading infrastructure.

“There is greater recognition in Europe that it needs to be self-sufficient when it comes to its own defense,” explains Samir Parekh, an equity portfolio manager with Capital Group International Equity ETF and EUPAC FundTM. “This is likely to have positive ramifications for many companies.” While it will take some time for the stimulus to be implemented, it represents opportunity for companies related to defense, building materials and infrastructure. There’s also a sense that the regulatory environment may become more pro-investment and open to change as European leaders seek to boost growth.

Corporate reforms are ongoing in Japan and South Korea, and there are signs of stabilization in China. Thanks in part to a weaker U.S. dollar, non-U.S. stocks have enjoyed a strong 2025. Through June 5, the MSCI Europe, MSCI EAFE and MSCI ACWI ex USA indexes have all outpaced the S&P 500.

International stocks have taken the lead

Sources: MSCI, RIMES, S&P Global. Data through June 5, 2025.

Security could be an enduring theme

As the U.S. and other nations redefine trade relationships and political alliances, governments around the world are taking steps to prioritize security, starting with national defense. Germany’s increased fiscal package includes a larger allotment for defense. In December 2024, Japan’s cabinet approved a 9.4% increase in its defense budget.

“The push for security extends beyond defense to the need for reliable energy sources, stable infrastructure and supply chains,” Parekh adds.

U.S. and Europe both seek to expand sources of traditional energy, as well as pursuing development of nuclear power and other alternatives. Along with these goals, the focus on supply chain and infrastructure security could represent growth opportunities for industrials. For example, global conglomerates like Mitsubishi Heavy Industries in Japan, Siemens Energy in Germany and GE Vernova in the U.S. offer products across power generation, grid modernization, defense systems and cybersecurity categories.

Security concerns in the spotlight

Sources: Capital Group, FactSet. Companies shown are among the largest constituents of their respective sub-industries within the MSCI All Country World Index and are meant to serve as examples of potential beneficiaries from investment across the various security applications listed. As of May 20, 2025.

Positioning portfolios for the future

The investment environment has transformed considerably since the start of the year, when markets reflected exuberance after the U.S. presidential election and U.S. tech giants focused on artificial intelligence generated the lion’s share of market returns. In the months since, risks to the economy and markets have increased, but opportunities are broadening. According to Frank, for long-term investors, it will be important to seek balance in portfolios and maintain flexibility.

“This year it is critical to remain nimble,” she says. “In periods of disruption, markets have tended to punish good companies as well as bad. So, a lot of companies will appear to be on sale. I will take these opportunities to determine where long-term value may lie. This can help lay the foundation for strong return potential in the years ahead.”

As turbulent as markets have been this year, circumstances appeared more dire during the COVID pandemic when industries like travel and restaurants seemed uninvestable. Many of those companies have since recovered. “Living through difficult periods can be unnerving,” Frank adds. “But our job as active managers is to be prepared and act with conviction when long-term opportunity arises.”

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

MSCI All Country World Index is a free float-adjusted, market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI ACWI ex USA Index is a free float-adjusted, market capitalization-weighted index that measures equity market results in the global developed and emerging markets, excluding the United States.

MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted, market capitalization-weighted index that is designed to measure developed equity market results, excluding the United States and Canada.

MSCI Europe Index is designed to measure the performance of equity markets in 15 developed countries in Europe.

MSCI Japan Index is designed to measure the performance of the large- and mid-cap segments of the Japanese market.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

-

Markets & Economy

-

World Markets Review

-

RELATED INSIGHTS

-

Markets & Economy

-

Global Equities

-

Economic Indicators

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Jody Jonsson

Jody Jonsson

Cheryl Frank

Cheryl Frank

Martin Jacobs

Martin Jacobs

Samir Parekh

Samir Parekh