Retirement Planning

At any moment, high net worth investors can face any number of financial questions. What’s the optimal tax strategy? Or how to teach the next generation to steward the wealth they’ll receive? Next to those kinds of weighty topics, retirement can take a back seat. After all, you already have a wealth plan and significant holdings — it might seem that you don’t need any special preparations.

Unfortunately, that’s the wrong way to think about the later stages of your wealth journey. From Social Security to Roth conversions, high net worth investors have a lot of choices to make before they reach retirement age, even if they have no intention of slowing down.

Some choices might seem small but they can add up. Thoughtful strategies for claiming your Social Security benefits can help maximize the benefits available to your household. Regularly reviewing legal and financial documents can save you and your beneficiaries time and heartache. Other choices are daunting, but can have a commensurate payoff — for instance, converting a traditional retirement account to a Roth can come with a cost, but the benefits can be greater over the life of the account.

And whether you’re planning on leaving the professional world behind or continuing your career, your decisions might have hidden implications. For example, if you plan on relocating to your dream home, have you considered how a new residency could impact your taxes? Have you given thought to how you’ll fill your days when you don’t have a business to build or a career to advance?

Fortunately, you’re not alone. Your Private Wealth Advisor has worked with many investors like you, and their legal and tax advisors, to prepare for and help manage their transitions to this stage of their lives. What follows is not intended to be legal or tax advice, and you should consult with your entire team before making any decisions regarding the following issues.

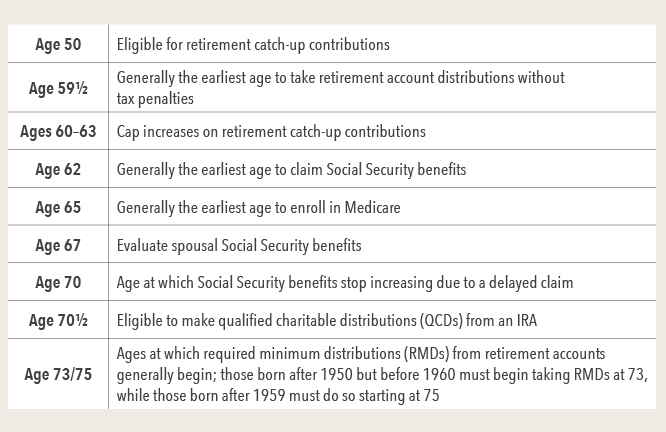

Milestone dates to discuss with your Private Wealth Advisor during the planning process

Source: Capital Group Private Client Services

Social Security benefits might be worth more than you expect.

Too often, high net worth investors don’t consider how to make the most of Social Security. That can be a mistake, as these payments can contribute to meeting the goals you have for yourself and others.

In 2025, beneficiaries who wait until “full retirement age,” currently 67, can receive up to $4,018 a month. Those who wait until 70 for the highest possible benefit may receive up to $5,108, or a little more than $60,000 a year. The federal government has a strong track record of boosting payouts to account for inflation, meaning that future benefits are likely to continue increasing.

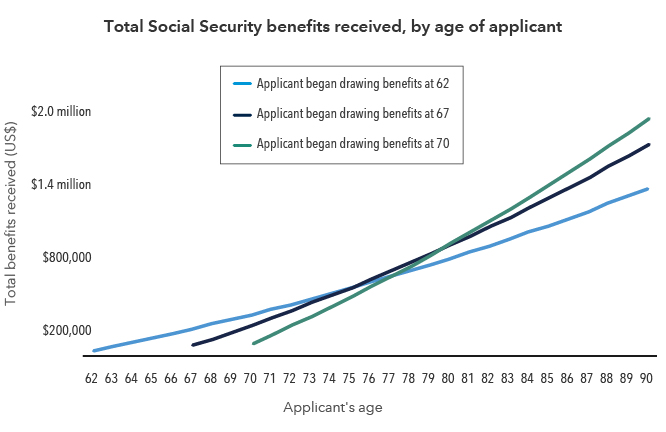

Over time, larger benefits can make a difference. That’s especially true for wealthy investors who have significant assets already — every dollar from Social Security represents a dollar that can continue compounding in a portfolio. We examined several scenarios and found that, after accounting for inflation, hypothetical investors who waited until 70 to take Social Security ended up receiving more in aggregate after eight years than someone who took benefits at 62. Perhaps more important, hypothetical investors who maximized their Social Security benefits had the largest portfolios by age 85 in the average outcome of any group we examined.

That doesn’t mean that everyone should wait for the largest payout, and your individual circumstances — including concerns over potential changes to government programs and policies — should always guide your decisions. Your Private Wealth Advisor can help quantify your thinking.

Delaying Social Security can result in higher total benefits over time

Sources: Social Security Administration, Capital Group Private Client Services. Benefits are pretax and assume an average annual inflation rate of 2.25%.

Roth conversions come with a cost but can be immensely impactful.

The deferred tax treatment offered by retirement accounts can be a powerful contributor to asset growth. However, not all accounts are built the same. Traditional accounts allow for pre-tax contributions, but all withdrawals are taxed at the current owners’ income tax rate; Roths, by contrast, only allow for after-tax contributions but do not levy taxes on withdrawals when certain conditions are met. Depending on where they live, wealthy investors can see nearly half their income go to federal and state coffers, making Roths potentially very attractive.

The good news is that you can convert to a Roth. The catch is that it doesn’t come free — to switch, you must pay income tax on the value of any assets shifted this way. That might sound like a wash, but every dollar withdrawn from a taxable deferred account is taxed the same way, whether it’s principal or asset growth. Roths, on the other hand, are funded with post-tax dollars and, when certain conditions are met, are specifically exempt from income and capital gains taxes, allowing investors to keep all the growth.

Your Private Wealth Advisor can help you evaluate the costs and potential benefits of a Roth conversion.

Take time every year to examine your paperwork.

Annually checking your accounts, wills and trusts is a simple way to ensure that they’re still in line with your wealth plan and legacy goals. Don’t assume that you don’t need to conduct a review just because nothing major happened in the last year — changes to the law can have unexpected ripple effects, and small shifts in your personal or financial life can add up to meaningful differences over time. You can often prevent uncomfortable legal situations later by ensuring that both your beneficiaries and your objectives for your estate are up to date.

Be prepared for surprises.

Approaching “retirement age” — even if it doesn’t feature actual retirement — can bring unexpected hurdles alongside its pleasures. Your Private Wealth Advisor can offer broad insights and can help you think through the potential implications of your decisions, even for plans that might not seem to be strictly financial.

Capital Group Private Client Services does not provide legal or tax advice. For estate planning or taxation matters, investors should consult with a legal and/or tax advisor regarding their individual circumstances.

Related Insights

Related Insights

-

-

Global Equities

-

U.S. Equities