International

After years trailing U.S. equities, international stocks are attracting fresh attention, as a long stretch of underwhelming results is giving way to a variety of promising developments. Those include fiscal stimulus in Germany, corporate reforms in Japan and South Korea, a weakening U.S. dollar, signs of stabilization in China and an improving policy environment in Europe.

The first half of 2025 brought a mix of uncertainty and opportunity. In the U.S., concern over the economic impact of unprecedented tariffs weighed on investor sentiment early in the year. Meanwhile, overseas markets benefited from a rotation into more value-oriented sectors. Momentum continued into the second quarter, boosted by overseas rate cuts and a surge in projected military spending in Europe.

“Once the dust settles, the setup for international stocks looks constructive,” says Samir Parekh, a Capital Group equity portfolio manager. “Starting valuations are much lower relative to the U.S. Many international companies have domestic businesses not exposed to U.S. policy disruption and corporate governance is improving in certain regions.”

Germany’s stimulus has set a new tone for Europe.

Germany’s decision in March to approve one of the continent’s largest fiscal stimulus packages since reunification marks a pivotal moment. This shift from decades of austerity signals a new European willingness to invest boldly, not just in roads and trains, but also in defense, energy and industry.

“Stimulus from Germany will benefit Europe, and we could see a stronger industrial cycle over the next three years,” says Gerald Du Manoir, a Capital Group equity portfolio manager. “That said, it’s going to take time for stimulus to be implemented and work its way through economies.”

European commercial banks, which have become more profitable and amassed significant capital reserves, are poised to benefit from government spending, as well as companies related to building materials and infrastructure. A pool of attractive companies — European insurers, telecom operators and utility providers, for example — are seen as resilient, dividend-paying stocks with minimal tariff exposure. Some may benefit if the euro gains further strength against the dollar.

As defense spending ramps up across the continent, military contractors are also well positioned. Long-term contracts and fresh government support are giving investors new openings across aerospace, logistics and related software.

“There is a greater recognition in Europe that they need to be self-sufficient,” adds Parekh. “The fact that Europe is focused on supporting their economy in the face of what they see as adversarial U.S. policy is likely to have positive ramifications for many companies.”

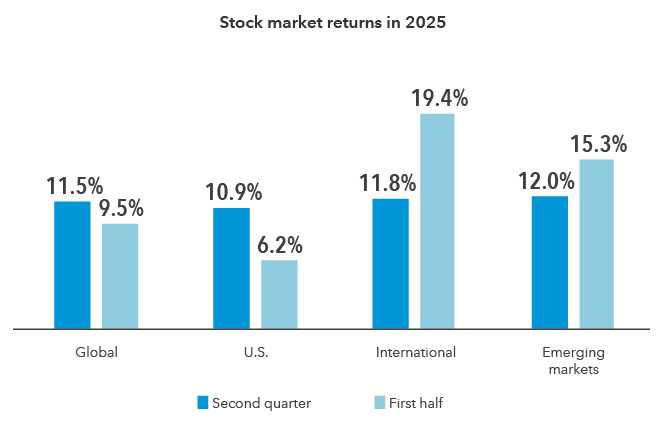

Non-U.S. companies have offered strong returns so far in 2025

Source: Morningstar, Global represented by MSCI World Index; U.S. by S&P 500 Index; international by MSCI EAFE Index; and emerging markets by MSCI Emerging Markets Index. As of June 30, 2025.

Japan could get a boost from trade and corporate reforms.

Japan could benefit from shifting trade alliances. The country’s average tariff rate remains among the world’s lowest, highlighting the potential for productive negotiations amid trade war fears.

In recent years, Japan has emerged as a free trade powerhouse, forging trade agreements such as JEFTA, TPP and RCEP. The country struck trade and digital agreements with the U.S. during the first Trump administration and continues to collaborate in areas such as 5G networks, space exploration and medical research.

Japan’s equity market is also gaining renewed attention from investors. Valuations remain relatively inexpensive compared to other developed markets, and there’s a sense that Japan may finally be moving past the economic stagnation of its so-called “lost decades.” Price growth has edged out of deflation territory and corporate leaders are increasingly focused on efficiency and profitability. Labor practices are evolving too, as a once rigid job market opens up, giving workers more mobility and placing new pressure on companies to compete for talent.

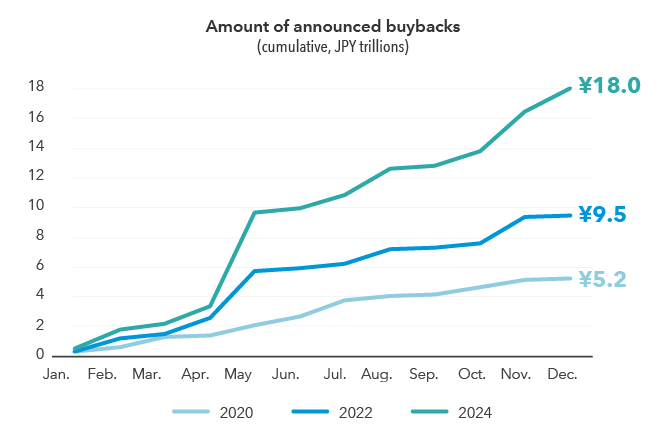

Japan is also undergoing a corporate governance revival. Reforms around profitability still have a way to go and have helped drive robust returns for the MSCI Japan Index since 2023. Companies are being encouraged, both by regulators and by shareholders, to use capital more efficiently and return more of it to investors.

Similarly, South Korea is in the early innings of adapting Japan’s playbook. It wants companies to focus on boosting their return on equity and book value. Potential outcomes could include larger dividends, share buybacks and asset divestitures.

Japanese firms have accelerated stock buybacks.

Source: Goldman Sachs. Data as of December 31, 2024. JPY: Japanese yen.

China may bolster its economy with stimulus.

To counter high U.S. tariffs, China’s leaders may enact stronger stimulus measures, which might indirectly benefit Europe, one of its largest trading partners. China’s export-led economy will likely face strong headwinds from tariffs, especially if its manufacturers saturate other markets with formerly U.S.-bound goods.

Larger stimulus might benefit domestic-focused companies that could benefit from the country’s huge consumer savings stockpile.

Additionally, it’s worth noting that China’s domestic policy is pivoting in a more positive direction for its entrepreneurial economy. Following the success of DeepSeek — a cutting-edge AI training model that made headlines earlier this year for rivaling industry leader ChatGPT — top officials have become more vocal in their support of companies in technology and electric vehicles. In February, China’s President Xi Jinping and top party leaders hosted a rare meeting with the country’s most prominent entrepreneurs.

Diversification matters, in more ways than one.

International equities also present opportunities to diversify a portfolio amid turbulence. Recent trade negotiations have helped calm markets, but there will likely be more volatility ahead. A diversified approach may provide more resilience during such periods.

Beyond trade policy, international markets also offer broad sector exposure. Compared to the U.S., non-U.S. markets are more varied, with greater exposure to heavy industry, energy, materials and chemicals. Robust demand for infrastructure, the energy transition and, now, defense spending offers thematic depth that global portfolios can lean into.

Over the last few years, the main argument in favor of international equities has been simple: cheaper valuations compared to similar U.S. businesses. But new catalysts are changing the narrative for the first time in years. With momentum building and structural reforms underway, international markets that once appealed primarily for their value are emerging as growth opportunities.

Past results are not predictive of results in future periods.

JEFTA: Japan-EU Free Trade Agreement.

RCEP: The Regional Comprehensive Economic Partnership.

TPP: The Trans-Pacific Partnership agreement.

MSCI EAFE (Europe, Australasia, Far East) Index is a free-float-adjusted, market-capitalization-weighted index that is designed to measure developed equity market results, excluding the United States and Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global emerging markets, consisting of more than 20 emerging market country indexes. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

MSCI Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market results of Japan. Results reflect dividends net of withholding taxes. Results reflect dividends net of withholding taxes. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. (7/10/25)

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States. Results reflect dividends net of withholding taxes. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Related insights

-

-

Economic Indicators

-