U.S. Equities

Of the many decades-long forces that have molded the international economy, “globalization” ranks alongside such era-defining events as the demise of communism and the advent of the internet. The globe-girdling trading system that emerged from the aftermath of World War II — and that launched into hyperdrive with China’s entry into the World Trade Organization in the mid-90s — shaped generations of consumers, workers and investors.

Globalization centered on multinational companies building out sprawling supply networks focused on cost efficiency above all else. But a string of disruptions — from the shock of the global financial crisis to the supply-chain breakdowns of the pandemic to the geopolitical upheaval of today — have exposed its shortcomings. While globalization itself is not going away, the system of the past is destined to look vastly different moving forward.

This is shown in how businesses have suddenly become attuned to the fragility of hyper-optimized, just-in-time supply chains. They’re now prioritizing resilience and security — building networks that can absorb shocks, avoid bottlenecks and adapt in real time. They’re bringing some operations back to the U.S. and nearshoring others, even if that reconfiguration is marbled with higher costs.

“Many multinationals are developing a ‘multi-local’ approach to business, moving closer to customers in the countries where they operate,” says Capital Group equity portfolio manager Jody Jonsson. “They are finding ways to adapt and succeed regardless of the environment.”

There’s no doubt that this upheaval is stirring confusion and uncertainty — but it’s also creating opportunity on two broad fronts. First, reshoring requires a lot of new infrastructure in the form of roads, ports, power lines and factories. Second, the utilities sector is emerging as a connective tissue of sorts. As electricity demand surges, so too does the need for long-overdue grid upgrades and new generation capacity.

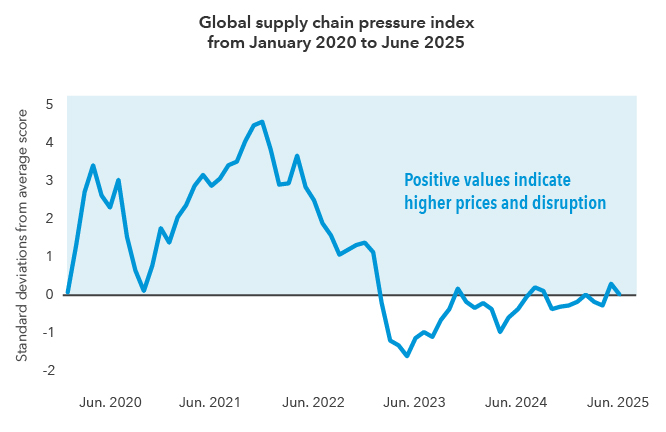

Supply chains were particularly challenged during the pandemic

Sources: Baltic Exchange; Bloomberg; Bureau of Labor Statistics; New York Fed; Haver Analytics; IHS Markit; ISM; Harper Petersen. Standard deviation is a measure of how much a data set varies from its mean. A higher standard deviation represents a wider array of values and thus more volatility. As of June 2025.

Opportunities are emerging in sectors with durable reshoring momentum, such as aerospace and defense, shipbuilding, semiconductors and pharmaceuticals. But there is also appeal among the “pick and shovel” players of this renaissance. That includes construction, automation software and advanced manufacturing tools. And as the industrial base expands, so will its appetite for power, positioning utilities and energy infrastructure as long-term beneficiaries.

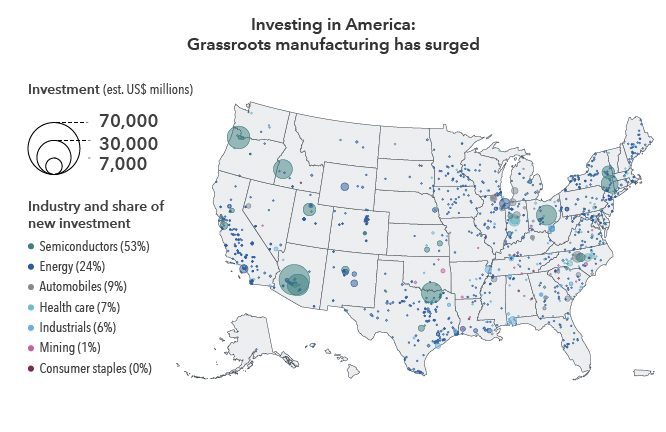

High-value sectors are reshoring some operations.

Semiconductor manufacturing, pharmaceuticals and electric vehicles are among the industries reshoring some operations. These businesses require tight quality control, benefit from access to local talent and customers, and face growing geopolitical risk in global supply chains.

Taiwan Semiconductor Manufacturing, a leading manufacturer of advanced computer chips, announced plans for a $65 billion semiconductor production facility in Arizona in 2020, and began producing its first chips this year. This year, German industrials giant Siemens opened a $190 million electrical equipment manufacturing plant in Fort Worth, Texas.

U.S. companies known for building their products overseas are taking the same approach. Apple recently said it would spend $500 billion on new U.S.-based manufacturing facilities over the next four years.

“It’s important to invest in the industries and geographies where we think reindustrialization is most likely to work — areas with a history of specialized manufacturing in a high value subsector and where government policy can provide additional support,” says Bobby Esnard, a Capital Group economist.

Rising demand for AI is helping fuel an industrial renaissance

Sources: Capital Group, AreaDevelopment.com, Clean Investment Monitor, U.S. Census Bureau, Whitehouse.gov, company reports. Map markers reflect current and upcoming projects that have been announced as of November 30, 2024. Data reflect a sample of infrastructure and manufacturing investments across the U.S., and estimated investment amounts are expected to occur over various timelines. Capital expenditure (capex) is money invested for acquisitions, upgrades, renovations and adoption. It can be tangible (e.g., real estate) or intangible (e.g., licenses, software).

Indeed, experience and know-how is key. It’s unlikely that an industry can spring up anew and compete on the global stage. In recent years, Washington, and Utah have had some success reindustrializing by doubling down on their existing regional specializations, such as aerospace and medical equipment.

Reshoring retail is another story.

Despite the reshoring momentum in certain sectors, consumer goods manufacturing remains deeply globalized. Clothing, toys, home goods and many electronics are still largely produced in Asia, where cost structures, labor availability and supplier networks remain unmatched. For most retailers, moving production back to the U.S. would be prohibitively expensive, with limited benefit to customers or shareholders.

But retail supply chains aren’t standing still. Many companies are rethinking how and where they source products. Some are shifting production to Vietnam, India or Mexico to hedge against rising costs or political tensions with China. Others are investing in supply chain technology to reduce lead times, increase agility and build contingency into their networks. Retailers that rely less on long-term forecasting — such as off-price chains like TJ Maxx and Burlington, which buy inventory opportunistically — are also addressing resilience. By purchasing already-manufactured goods, they effectively shorten their supply chains and reduce exposure to overseas delays.

“Generally, risk can be limited through shorter lead times and either countries of origin with less tariff risk or having flexibility of where you’re sourcing goods from,” says Rachel Bowman, a Capital Group analyst who covers large-cap retail.

Reshoring is accelerating the need for infrastructure.

Reshoring has significant implications, particularly for the U.S. power grid. Existing infrastructure, much of which dates to the mid-20th century, was not designed to accommodate the scale of demand that new facilities represent. Already strained by extreme weather and population growth, the system is being pushed further by the demands of energy-intensive facilities such as semiconductor fabs and AI data centers. This is driving an urgent need for upgrades and expansion.

Data centers, in particular, are emerging as a new and significant driver of energy demand. Industry forecasts suggest that energy use from U.S. data centers could double between 2022 and 2026, with AI accounting for much of the growth. Utilities are now under pressure to build new generation capacity, expand transmission lines and modernize outdated systems. These moves come with large capital needs and long-term investment opportunities.

For example, in Columbus, Ohio, more than 40 data centers have been built or planned across roughly 3,600 acres in suburban New Albany. All of the so-called “Magnificent Seven” tech companies have a presence there, and Intel is constructing a $28 billion semiconductor facility in the same corridor.

Global trade is evolving: U.S. imports from Mexico topped those from China in 2023 and 2024

Sources: U.S. Census Bureau; U.S. Bureau of Economic Analysis. As of June 5, 2025.

The energy transition is paving the way for an industrial renaissance.

These overlapping trends are converging to create an industrial renaissance, with companies in construction, engineering, electrical infrastructure and materials poised to benefit from the increased pace of domestic development. The physical infrastructure needed to support both manufacturing and digital expansion requires an array of equipment, labor and specialized services — much of which is being provided by firms that operate outside of the traditional technology sector.

For investors, the implications are broad. Utilities are deploying capital on a scale unmatched in a generation. Construction and engineering firms are experiencing a surge in demand. Equipment makers and grid tech providers are building necessary tools. These “pick and shovel” investment opportunities may offer more durable value than the marquee projects they support. For example, Lennox International, which is well known for its residential HVAC business, is well-placed to benefit from expected commercial demand. United Rental, a leading construction and industrial equipment rental company, is similarly positioned.

While energy policy remains a point of political debate, the current buildout appears to have broader support than other aspects of industrial policy. Reshoring, energy independence and grid reliability resonate across the political spectrum. Even if clean energy incentives are a target of future policy changes, the broader drivers of energy demand, particularly AI and manufacturing, are expected to remain in place.

What began as a response to changing geopolitics and new technology may ultimately result in a deeper transformation of the nation’s energy systems, with long-term implications for how industry operates and where investment flows.

Instead of one dominant trend, there are multiple overlapping transformations: the reshoring of strategic industries, the modernization of the energy grid, the reengineering of global supply chains. This is creating a more complex, but more compelling, investment landscape.

Related insights

-

-

Economic Indicators

-