outlook

When the first robotaxis debuted in the Bay Area a couple years ago, people stopped and gawked. Nowadays, they barely look up from their phones, as cars loaded with whirring sensors but no drivers have become ubiquitous in San Francisco, Phoenix and other U.S. cities. Clearly, the age of robotaxis — fully autonomous ride-hailing vehicles — have moved from distant sci-fi future to modern-day reality.

All of this has raised intriguing questions about the pace and trajectory of the burgeoning industry. These issues are particularly timely given swift advances in both the underlying technology and the cultural acceptance of the cars themselves. I believe robotaxis are here to stay, but from an investment perspective, the ultimate question is what it will take for companies to achieve long-term leadership in a business that seemed fantastical just a few years ago.

The answer lies partly in the quality of each company’s artificial intelligence (AI), which is the backbone of any self-driving system. However, these days, leadership in AI seems to not last long. Breakthroughs spread quickly, and once-complex capabilities can become widely accessible.

I believe success will also hinge on more prosaic measures, primarily how profitably a company can operate a robotaxi business in different local markets. In other words, how efficiently can it run fleets, work with regulators and earn rider trust. Waymo is so far leading the way in all areas, and its path could open the door for different winners to emerge across regions.

The allure of robotaxis isn’t what you think.

Robotaxis are taking off for more than just their novelty. For most consumers, the draw isn’t the sensors on the roof or the AI running under the hood. It’s the ride itself. Without the variable of a human driver, rides are remarkably consistent: smooth acceleration, clean vehicles and cautious driving.

In a world of surge pricing and aggressive drivers, robotaxis offer a predictability that is hard to match. And that, more than any headline-grabbing innovation, may be what earns them a permanent place in our daily lives.

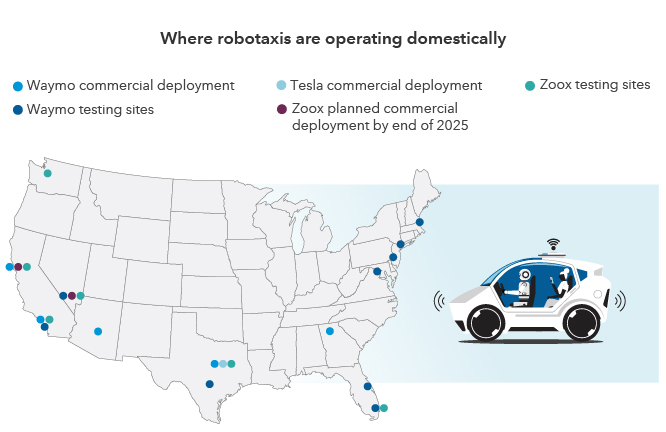

Robotaxi technology is in many U.S. cities

Source. Waymo, Zoox, Tesla. As of July 21st, 2025.

A basic framework helps define the industry.

The self-driving industry is often discussed in futuristic terms, but much of it is still grounded in a five-level framework developed years ago.

Level one and two systems are found in most new cars today. They offer driver assistance, not full automation — think lane assist or adaptive cruise control — but you’re still expected to keep your hands on the wheel and eyes on the road.

Level three introduces more autonomy. Cars have self-driving capabilities, but someone must be in the driver’s seat ready to intervene. Importantly, if an accident occurs while self-driving is engaged, the fault lies with the vehicle’s software, not the driver. There are a few level three vehicles on the market today, but, so far, the self-driving feature can only be used in specific situations, often on highways.

The robotaxis taking over cities are operating at level four, achieving total self-driving capabilities within carefully mapped zones. Alphabet’s Waymo, May Mobility, Hyundai’s Motional, Amazon’s Zoox and, most recently, Tesla have deployed level four fleets.

Once autonomous vehicles can drive anywhere, at any time, even on unfamiliar roads, they will have reached level five. This is still far away in the future due to the unique driving conditions present throughout the world. In the meantime, level four is good enough to be the backbone of a business if companies can manage to scale profitably.

Can a software-first model usurp the brute force one?

Two of the biggest names in robotaxis — Waymo and Tesla — have taken different approaches to developing their autonomous vehicles.

Waymo sends sensor-packed vehicles into new cities to slowly, methodically map all the roads and obstacles. Its vehicles have sophisticated light detection and ranging sensors that allow each car to perceive its surroundings in 3D, even in low-visibility conditions. And its AI is backed by 15 years of driving data, an incredible AI team and manually coded responses to unusual scenarios, such as avoiding confusing intersections. It’s a costly process that presents some scaling challenges, but manually addressing these scenarios has been the only way to develop a robotaxi fleet that is safer than human drivers, so far.

Tesla, by contrast, is betting on a software-first, hardware-light model that uses just cameras. Its strategy is to let AI handle everything, training its model with the massive amounts of real-world driving data from the millions of Tesla cars already on the road. The company rolled out its first robotaxi program in Austin, Texas in June. Results are still early but I’m watching closely. I’m optimistic that a model like this can work eventually. If it does, it would unlock the lowest cost robotaxi program yet. In the meantime, Waymo and other hardware heavy companies will continue to scale.

The competitive edge might be operational.

Building a robotaxi is part of the battle — operating a fleet is something else entirely. It’s a logistical business that requires working with local regulators, vehicle maintenance, user acquisition and community outreach, which could be necessary if residents push back on the presence of driverless cars in their neighborhoods.

This is why I believe the long-term winners in the robotaxi race won’t just be the companies with the top software. They’ll be those with the best operational playbook to launch successfully in new markets.

Crucially, I don’t think there will be a single winner. As AI models become easier to replicate or license, the true differentiator will be execution. This opens the door to different winners in different regions, whether it’s a U.S. operator scaling in North America or an Asia-based firm dominating in China.

As the technology spreads, so will the chances to back new leaders, city by city, market by market. Though the technology may seem futuristic, the themes around building a successful business are familiar: profitably scaling, safety, trust and getting the details right.

Related insights

-

-

Economic Indicators

-

Robin Prendes

Robin Prendes