U.S. Equities

For travelers of an earlier era, cruise ships might best be described as floating hotels known for stately dining rooms and clusters of deck chairs. The experience was elegant and relaxing — albeit a tad sedentary. Today, that image couldn’t be more outdated. Modern-day ships are more like seafaring entertainment centers — chock-full of outdoor water parks, indoor skydiving and go-kart racing. Some even feature access to private islands.

The kaleidoscope of amenities is part of a larger transformation in which the industry is adapting to — and benefiting from — shifting tastes in travel. With younger consumers in particular prioritizing experiences over material goods, activity-laden voyages are attracting a more youthful cohort. At the same time, leading companies have retained the loyalty of traditional customers.

Equally important, the industry has created new revenue streams by altering its previously all-inclusive business model. For example, while adrenaline-pumping activities and fine dining are alluring, they may come at an additional cost on top of one’s ticket.

To be sure, the cruise industry is not without its challenges. The risks were cast into sharp relief when travel ground to a halt during the pandemic, forcing cruise lines to take on billions in debt while ships stayed docked for months. Although initially slow to rebound because of CDC guidance, top cruise lines are now experiencing skyrocketing demand and success with their evolving, higher-margin business models. As a result, I believe the industry is positioned for sustained growth in the years to come.

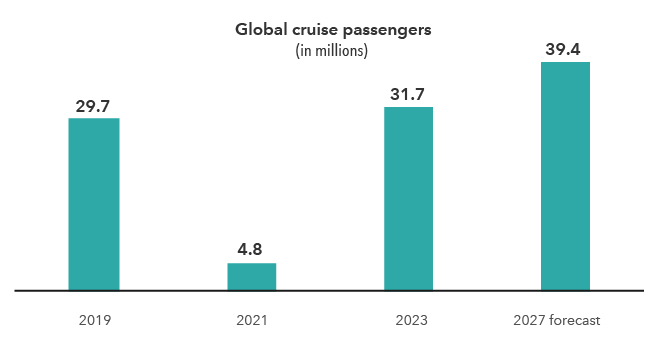

Passengers have embraced cruise ships

Sources: Statista, CUA 2024 State of the Cruise Industry Report. As of April 2024.

“Land travel” is losing appeal.

Cruises have long marketed themselves as offering strong value compared to land-based alternatives. In recent years, as domestic travel has become more expensive and less predictable, they are gaining even more ground. The hospitality industry, still recovering from pandemic-related labor shortages, has experienced rising costs and, often, declining service. Pared-down services, such as less frequent hotel room cleanings, have become the norm.

Cruise lines have largely avoided these issues. By employing a global workforce, they have kept labor costs down, ensuring consistent service that didn’t pass on inflationary pressure to consumers.

As a result, cruises are booking further in advance than ever before. In the past, savvy travelers could secure last-minute discounts as cruise lines scrambled to fill ships. Today, consumers are incentivized to plan ahead, a reflection of the growing popularity of cruises. Consequently, those looking for a last-minute bargain can find themselves stuck with higher prices.

Premium offerings are changing the onboard experience.

Successful cruise lines are continually investing in ways to make their vessels friendlier to all types of travelers. For one, the onboard activities on the top cruise ships are becoming more wide-ranging and elaborate. Royal Caribbean’s Icon of the Seas, which was the world’s largest cruise ship when it first set sail in 2024, includes several pools and water slides, an escape room, laser tag, rock-climbing walls, mini golf, sport courts and an arena for ice skating shows. It even features an “AquaTheater,” where athletes perform aquatic stunts.

The cruise industry’s revenue model is also shifting to cash in on certain high-value amenities. A basic cruise ticket still includes accommodations, meals and general entertainment, but some of the onboard experience has shifted to a variation of the “freemium” model. On top of the complimentary amenities and activities, customers can now reserve and pay for premium add-ons before they even step on board thanks to improved online booking systems that make it easier to reserve such experiences ahead of time.

Norwegian’s Encore ship is popular for its fine dining restaurants — which come at an added cost — including a tapas bar serving Asian-Latin fusion cuisine as well as a sister restaurant to Scarpetta, the upscale Italian eatery with outposts in Manhattan and Las Vegas. Royal Caribbean’s Icon of the Seas also boasts premium dining establishments, such as a high-end steakhouse, hibachi eatery and an Old New York-inspired restaurant serving multi-course dinners with wine pairings.

The trend toward advance booking also complements the “fresh wallet” effect. Since travelers typically pay for any extras months before they embark, they are more comfortable spending further while onboard.

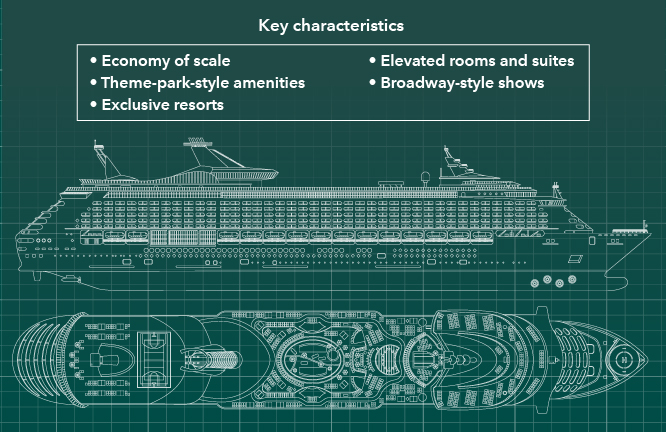

Profitable cruise lines tend to share key characteristics

Source: Capital Group Private Client Services

Exclusive destinations also drive revenue.

Private destinations have become a cornerstone of the modern cruise experience. The companies are increasingly leasing islands or beaches, turning them into exclusive stops for their guests — not to mention another opportunity to capture more customer spending. By stopping for a day on their own islands, cruise lines keep passengers spending money “in-house” as opposed to at port cities.

One notable example is Royal Caribbean’s $250 million revamp of a private island in the Bahamas, which it completed in 2019. The island now includes a Las Vegas-style pool party experience, a beach club with overwater cabanas and a water park complete with soaring slides and a wave pool.

I believe that the companies that are positioned for success will be those with the best ships, the most exciting experiences and access to exclusive islands. With rising demand for experiences, a more diversified revenue model and a focus on travelers of all ages, I foresee the top industry players continuing to churn out higher margins as they fine-tune this business model.

Related Insights

Related Insights

-

-

Global Equities

-

U.S. Equities

Todd Saligman

Todd Saligman