Participant Education

Health saving accounts (HSAs) were introduced in the early 2000s to increase the adoption of high-deductible health plans and, in turn, reduce health care costs for companies and employees. But as of 2024, just one in five workers with health insurance had an HSA, according to health policy researcher KFF, and few of them took advantage of the HSA’s investment options.

To encourage greater adoption, employers are becoming increasingly sophisticated in the way they position HSAs within the overall retirement security benefit package. Rather than framing them solely as a health benefit, many employers are highlighting how HSAs can work alongside the defined contribution (DC) plan to promote better retirement outcomes.

Unlocking the power of HSAs

An employee can access an HSA if their employer offers a consumer-directed health plan (CDHP), which typically carries a higher deductible than other kinds of health plans. These plans were intended to lower health care spending by exposing employees to the costs of medical treatment through the high deductibles. Nevertheless, per capita health care spending in the U.S. nearly tripled from 2000 to 2022, according to the World Bank, posing a significant threat to retirement readiness for many U.S. workers.

HSAs can be a powerful tool to help. They offer employees a triple tax-free structure: tax-deductible contributions, tax-deferred growth and tax-free withdrawals for qualified medical costs.¹ Employees typically have the option to invest their HSA balances in stock and bond funds and other instruments to help build savings for future health care expenses. Amounts that are not invested are usually held in low-interest-rate deposit accounts. Many employers also make annual contributions to HSAs to encourage the adoption of CDHPs.

However, most employees with HSAs are missing out on the potential for investment gains. More than half of the total assets in HSAs are held in deposit accounts, and nine out of 10 HSAs have no investment holdings, according to June 2024 figures from Devenir Research. Encouraging employees to consider investing more of their HSA balances is an important way that employers can help them unlock the potential of these accounts.

To do so, companies are focusing on their HSA investment menus and providing more employee education. Many ideas from DC menu planning can be applied to the investment options in HSAs. In addition, factors that influence HSA investment decisions – such as career stage and risk tolerance – follow well-established patterns used in DC planning. With support and guidance from plan sponsors and financial professionals, savers can learn to view HSAs as not simply a health care benefit, but a pillar of retirement security.

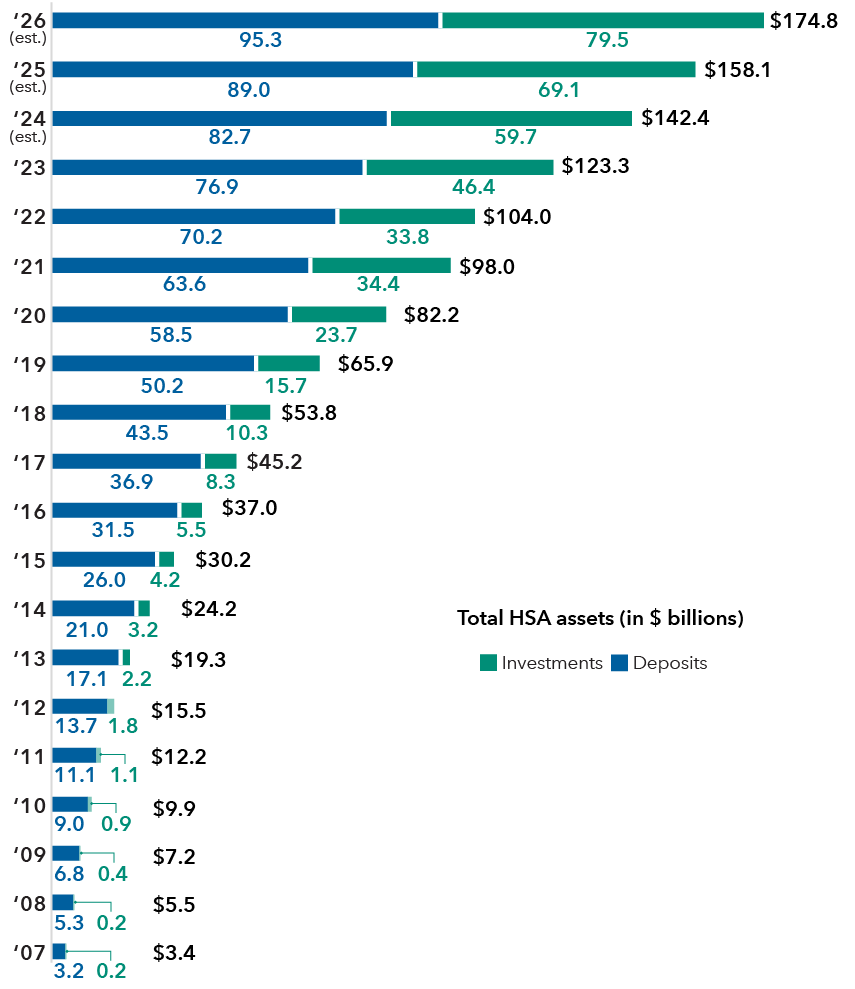

HSA assets are growing

As of June 2024, nearly 38 million HSAs were holding $137 billion in assets, a year-over-year increase of 5% for accounts and 18% for assets. However, just 3.2 million of those accounts — less than 9% of the total — were even partially invested.

HSA assets are on the rise

Source: Devenir Research. As of June 30, 2024.

Help employees make the most of their HSA

There are many ways that employers can help employees maximize this benefit.

- Create an HSA investment menu. This is the first step if your HSA currently has no investment options. Consider using a target date series or mirroring the DC plan menu. Provide a range of options to give employees access to investments across the risk spectrum.

- Highlight costs. Help savers understand the costs of medical care in retirement and how HSAs can be used to address them.

- Explain the importance of investing HSA balances. The large amount of HSA assets held as deposits suggests that many employees believe it’s best to be ultra-conservative with money earmarked for health care expenses. But with that approach, they might not even keep up with medical cost inflation. Explain how investing at least some HSA money in vehicles with more growth potential could help them cover future medical expenses more easily.

- Encourage a holistic approach. Help savers understand how their time horizon, financial situation, risk tolerance and anticipated health care spending factor into the HSA investment decision. For example, an employee with few current health care expenses and a long horizon to retirement might benefit from investing a significant portion of their HSA in a range of vehicles, including more growth-oriented equity funds. Help them understand how the HSA can ultimately help supplement their retirement nest egg by providing a funding source for unexpected medical costs later in life.

- Differentiate. Distinguish HSAs from “use it or lose it” flexible spending accounts. Explain tax differences between HSAs and DC plans. Highlight the triple tax-free benefit of HSAs.

¹ Tax benefits noted are at the federal level. Some U.S. states vary in their tax treatment of health savings account contributions and investment gains.

Although target date portfolios are managed for investors on a projected retirement date time frame, the allocation strategy does not guarantee that investors' retirement goals will be met.

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

Don't miss our latest insights.

Our latest insights

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Ryan Tiernan

Ryan Tiernan