Economic Indicators

Aerospace

Every two years, the commercial aerospace industry gathers at the Paris Air Show, where flashy aerial exhibitions, the unveiling of multibillion-dollar plane orders and the latest tech wizardry are on display. We attended the June event, which was a good reminder of the secular growth, wide moats and good management teams this sector possesses.

We believe global aerospace is a well-positioned industry for a decade-long cycle of growth, absent a major geopolitical crisis or a deep recession.

Commercial aerospace firms are riding multiple tailwinds that could help boost earnings, margin power and cash flows. The setup is favorable, and one any industry would covet: There’s strong demand, tight supply, great pricing power and growth visibility over a long cycle. These dynamics may support the group moving forward — even after a multi-year run for many stocks and an increase in valuations.

Here are three takeaways from our conversations with industry executives at the Paris Air Show that underscore why we think the outlook is attractive for commercial aerospace.

- Business is booming for aftermarket services. When COVID hit, travel ground to a halt and airlines canceled orders for new planes. Global air travel has recovered. However, due to supply chain challenges, airlines have relied on existing fleets and retired fewer aircraft, creating vibrant demand for the maintenance and repair of engines and components — the most profitable slice of an aerospace company’s business. It is also an area with pricing power. Aerospace firms have raised prices for many years and appear to be in a position of strength.

- Supply chain issues are improving. The industry underwent layoffs and retirements during the pandemic, a factor that has led to longer delivery lead times for new aircraft. While the situation is improving, deliveries of new planes have been pushed out and will take several years to ramp up, in turn helping the profitable aftermarket service business.

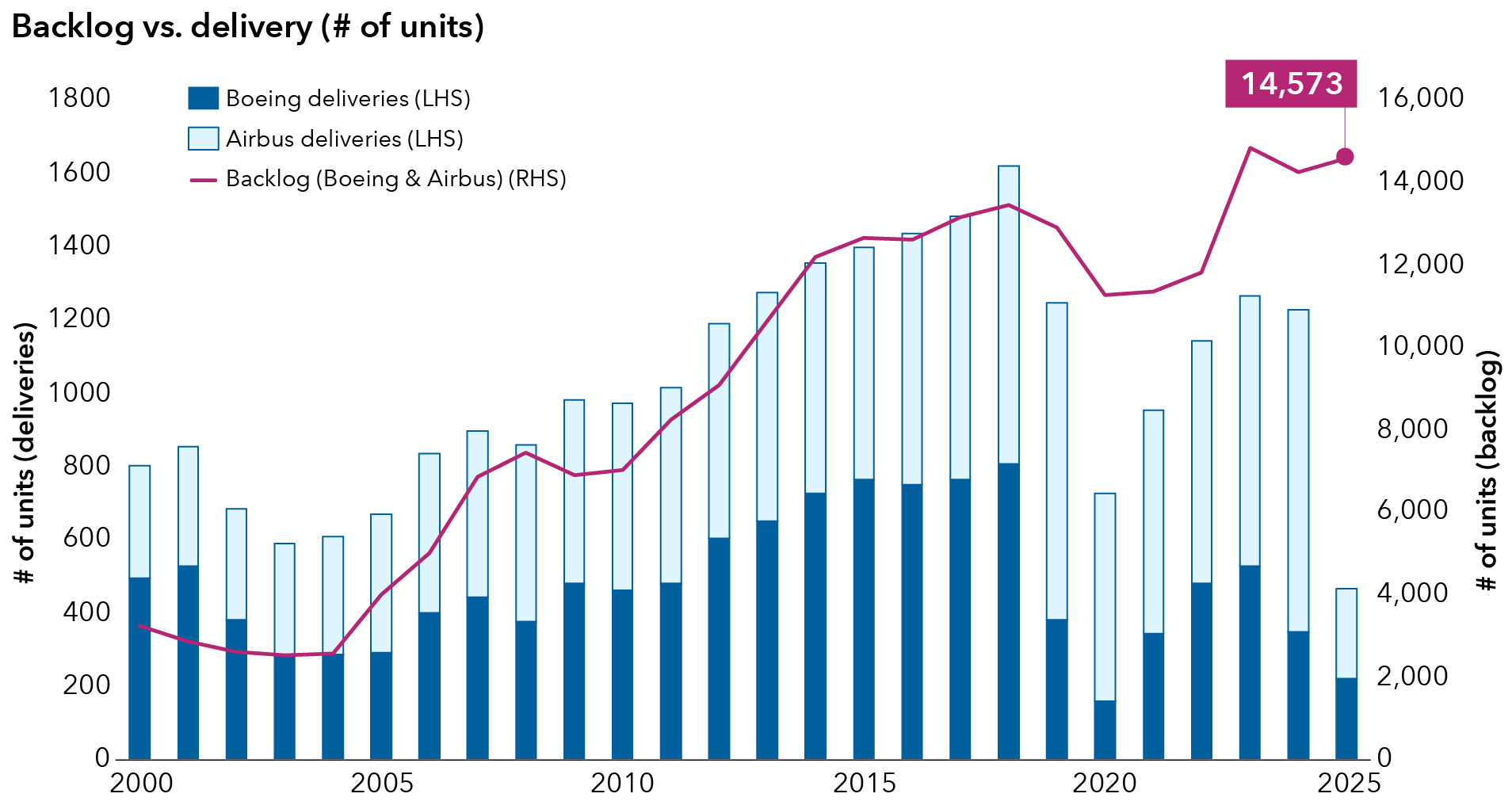

- The delivery cycle is likely to grow into the next decade. Long-term demand looks bright for new aircraft (narrow and widebody), engines and related components. Backlogs for aerospace companies are growing with the resurgence of travel, the need to replace older planes and an increase in middle-class income in certain emerging markets. One example is India, where rising wealth has spurred demand for air travel inside and outside the country.

Commercial airplane backlogs have rebounded

Sources: Airbus, Boeing, Goldman Sachs. As of May 31, 2025. The bar and backlog for 2025 shows data through May 31, 2025.

Bottom line

The Paris Air Show reinforced our view that the aerospace industry is poised to enjoy a favorable business environment, driven by improving volumes, strong pricing, an improving supply chain and low levels of capital expenditures, which may translate into higher cash flows.

The situation is appealing because the aerospace business is essentially an oligopoly. Airbus and Boeing, for instance, dominate global airplane manufacturing, while the likes of Safran, Rolls-Royce and GE Aerospace command significant market share in aircraft engines and components.

And lastly, amid some concerns about too much exposure to a concentrated U.S. equity market in technology-oriented stocks, we find commercial aerospace is an attractive investment opportunity that will provide broader international exposure in both growth- and dividend-oriented portfolios.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets.

The MSCI USA Index is a free float-adjusted, market capitalization-weighted index that is designed to measure the U.S. portion of the world market.

The MSCI World Aerospace and Defense Index is composed of large and mid-cap stocks across 23 Developed Markets countries.

Our latest insights

-

-

-

Markets & Economy

-

World Markets Review

-

RELATED INSIGHTS

-

Markets & Economy

-

World Markets Review

-

Global Equities

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Renaud Samyn

Renaud Samyn

Johnny Chan

Johnny Chan