2. The Fund may invest in emerging market securities and may be subject to additional risks arising from factors such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

3. If the Fund invests in debt securities which are below investment grade or unrated, including high yield bonds, it may, as a result, be subject to liquidity, volatility, default and counterparty risk.

4. While the Fund uses derivative instruments in a prudent manner for investment purposes, hedging and/or efficient portfolio management, in an adverse situation, derivative instruments may expose the Fund to a risk of significant loss.

5. The Fund may at its discretion pay dividends out of and/or effectively out of capital. This amounts to a return of part of an investor’s original investment or distribution of capital gains. This may result in an immediate reduction in the net asset value per share.

6. The currency hedging process used for currency hedged share classes may not give a precise hedge; there is no guarantee that hedging will be totally successful.

7. Investors should not make any investment decision solely based on this document.

OPPORTUNITIES

Income in the new investment regime

While interest rates have languished at near-zero for many years, they are back with a vengeance. It is now possible to derive a meaningful level of income from a globally diversified portfolio of bonds.

The power of 4

Capital Group Multi-Sector Income Fund (LUX)

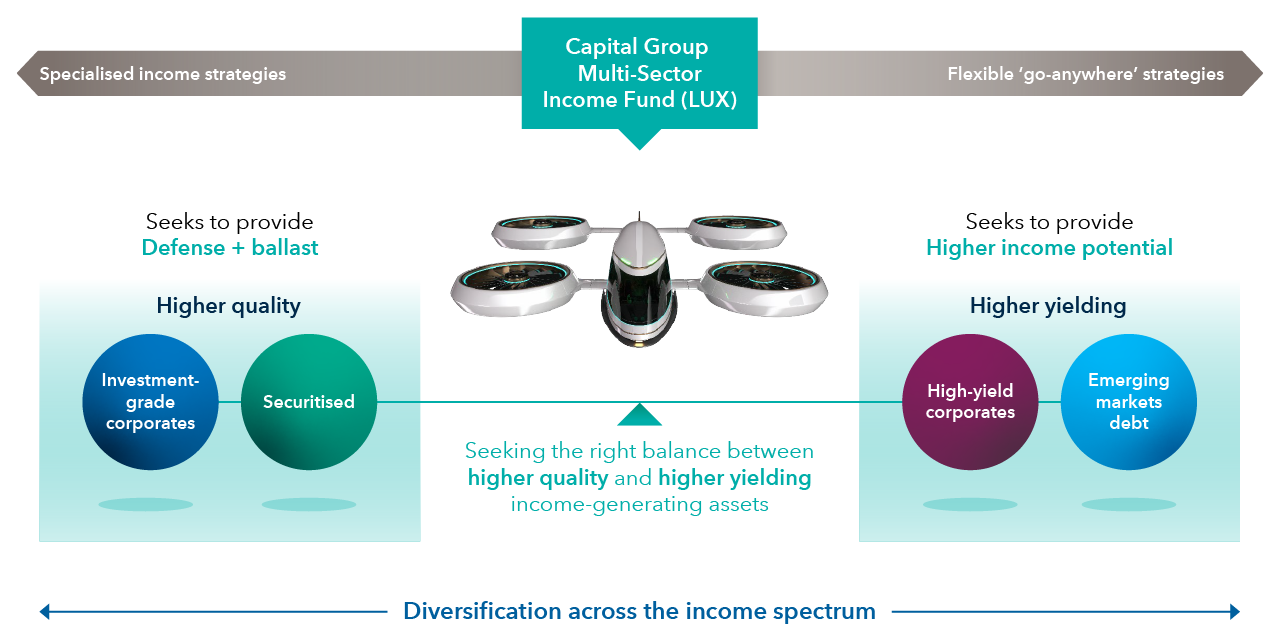

A fund that combines the four fixed income sectors in a single portfolio offers the potential to benefit from attractive income with less volatility.

The Multi-Sector Income Fund combines the power of four key fixed income credit sectors, each of which has distinctive income characteristics.

Investment-grade corporate bonds

Bonds issued by companies to finance their spending or investment. Considered higher quality, typically meaning they carry a lower risk of default but consequently tend to pay a lower income. The main focus is on US bonds.

Emerging market bonds

Bonds issued by governments or companies in developing countries, which typically offer higher growth prospects but carry greater risks given their stage of development. Here we primarily focus on government bonds issued in US dollars.

High-yield corporate bonds

Bonds issued by companies to finance their spending or investment. Considered generally lower quality, typically meaning they carry a higher risk of default but consequently tend to pay a higher income. The main focus is on US bonds.

Securitised bonds

Financial securities that are created by securitising individual loans. These can range from residential or commercial mortgages, to auto loans or other asset-backed securities.

The fund seeks an optimal balance between high-quality and high-yielding assets. High-quality bonds offer stability and resilience, while bonds with higher income potential can enhance cash flows and yield. A well-balanced mix of these assets can deliver a robust level of income while aiming to keep risks in check.

Our portfolio managers have the flexibility to dynamically change, or ‘tilt’, the portfolio across the four sectors to reflect our latest investment views. This flexibility helps managers to take advantage of opportunities and mitigate risks where possible.

Diversification across income sectors

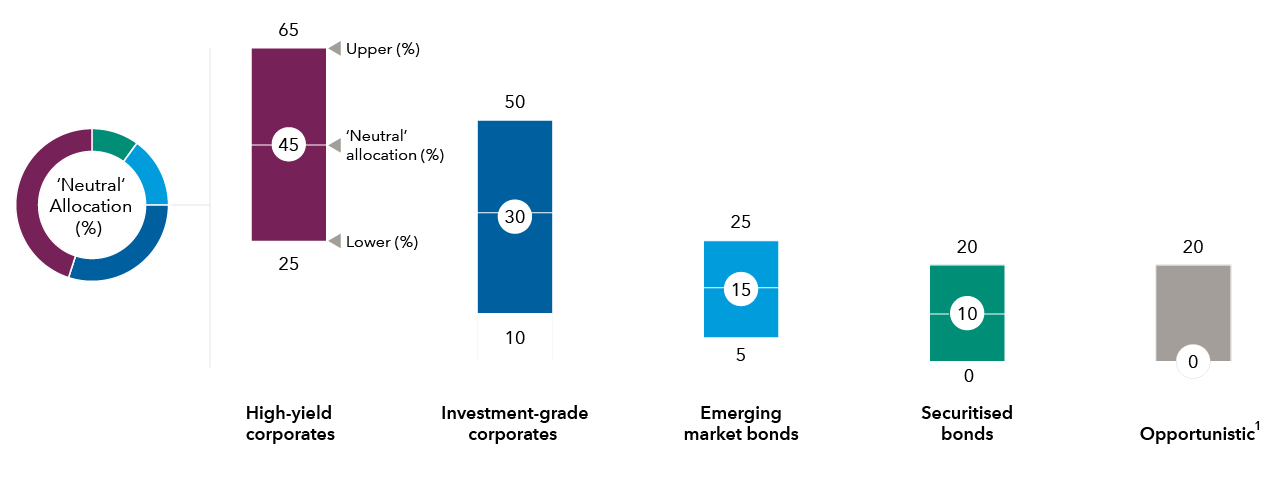

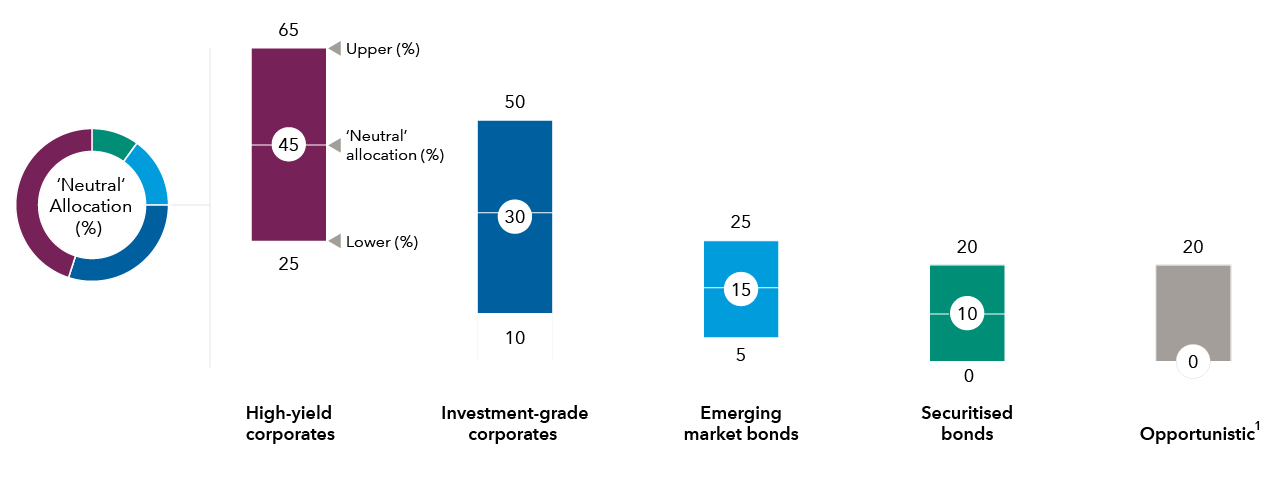

The allocations (%) illustrated indicate the typical range within which a sector will be represented. ‘Neutral allocation’ reflects the allocation under normal market conditions.

1. The managers have the option to invest in other areas in an opportunistic way if they identify particularly attractive opportunities, but this typically remains a small part of the overall allocation. This may include, but is not limited to, US government debt, municipal debt and non-corporate credit, in response to market conditions.

EXPERIENCE COUNTS

Managed by an experienced and specialist team

Each of the four sectors is managed by an experienced sector specialist portfolio manager. They are supported by large, dedicated investment analyst teams that help create a portfolio built on deep insights into each of the securities the fund invests in.

Damien J. McCann

Principal Investment Officer

25 years with Capital

25 years of industry experience

Shannon Ward

US high yield

8 years with Capital

32 years of industry experience

Sandro Lazzarini

US high yield

9 years with Capital

17 years of industry experience

Scott Sykes

US investment-grade corporates

19 years with Capital

24 years of industry experience

Robert Burgess

Emerging markets debt

9 years with Capital

33 years of industry experience

Xavier Goss

Securitised credit

4 years with Capital

21 years of industry experience

Years of experience as at 31 December 2024.

WHY CAPITAL GROUP

A leader in global investing

For more than 90 years, we’ve been searching the world for long-term opportunities, making Capital one of the oldest global investors today.

Global investing credentials

US$2.8T

in total assets managed

25 years

average investment experience of our fixed income portfolio managers

US$550.3B

Fixed income assets managed*

*Assets under management by Capital Fixed Income Investors.

Data as at 31 December 2024

Capital Group Multi-Sector Income Fund (LUX)

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- Some portfolios may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

- The Prospectus - together with locally required offering documentation - sets out risks which, depending on the fund, may include risks associated with investing in fixed income, derivatives, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.

All data as at 31 December 2024 and attributed to Capital Group, unless otherwise specified.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Glossary

10 year Treasury Bill: A type of debt issued by the US Treasury with a maturity of 10 years.

Bond: A debt instrument, essentially a loan, issued by governments (a sovereign bond) or corporates (a corporate bond) and financed by investors. The bondholder receives interest payments, known as a coupon, and the principal of the bond when it is due.

GFC: Global Financial Crisis.

High-quality bonds: May offer a lower risk, lower potential return profile.

High-yield bonds: A high-yield bond is one with a lower credit rating than an investment grade bond. High-yield bonds typically offer a higher rate of interest because of a greater risk of default.

Index / Indices: An index represents a particular market or segment of it, and is a tool used to describe the market and compare returns on specific investments.

Security: A mutually interchangeable, negotiable financial instrument that holds some type of monetary value. It represents an ownership in a publicly-traded corporation - via via stock; a creditor relationship with a governmental body or a corporation - via bond; or rights to ownership via an option.

Yield: The income returned on an investment, such as the interest or dividends received from holding an asset. The yield is usually expressed as an annual percentage rate based on the investment’s current market cost.

.png)

.png)