Embrace the unknown with a time-tested investing approach

Since its inception in 1975, American Balanced Fund (AMBAL) has helped shepherd investors through wide-ranging market conditions with its well-balanced portfolio of high-quality stocks and bonds. Here's what makes it special...

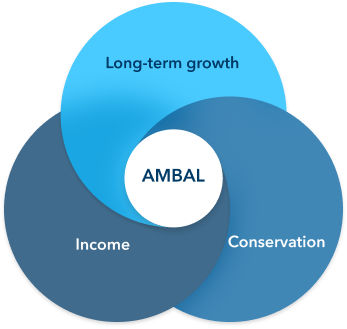

Focused on three objectives

Decades later, the fund’s three-fold investment objectives of long-term growth of capital and income, conservation of capital and current income remain unchanged. The fund was initially designed to serve as the entire investment portfolio for a prudent investor. This tried-and-true approach has served investors well against the index through difficult market environments.

- Long-term growth

- Conservation

- Income

Index-beating lifetime results

The key behind its resilient track record? A combination of active flexibility, fundamental research and the pursuit of high-quality investment opportunities.

Learn more about the fund's 50-year history and how a 60% equity/40% fixed income portfolio generally works.

A flexible approach to asset allocation

A three-pronged asset allocation approach is designed to help AMBAL navigate different market conditions.

Equities

Equities offer long-term growth potential through capital appreciation and dividends. They help the fund pursue higher returns, diversify risk and participate in market upside, especially when supported by strong fundamentals and disciplined portfolio management.

Fixed income

Fixed income helps provide a cushion and income through regular interest payments. It helps the fund manage volatility, preserve capital and balance equity exposure, especially during market downturns or economic uncertainty, supporting a more resilient and diversified investment strategy.

Cash and equivalents

Cash & equivalents offer liquidity and flexibility, allowing the fund to meet short-term obligations, seize investment opportunities and manage risk. It acts as a buffer during market stress and supports dynamic asset allocation, without forcing the sale of long-term holdings.

A fresh look at balanced portfolios

AMBAL seeks to provide a balanced approach to growth and income investing, blending equities and fixed income to promote diversification, competitive returns and help shelter from outsize volatility. Yet, compared to passively implemented 60% equity/40% fixed income solutions — where the asset allocation seeks to replicate the positioning of an index — the fund has a flexible, dynamic asset allocation approach that can shift within established guardrails in response to market conditions based on the research and convictions of the portfolio managers.

100% equity portfolio

PROS

- Maximizes capital appreciation potential

- Reduces longevity/shortfall risk

CONS

- Higher expected volatility

- Increased wealth variability

100% fixed income portfolio

PROS

- Capital preservation focus, especially with high-quality bonds

- Reduces market risk

- Potential to generate income via coupon payments

CONS

- Increased credit default risk (at higher yields)

- Potential longevity/shortfall risk

60% equity/40% fixed income

PROS

- Seeks a balance of objectives, including capital appreciation and income

- Can reduce drawdown and exposure to market selloffs

CONS

- Limited capital appreciation potential vs. 100% equity portfolio

- Higher downside risk vs. 100% fixed income portfolio

Pros and cons are in relation to the other stated hypothetical portfolios. For illustrative purposes only.

The power of active management

Watch as AMBAL portfolio manager Paul Benjamin and investment director Jacob Gerber talk about the fund, its history and what they are watching in the current market environment.