American Balanced Fund®

INCEPTION DATE

July 26, 1975

IMPLEMENTATION

Consider for a U.S. balanced allocation

OBJECTIVE

Seeks to provide conservation of capital, current income, and long-term growth of capital and income.

VEHICLE

American Balanced Fund

An investment approach designed for prudent investors

A three-pronged approach

American Balanced Fund's approach offers balance by seeking a mix of high-quality stocks and bonds; diversification by investing in a wide variety of fixed income vehicles and equities; and consistency by seeking to deliver consistent results for both accumulation and withdrawal scenarios.

Identifying potential leaders across sectors and regions

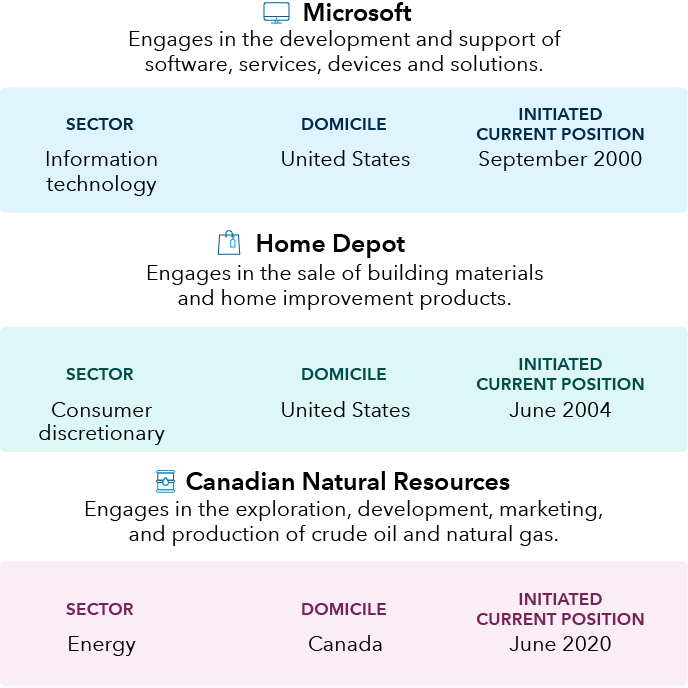

Examples of top 20 equity holdings in the portfolio

Sources: Morningstar, FactSet, Capital Group. As of September 30, 2024.

Companies shown are among the top 20 equity holdings by weight in American Balanced Fund as of 9/30/24. (Broadcom, Microsoft, Alphabet, UnitedHealth Group, Meta Platforms, Philip Morris International, TSMC, Apple, Eli Lilly, Amazon, JPMorgan Chase, Vertex Pharmaceuticals, Mastercard, Home Depot, ASML, Constellation Energy, Transdigm, Nvidia, Canadian Natural Resources, Visa.)

American Balanced Fund

American Balanced Fund is offered in various share classes designed for retirement plans, nonprofits, and other institutional and individual investors.

Portfolios are managed, so holdings will change. Certain fixed income and/or cash and equivalents holdings may be held through mutual funds managed by the investment adviser or its affiliates that are not offered to the public.