Clients may be drawn to alternatives for their potential to enhance portfolio diversification, capture illiquidity premiums, access differentiated sources of return and hedge against traditional market volatility.

Diversification can be a powerful talking point. When you invest in private credit, for example, you’re investing in a broad universe of privately held companies that aren’t available through traditional public equity markets. Just how large this market is may surprise your clients: Approximately 87% of U.S. companies with annual revenue of $100 million or more are privately held, according to data from S&P Capital IQ cited by Apollo Global Management.

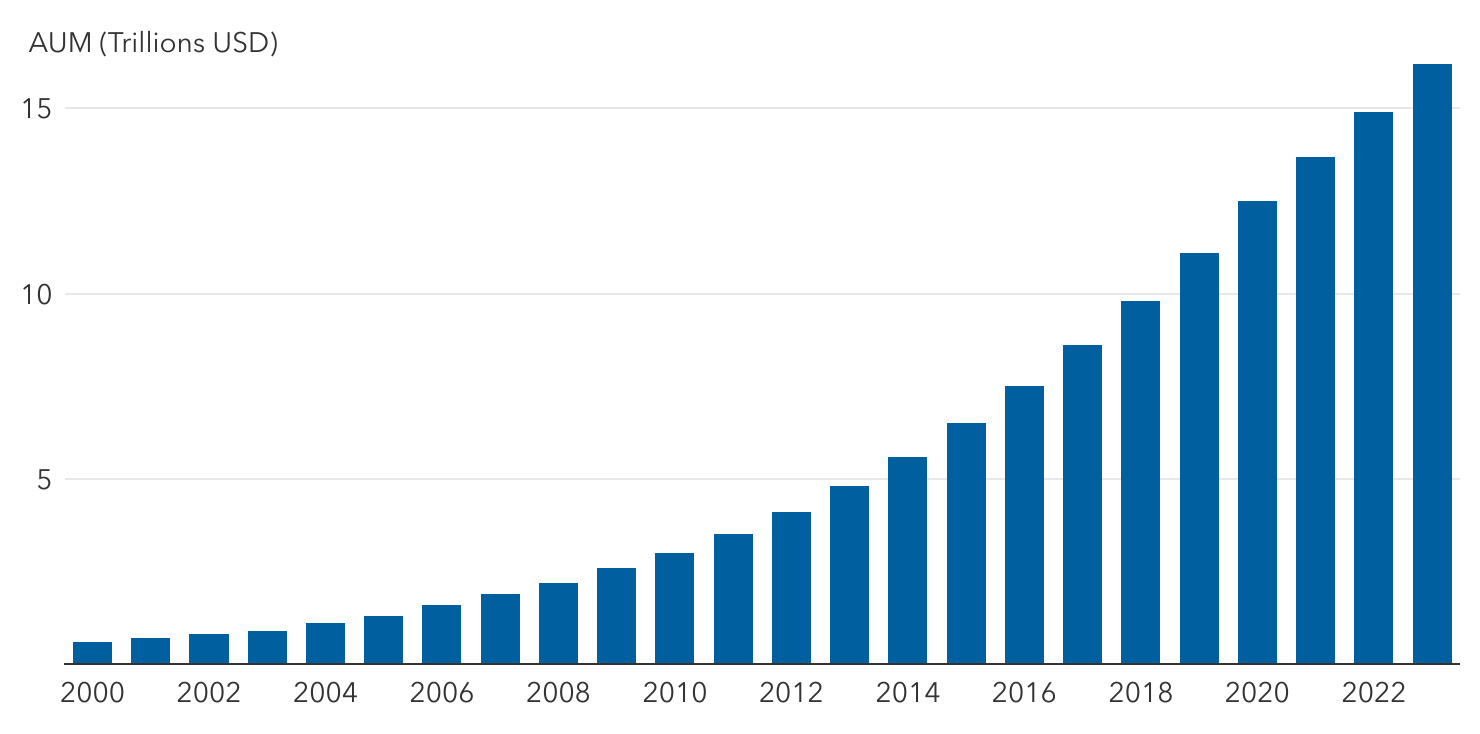

To amplify that point, consider private credit as a growing asset class within the broader fixed income market. “If your objective is to build a truly diversified approach to fixed income in a portfolio, with exposure across the fixed income landscape, you’re not getting that complete exposure if you’re not invested in private credit,” Broadbery says.

Lower volatility is another potential advantage. Private credit, for example, has historically demonstrated lower volatility than other fixed income asset classes such as high-yield bonds, leveraged loans and even investment-grade corporate bonds. A variety of factors can help dampen volatility in private credit, including lack of daily price discovery, which means valuations are not subject to daily market swings driven by investor sentiment or headlines.

Illiquidity premiums are also a reason to consider private markets, particularly private credit. Capital Group research indicates that over the past nine years, private credit investments have yielded roughly 3% more than low-grade bonds.

However, it’s important to recognize the unique features and challenges of private credit:

- Fees and complexity: Private market investments often carry a reputation for high fees. Clients may worry about administrative, management and performance fees eating into returns. Some recently launched public-private funds, such as those offered by Capital Group and KKR, aim to reduce complexity and cost by avoiding leverage and simplifying tax reporting through 1099s instead of K-1s, for example.

- Valuation transparency: Unlike publicly traded assets, private credit investments and many other alternative investments cannot necessarily be sold daily. When evaluating a specific alternative strategy, make sure you and your client understand the process the investment manager uses to determine valuations.

- Liquidity and time horizon: Private credit funds often have limited liquidity, which can restrict the ability of investors to buy and sell assets. Given limited liquidity, investors will want to consider their time horizon for such investments, a consideration that is not always a factor with investment vehicles that trade daily.