Typical sector ranges (%)1

Multi-Sector Income is a diversified, flexible multi-sector bond strategy that pursues a high level of income and capital appreciation.

Diversified income

Combines diverse, income-generating credit sectors

Flexible strategy

Dynamically tilts sector exposure in changing markets

Balanced risk profile

Blends both high quality and higher yielding sectors

Video and brochure

Overview

Hear from Damien McCann, Principal Investment Officer, on how the strategy’s diversification, flexibility and balanced risk profile aim to deliver high income to investors.

Learn more about Multi-Sector Income’s strategy in our brochure.

Key features

Multi-Sector Income incorporates a wide range of opportunities within the income universe. It actively seeks investment ideas from four key credit sectors, each of which has unique income characteristics. Each sector serves a strategic purpose, contributing to the portfolio’s results in a distinctive way.

Investment-grade corporate bonds

Limit volatility and seek modest levels of income

High-yield corporate bonds

Seek higher income while being mindful of sector risk

Securitized bonds

Provide diversification among high-quality bonds with similar credit risk

Emerging markets debt

Broadens geographic exposure while adding high-income potential

Multi-Sector Income’s investment approach is dynamic and flexible, enabling it to target both income and returns under varying market conditions.

The portfolio managers are empowered to seize opportunities whenever they arise, regardless of the sector. By maintaining a broad range of allocations, the portfolio aims to lower the risk associated with too much concentration in a single sector.

1 Minimum and maximum allocation amounts are not intended to reflect limits; they indicate the typical range within which a sector will be represented. Neutral allocation reflects the allocation under normal market conditions. Multi-Sector Income has the flexibility, as illustrated above, to substantially adjust exposures in any given market climate.

2 Securitized benchmarked against 80% Bloomberg CMBS Ex AAA Index/20% Bloomberg ABS Ex AAA Index.

3 The managers also have the option to invest in other areas in an opportunistic way if they identify particularly attractive opportunities, but this typically remains a small part of the overall allocation. Opportunistic includes, but is not limited to, U.S. Treasuries, non-corporate credit and other debt instruments.

While the portfolio can flex with changing markets, it has guardrails, seeking an optimal balance between higher yielding (non-investment-grade bonds) and higher quality (investment-grade) bonds.

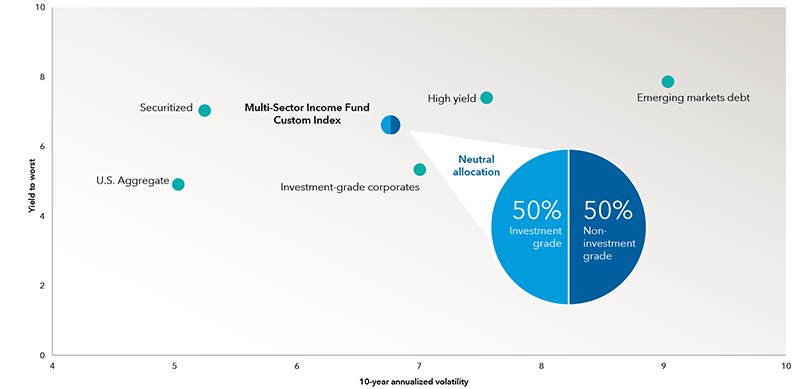

The chart below shows the key sectors of the strategy, each with varying yields and volatility. By strategically mixing high-income and high-quality sectors, the portfolio aims to capture significant yield while reducing risk in comparison to single-sector strategies like high-yield bonds or emerging markets debt.

Seeking the right balance between income and stability

Fixed income sector yields vs. 10-year annualized volatility (%)

Data as of December 31, 2024. Standard deviation (volatility) based on returns in USD. U.S. Aggregate represents Bloomberg U.S. Aggregate Bond Index; High yield represents Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index; investment-grade corporates represents Bloomberg U.S. Corporate Investment Grade Index; Emerging Markets Debt represents JPMorgan EMBI Global Diversified Index; Securitized represents 80% Bloomberg CMBS Ex AAA Index/20% Bloomberg ABS Ex AAA Index. Multi-Sector Income Fund Custom Index comprises: 45% Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index; 30% Bloomberg U.S. Corporate Investment Grade Index; 15% J.P. Morgan EMBI Global Diversified Index; 8% Bloomberg CMBS Ex AAA Index to September 30, 2023, and 8% Bloomberg Non-Agency CMBS Ex AAA Index thereafter; and 2% Bloomberg ABS Ex AAA Index.

EXPERIENCE COUNTS

The Multi-Sector Income investment team

The portfolio is managed by a Principal Investment Officer and a team of seasoned sector specialist portfolio managers. They are supported by large, dedicated investment analyst teams that help create a portfolio built on deep insights into each security.

Robert Burgess

Portfolio Manager

London

Years of CG Experience: 9

Xavier Goss

Portfolio Manager

Los Angeles

Years of CG Experience: 6

Sandro Lazzarini

Portfolio Manager

Los Angeles

Years of CG Experience: 9

Damien McCann

Portfolio Manager

Los Angeles

Years of CG Experience: 25

Scott Sykes

Portfolio Manager

New York

Years of CG Experience: 19

Shannon Ward

Portfolio Manager

Los Angeles

The investment director does not have portfolio management responsibilities.

Naoum Tabet

Fixed Income Investment Director

Montreal

Why Capital Group for multi-sector investing

2019

Multi-Sector Income strategy first offered to U.S investors

1973

Begins managing investment-grade corporates and securitized debt for U.S. investors

1988

Emerging markets debt securities added to Capital Group portfolios in the U.S.

250

Fixed investment professionals around the world†

US$352 billion

Global multi-sector assets†

Multi-Sector Income is offered as a mutual fund and ETF to suit investors’ preferences.

Mutual Fund

Multi-Sector Income

Inception: June 30, 2022

Exchange-traded Fund

Multi-Sector Income Select ETF | CAPM

Inception: October 22, 2024

Though the mutual fund and ETF follow the same strategy, holdings may differ due to optimization for the specific vehicle.

Multi-Sector Income LITERATURE

Mutual fund resources

For advisor use only. Not for use with investors.

†As of March 31, 2025. Figures are approximate and include high yield, investment-grade corporate, emerging markets debt and securitized. Reflects the Capital Group global organization.

This content is confidential and designed for the exclusive use of registered dealers and their representatives. Canadian securities legislation, including National Instrument 81-102, prohibits its distribution to investors, potential investors or the general public. It is not intended to be a sales communication, as defined in the Instrument, and has not been designed to comply with its requirements relating to sales communications.

Views expressed regarding a particular company, security, industry or market sector should not be considered an endorsement or an indication of trading intent of any investment funds managed by Capital International Asset Management (Canada), Inc. These views should not be considered as investment advice or as a recommendation to buy or sell.

Capital Group funds are available in Canada through registered dealers. Funds may not be available for distribution by all dealer firms. Please confirm with your home office whether our funds are among your firm's approved offerings.

Capital Group exchange-traded funds (ETFs) are actively managed and do not seek to replicate a specific index. ETF units are bought and sold through an exchange at the then current market price, not net asset value (NAV), and are not individually redeemed from the fund. Units may trade at a premium or discount to their NAV when traded on an exchange. Brokerage commissions will reduce returns. There can be no guarantee that an active market for ETFs will develop or be maintained, or that the ETF's listing will continue or remain unchanged.

The ETFs are prospectus qualified in Canada and are not registered with the United States Securities and Exchange Commission and are not intended for distribution in the United States.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.