Client Conversations

Market volatility shines a spotlight on the critical role advisors play in helping clients stay the course in turbulent times. Your guidance during volatile markets could transform challenges into opportunities to deepen trust and demonstrate your value.

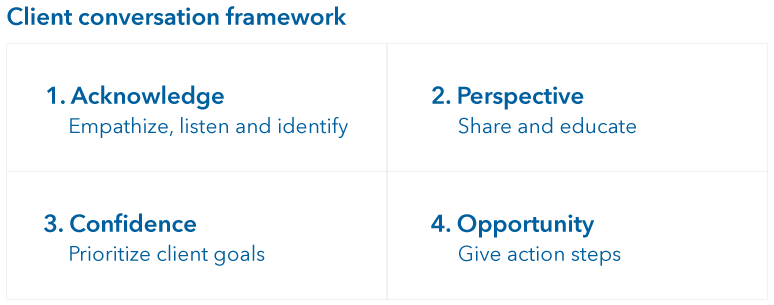

That’s why we developed a four-step framework for having conversations with clients. It provides you with a repeatable way to take these opportunities to strengthen relationships with your clients and help keep them focused on their long-term goals.

Here's a guide to applying these four steps to your conversations with clients about tariffs, market volatility and what it could mean for them.

Step 1: Acknowledge client concerns

“Empathy matters tremendously in these conversations,” says Chris Jenkins, senior vice president at Capital Group's Private Client Services group. “Hear clients out and let them vent.” Here are some of the concerns to anticipate.

Looming recession. In the days following President Trump's announcement on April 2, many economists significantly increased their recession odds. Your clients may be reading headlines that are alarming to them.

Worsened inflation. Tariffs essentially function as taxes on imported goods and those costs typically get passed along to consumers. Clients have already been feeling the pain of inflation and may be anticipating it will get even worse.

Retirement timeline disruption. For those approaching retirement, these market declines feel particularly threatening. They may be wondering if they need to postpone retirement.

Political views. Some clients' strongest feelings have nothing to do with markets or economics. They may want to talk with you about politics more than portfolios.

As you hear them out, Jenkins recommends, “Trust but verify. Their portfolio may not be down as much as they think it is.” And log conversations with clients, highlighting their biggest concerns, in your customer relationship management (CRM) system. That helps you remember how they reacted to these events and lets you maintain a more accurate, holistic picture of your clients' wants and fears.

Conversation starters:

- “How are you feeling?”

- “What are you most concerned about right now?”

- “What specific aspects of the situation have you been following most closely?”

- “When you think about your financial goals, which ones feel most vulnerable right now?”

Step 2: Offer relevant perspective

After you thoroughly acknowledge your clients' concerns, offer context that helps them see beyond headlines. Historical data can help put current events into perspective. “History may not repeat, but it certainly rhymes,” Jenkins notes. “We've seen market fluctuations before, and things are rarely as bad as they seem in the moment. Statistically speaking, the world doesn't end all that often.”

Here are some talking points you can use.

Market downturns are to be expected. Since 1950, the S&P 500 has typically dipped at least 10% about once a year and 20% or more about every six years.

The market was resilient and inflation was muted during past trade tensions. During President Trump's first term, trade disputes caused the S&P 500 to fall 4.4% in 2018, but the market recovered sharply in 2019, gaining 31.1% as trade agreements materialized and consumer spending remained strong.

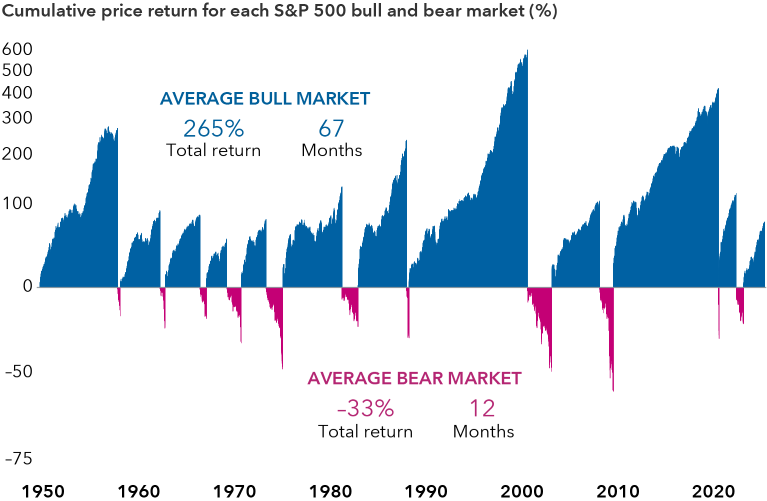

Bull markets have been longer and stronger than market declines. Bear markets have averaged 12 months in duration while subsequent bull markets have typically lasted more than five times longer. Returns have often been strongest immediately following the sharpest declines, with the first year after the five biggest bear markets since 1929 averaging a 70.9% return.

Sources: Capital Group, RIMES, Standard & Poor's. As of 12/31/24. The bull market that began in 2022 is considered current as of 12/31/24 and is not included in the "average bull market" calculations. Bear markets are peak-to-trough price declines of 20% or more in the S&P 500. Bull markets are all other periods. Returns shown on a logarithmic scale.

Consider talking with your clients about how much they’re allowing themselves to be bombarded by news commentary — and whether that’s helpful. “Clients might benefit from turning off the news for a while,” Jenkins says.

Conversation starters:

- “Tell me what you know about tariffs, and I’ll see if I can help fill in any gaps.”

- “Would it help to see how the market has historically responded to similar situations?”

- “What investment experiences have you had during past market declines?”

- “There’s so much noise out there and everyone has an opinion. How are you deciding what to listen to and what to ignore?”

Step 3: Build confidence

With concerns acknowledged and context provided, refocus clients on their financial plan. Caution against overreacting. As Jenkins notes, “Success in investing in markets like this may not be determined by the presence of heroics, but by the absence of mistakes.” Show that their portfolio was built to weather these storms. Point to stress-testing you previously conducted for them.

If applicable, also point out their emergency funds and the assets they may have access to if the need arises. For clients who have the means, provide reassurance that they can cover their day-to-day expenses thanks to diligent planning.

Most importantly, focus the conversation on goals. You might say, “Portfolio returns are merely a means to an end to help you achieve your goals. The most important metric isn't how your portfolio performed last week, but whether you remain on track to fund the life you've envisioned.”

Conversation starters:

- “How confident are you feeling about your financial plan right now?”

- “Would you like to review how your financial plan was designed to handle this type of market environment?”

- “How has your thinking about your financial goals changed, if at all, during this market turbulence?”

- “What aspects of your financial plan would you like reassurance about today?”

Step 4: Share opportunities

Finally, discuss potential action steps with the client. Some common wealth planning ideas might include:

Reviewing cash reserves. Look at emergency funds to ensure clients have enough to cover expenses without being forced to close out positions at a loss.

Roth conversions. Market declines may present an opportunity to convert traditional IRA assets to Roth accounts at lower prices, potentially reducing the tax impact.

Trust strategies. Review whether clients might benefit from grantor retained annuity trusts (GRATs), swapping provisions or other trust mechanisms to take advantage of current market conditions.

Tax-loss harvesting. You might capture tax losses from positions that have declined for some investors, offsetting future capital gains.

Some ideas for their portfolios might include:

Portfolio rebalancing. For some clients, consider increasing allocations to quality assets that are oversold.

Increasing contributions. Consider contributing more to retirement and college savings accounts, taking advantage of lower prices to make progress toward long-term goals.

Dollar-cost averaging. For clients with cash on the sidelines, they might systematically invest during market declines to acquire more shares at lower prices without having to perfectly time the market.

Defensive positioning. In the current environment, investors might benefit from quality companies with strong balance sheets, domestic revenue streams and pricing power.

Conversation starters:

- “Is there anything you feel strongly that you should do right now?”

- “Would you like to discuss some strategic moves we might consider in this environment?”

- “Do these events make you think differently about how much risk you can stomach or how much you want on hand in cash reserves?”

- “Is there any part of your portfolio you've been wanting to adjust that this market environment might make more favorable?”

Tariff-related volatility presents a unique opportunity to demonstrate your value as an advisor. This four-box framework gives you a structured approach to these conversations. While each client's situation is unique, this methodology adapts to individual needs while ensuring you cover essential elements of effective communication during market disruptions. That enables you to turn adversity — what began as a moment of anxiety and confusion — into an opportunity to refocus clients on their goals, deepen your relationships with them and reaffirm your value.

Regular investing does not ensure a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Past results are not predictive of future performance. The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index.

Chris Jenkins

Chris Jenkins