Referrals

“If you’re not growing, you’re dying,” says Molly Bennard, president of international operations at Focus Financial, a firm with over $400 billion in assets under advisement (as of December 2024).

That’s because outflows outpace asset growth from existing clients. Firms have an average outflow of 4.3% of AUM (due to loss of clients or withdrawals by existing clients) and inflow of 3.3% from existing clients, according to Fidelity’s 2023 RIA Benchmarking Study. Without new clients, practices shrink by 1% of AUM per year on average.

And referrals remain the top way advisors seek new clients by a wide margin. Referrals accounted for 87% of all new business in our 2023 Pathways to Growth: Advisor Benchmark Study of more than 1,500 advisors. But how do you improve your referral strategy’s success rate? How do you get more referrals from clients and COIs (centers of influence)?

In a recent PracticeLab webinar, which is also available as a podcast, Bennard joined Capital Group practice management consultants Max McQuiston and Jon Wainman to offer some answers. It comes down to being clear about your goals and expectations, transparent with both clients and COIs and candid about what’s working (and what’s not).

Be candid about what success looks like (and doesn’t)

If advisors want their referral efforts to succeed, they need to be clear about what success looks like. That means creating a written plan with clearly defined key performance indicators (KPIs). “Many firms don't have a strategic plan with goals,” Bennard observes. “And the truth is, if you don't have that in place, ultimately there will be no roadmap and no budget to make the growth happen.”

Schwab's 2024 RIA Benchmarking Study reveals that advisors with defined COI referral plans generated over four times as many assets as those without one. Firms with written marketing plans gained 67% more clients than those without.

“If you don't measure, quite frankly, your goal never existed,” Bennard says. She recommends tracking metrics including:

- Leads by source (how many referrals come from whom)

- Number of referrals received

- Conversion rate (how many referrals become clients)

- Retention rate

- New assets acquired by referral

In addition to a defined plan, Bennard says there are three other things advisors should have in place before they start trying to get referrals:

- A refined value proposition articulating your “why”

- A clearly defined target market or niche

- A comprehensive marketing plan and budget

Get your clients’ honest take

Satisfied clients make 2.5 times the number of referrals on average, according to Fidelity’s 2023 report, “Improving the Planning Experience.” You could take that to mean you should strive to satisfy every client, which is always important. You could also take it to mean you’ll always have some clients who are happier than others and you should identify the ones who are most likely to refer you.

Effective client segmentation goes beyond assets under management. “Many advisors forget to segment their clients based on their willingness to advocate and provide referrals,” explains Bennard. She suggests categorizing clients as neutral, supporters or advocates.

Segment your book by advocacy level

Source: Capital Group

This requires getting a realistic view on how your clients feel about you and the service you provide to them. You can make it part of your client review process, conduct surveys, have other team members ask on your behalf or form a client advisory board.

Advisory boards are especially good for getting your clients’ candid views, according to Wainman. “You can have unbiased feedback. What are some things that maybe I should be thinking about and incorporating into my business?”

When do you approach clients about referrals? McQuiston suggests making it part of your process to have the conversation at seven points, from onboarding and reviews to life milestones and after navigating financial challenges.

Key moments for asking clients about referrals

Source: Capital Group

It’s at these points that clients have the clearest, freshest view on how much value you add for them. “When a client says thank you, don't just say you're welcome,” McQuiston advises. Use it as an opportunity to ask the client for an introduction to someone who would benefit from your services.

Better yet, ask for introductions to specific people you’ve identified ahead of time. You can use LinkedIn to find people in your client’s network with job titles, employers or other demographic data that match your niche. Be candid with your client about why you think those people would especially benefit from your services. If you have LinkedIn Sales Navigator, you can also use a prebuilt set of filters and searches to find those people.

Note the language shift: ask for introductions, not referrals. “Twenty percent of people are comfortable making a referral. Eighty percent are comfortable making an introduction,” McQuiston points out. Being transparent about why you're seeking introductions to specific individuals makes the process more comfortable for both parties.

Cultivating transparent COI relationships

Many advisors have had the unpleasant experience of having one-sided relationships with COIs. You refer plenty of people to them; you don’t get any referrals in return. On the other hand, some advisors are creating unpleasant experiences for other people by taking referrals from them but never reciprocating in any way.

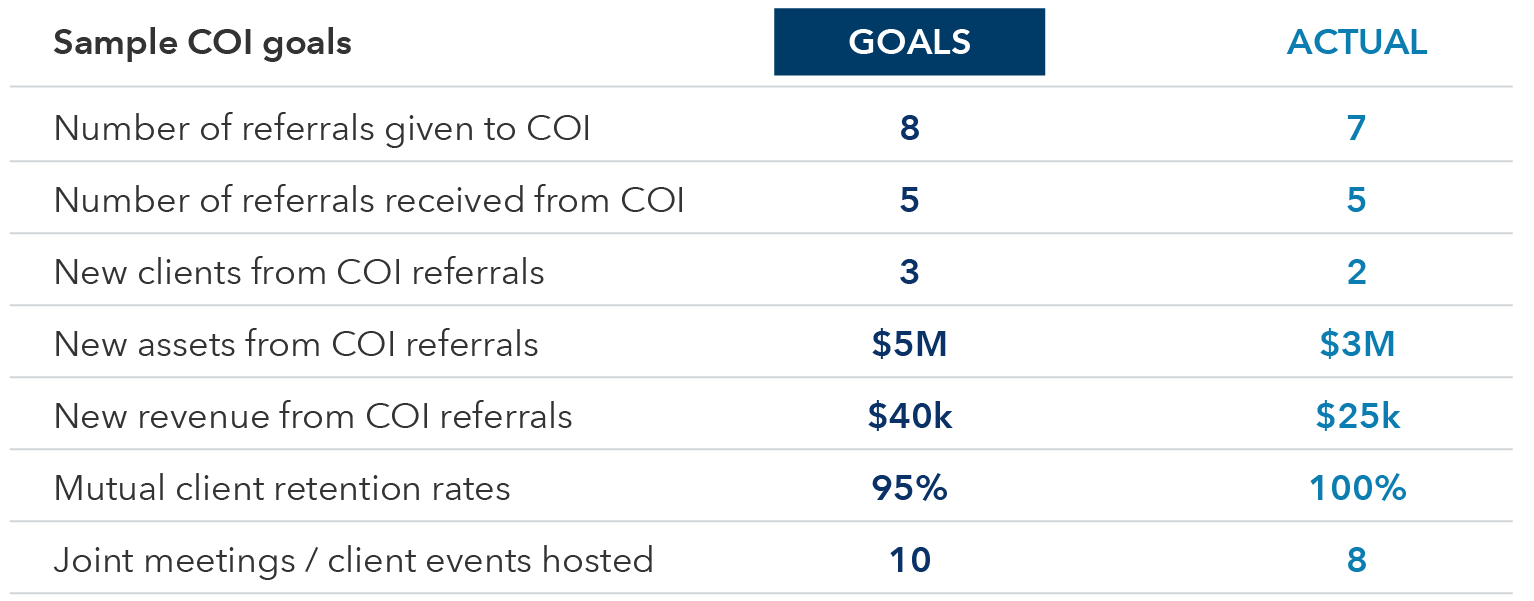

Apply the goal-setting mentality to your COI partnerships. Bennard says it’s critically important for advisors to set mutual goals with COIs. These goals can mirror those you’re setting for your own practice, such as new assets and client retention. They can also include referrals sent in both directions and joint events hosted.

Set mutual goals with COIs

Source: Capital Group

There are many different types of COI relationships you can have and different goals you can set with a given COI. You might commit to sharing key information with each other about your respective industries or sharing each other’s content. The key is to have a candid conversation about what those mutual goals are upfront.

Bennard also recommends scheduling regular, structured meetings to review your partnership's progress against those goals. And if you can’t get on the same page, it’s important to be honest about that. “Some COI relationships don't work or are not effective, given your goals may not be mutual,” she says. “It’s important to know when to quit.”

This requires a level of candor with COIs that is uncommon among advisors. But it’s critically important to have, if you want both parties to be satisfied with the partnership. Reciprocity is the key. “Think of them as strategic partners, not just centers of influence,” McQuiston says. “It's a two-way street.”

Wainman suggests setting yourself up for success by identifying the right COIs, and not just the ones that advisors commonly think of, like accountants and attorneys. “Think about what other professional providers may intersect with your target clients,” he says. For affluent clients, this might include trust officers, exclusive event planners, luxury car and jet brokers, divorce attorneys and marriage therapists, travel agents and architects. For business owners or larger businesses, consider Chambers of Commerce, commercial real estate brokers, HR consultants, recruiters, management consultants and insurance brokers.

Whether cultivating referrals from clients or COIs, transparency forms the foundation of success. Be transparent with yourself about your goals and metrics. Be transparent with clients about your value and their satisfaction. Be transparent with COIs about expectations and results.

Embracing transparency throughout your referral strategy can help you create the organic growth needed not just to replace inevitable outflows, but to build a thriving practice for years to come.

How you use social media platforms will depend on your firm’s compliance department and its guidelines on using social media. Before taking any steps, you should verify that these actions fall under the rules of your organization.

Molly Bennard

Molly Bennard

Jon Wainman

Jon Wainman

Max McQuiston

Max McQuiston