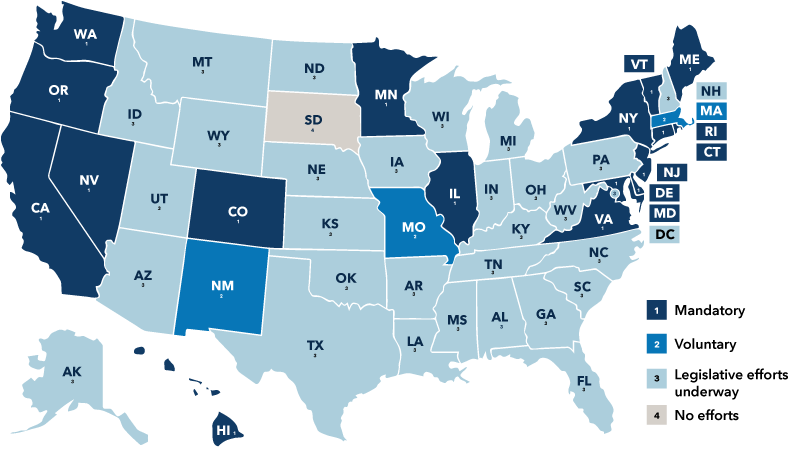

State plans

Some states now require, or are considering requiring, employers to join a state-controlled retirement program if they don’t offer their workers a retirement plan. But a state-sponsored plan is just one of many options.

State-by-state status is compiled from Georgetown University’s Center for Retirement Initiatives as of December 1, 2025. For more details about your state’s plan and its current legislative status, go to cri.georgetown.edu/states/.

Alternative solutions

While a state-run program can help more people save for retirement, there are several low-cost alternatives.

Read more about state-sponsored plans and alternative solutions

Capital Group’s retirement plan solutions are scaled to fit a range of clients.

AUTO-IRA

ELIGIBILITY

Varies by state

MAXIMUM PARTICIPANT CONTRIBUTIONS FOR 2026

$7,5001

$1,100 catch-up for age 50 or older

EMPLOYER CONTRIBUTIONS

Not permitted

SEP IRA

ELIGIBILITY

Any employer or sole proprietor

MAXIMUM PARTICIPANT CONTRIBUTIONS FOR 2026

None

EMPLOYER CONTRIBUTIONS

Discretionary4

Cannot exceed the lesser of 25% of compensation or $72,0007

SIMPLE IRA

ELIGIBILITY

Employers with 100 or fewer employees

MAXIMUM PARTICIPANT CONTRIBUTIONS FOR 2026

$18,100 / $17,0002

$3,850 / $4,0002

catch-up for ages 50-59 and 64+

$5,250 catch-up for ages 60 to 633

EMPLOYER CONTRIBUTIONS

Mandatory5; either:

• Dollar-for-dollar match of up to 3% of compensation6, or

• Across-the-board contribution of 2% of compensation7

401(k)

ELIGIBILITY

Any employer (except governmental entities)

MAXIMUM PARTICIPANT CONTRIBUTIONS FOR 2026

$24,500

$8,000 catch-up for ages 50-59 and 64+

$11,250 catch-up for ages 60 to 63 only3

EMPLOYER CONTRIBUTIONS

Discretionary

Total contributions cannot exceed lesser of 100% of compensation or $72,000 (or $80,000 with catch up

contributions, or $83,250 with higher catch-up contributions)3

Footnotes/Important information:

1 Income restrictions apply to Roth IRA contributions and to tax deductions on traditional IRA contributions.

2 The first limit shown applies to smaller employers (those with no more than 25 employees who earned at least $5,000 in the prior year), and larger employers (those with more than 25 employees who earned at least $5,000 in the prior year) if increased employer contributions are made.

3 The higher catch-up limit is only applicable to participants who attain ages 60, 61, 62, or 63 in 2026.

4 Employer SEP IRA contributions must be the same percentage for every employee.

5 Employers may also make an optional across-the-board non-elective contribution above the mandatory contributions, which must be made to all eligible employees and cannot exceed the lesser of 10% of compensation or $5,300.

6 SIMPLE IRA matching contributions may be reduced to a minimum of 1% for two of every five calendar years.

7 Compensation on which the employer calculates the maximum contributions is limited to $360,000 for 2026, except for SIMPLE IRA matching contributions.

AUTO-IRA

SEP IRA

SIMPLE IRA

401(k)

Eligibility

Varies by state

Any employer or sole proprietor

Employers with 100 or fewer employees

Any employer (except governmental entities)

Maximum participant contributions for 2026

$7,5001

None

$18,100/$17,0002

$24,500

$1,100 catch-up for age 50 or older

none

$3,850/ $4,0002 catch-up for ages 50-59 and 64+

$5,250 catch-up for ages 60 to 633

$8,000 catch-up for ages 50-59 and 64+

$11,250 catch-up for ages 60 to 633

Employer contributions

Not permitted

Discretionary4

Mandatory5; either:

Discretionary

Cannot exceed the lesser of 25% of compensation or $72,0007

• Dollar-for-dollar match of up to 3% of compensation6, or

• Across-the-board contribution of 2% of compensation7

Total contributions cannot exceed lesser of 100% of compensation or $72,000 (or $80,000 with catch up

contributions, or $83,250 with higher catch-up contributions)3

Footnotes/Important information:

1 Income restrictions apply to Roth IRA contributions and to tax deductions on traditional IRA contributions.

2 The first limit shown applies to smaller employers (those with no more than 25 employees who earned at least $5,000 in the prior year), and larger employers (those with more than 25 employees who earned at least $5,000 in the prior year) if increased employer contributions are made.

3 The higher catch-up limit is only applicable to participants who attain ages 60, 61, 62, or 63 in 2026.

4 Employer SEP IRA contributions must be the same percentage for every employee.

5 Employers may also make an optional across-the-board non-elective contribution above the mandatory contributions, which must be made to all eligible employees and cannot exceed the lesser of 10% of compensation or $5,300.

6 SIMPLE IRA matching contributions may be reduced to a minimum of 1% for two of every five calendar years.

7 Compensation on which the employer calculates the maximum contributions is limited to $360,000 for 2026, except for SIMPLE IRA matching contributions.

Our products

SEP IRA

For sole proprietorships and businesses with few employees.

SIMPLE IRA

Affordable, easy solution for businesses with 100 or fewer employees.

SIMPLE IRA Plus

401(k)-style features at a SIMPLE IRA price, exclusive to Capital Group.

RecordkeeperDirect®

A low-cost 401(k) solution designed for startups and smaller plans.

PlanPremier®

A full-featured 401(k) solution designed for plans of all sizes.

Resources

Use the following resources to learn more as you and your clients weigh retirement plan options.

Are tax credits available?

Expanded tax credits could significantly defray the cost of starting a plan.

How are participants supported?

Financial professional support and engaging tools, like our ICanRetire® site, can help participants stay on track.

How are the plan investments managed?

Quality plan menus can make a difference in participant outcomes. Explore what sets Capital Group’s investments apart.

Boosting retirement savings using new tools

The current state of state-sponsored retirement plans

Build a better 401(k) for your clients

Trust in a proven leader

Our target date series has “Thrilling” underlying strategies.‡

We were selected most often by advisors managing less than $50M in DC AUM as a “company I trust” and “easy to do business with.”§

Ready to get started?

We’re here to help.

Give our team of dedicated retirement plan specialists a call today.

888-777-1579

Footnotes/Important information:

§ Escalent, Cogent Syndicated, Retirement Plan Advisor Trends™, October 2025. Methodology: 411 respondents participated in a web survey conducted September 8-19, 2025. For “Ownership” of Core Brand Attributes — Tier 1, among 227 financial advisors managing less than $50M in defined contribution (DC) assets under management (AUM), Capital Group | American Funds was selected most often in response to the question, “Which — if any — of these DC plan providers are described by this statement … ‘is a company I trust' and ‘easy for advisors to do business with’?” Capital Group has provided input on some of the questions to be included in Cogent surveys over time. Additionally, Capital Group has made a subscription investment to Cogent Syndicated to access a detailed version of the Retirement Plan Advisor Trends report.

‡ Source: Morningstar, “The Thrilling 33” by Russel Kinnel, August 13, 2025. Morningstar’s screening took into consideration expense ratios, manager ownership, returns over manager's tenure, and Morningstar Risk, Medalist and Parent ratings. The universe was limited to share classes accessible to individual investors with a minimum investment no greater than $50,000, did not include funds of funds, and must be rated by Morningstar analysts. Class A shares were evaluated for American Funds. Visit morningstar.com for more details. Not all six funds listed in the “The Thrilling 33” list are in each target date fund. Underlying funds may change over time.