2. Perspective: What feels new might not be

After you’ve gotten a better understanding of your client’s specific questions and concerns, you can make a better decision about what perspectives would be helpful to share.

AI has become a part of your daily life. The phrase “artificial intelligence” was first coined at Dartmouth in 1956. For decades, AI rarely dominated mainstream headlines and everyday conversations. But in the background, researchers and companies were making breakthroughs, especially in generative AI (gen AI), a type of AI that can create new content. Their work paved the way for large language models (LLMs), which can understand and generate human-like text, and generative pretrained transformers (GPTs), a family of LLMs developed by OpenAI.

On November 30, 2022, OpenAI released ChatGPT, a chatbot built on an LLM called GPT-3.5. ChatGPT reached 100 million users in two months. By comparison, it took TikTok nine months and Instagram two and a half years to reach the same mark.4

Today, almost everyone uses AI — but they often don’t realize it. In a Gallup poll of nearly 4,000 Americans, 99% of people had used at least one AI-enabled product in the past week, and 83% had used at least four. These products include streaming, social media, shopping, navigation, weather forecasting and personal virtual assistants like Alexa and Siri.

But when those same people were asked if they had used AI in the past week, half of them said no.5

Gen AI is embedded in everyday tasks like Internet searches, thanks to tools like Bing with ChatGPT and Google’s AI overviews, and emailing, thanks to tools like Copilot in Outlook and Gemini in Gmail. People are using gen AI for therapy and companionship, organization, learning and self-improvement, diet and exercise planning, creating travel itineraries and much more.6

Think about tech’s impact on individual tasks, not entire jobs. Historically, technology transforms individual jobs more than it decreases the overall number of jobs in the market. Take computers, for example. As a landmark MIT and Harvard study found, computers took over routine tasks that are time-consuming and manual, but they increased the need for non-routine tasks that require creativity or interacting with people. Companies either adjusted the jobs their employees were doing to focus on non-routine tasks or hired more people who had training in the non-routine tasks.7

This task-based (not job-based) paradigm is still used in labor economics today, and it can be applied to AI. OpenAI research indicates that 80% of the US workforce could have at least 10% of their tasks affected by GPTs and 19% could have at least 50% of their tasks affected.8

So, for individuals, the key is to focus on tasks. List the tasks AI can easily handle, then double-down on the ones it can’t — ones that require judgment, imagination and relationship-building, just to name a few — and keep learning so your job tilts toward work that only humans do best.

This “re-bundling” approach is key, and it may offer some reassurance. As the Organisation for Economic Cooperation and Development (OECD) puts it, “Since occupations usually consist of performing a bundle of tasks not all of which may be easily automatable, the potential for automating entire occupations and workplaces may be much lower than suggested.”9 Many advisors are already using AI to re-bundle their jobs. They’re allowing AI to take over routine tasks so they can focus on non-routine, high-value tasks.

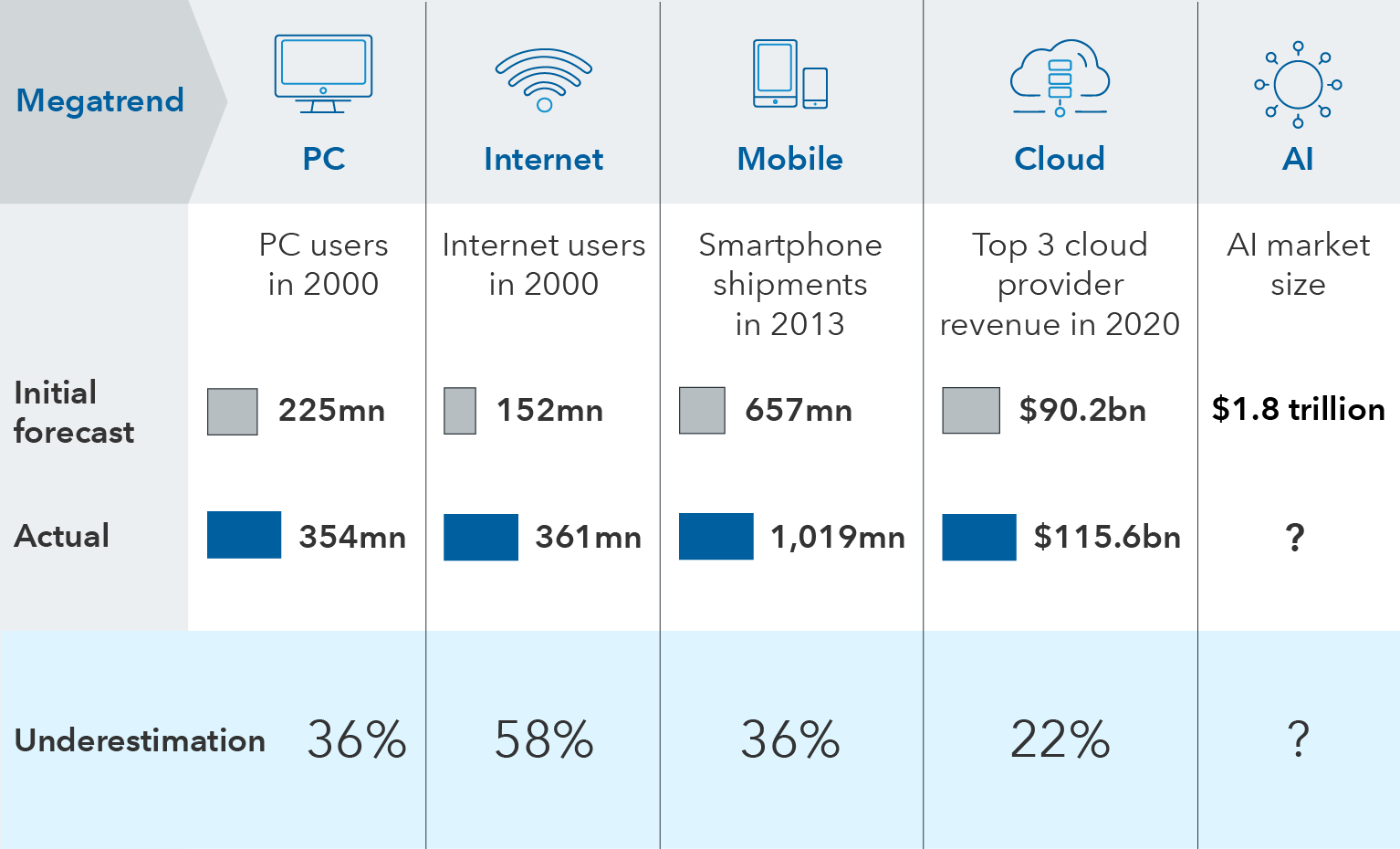

AI could be overhyped in the short-term and underestimated in the long-term. With new tech, companies tend to spend aggressively early on. It usually takes years for them to see returns.