December 12, 2025

KEY TAKEAWAYS

- U.S. stocks have been on a hot streak in recent years. With U.S. equities near all-time highs, more capital has started moving into the core and core-plus bond funds that investors traditionally rely on for ballast in their portfolios.

- What’s behind this evolution? In many cases, the dramatic increase in U.S. stock prices since October 2022 may have pushed investors’ asset class allocations away from their long-term percentage targets, and as a result, investors’ portfolios may now contain more risk than they expect.

- In addition, elevated valuations in the equity markets suggest more moderate returns in these markets in the years ahead. On the other hand, with starting bond yields generally indicating higher returns going forward, we believe that investors should consider increasing their fixed income allocations relative to past allocation percentages.

Stock market highs may be triggering a wave of rebalancing

U.S. stocks have been on a hot streak in recent years. With U.S. equities near all-time highs, more capital has started moving into the core and core-plus bond funds that investors traditionally rely on for ballast in their portfolios.1

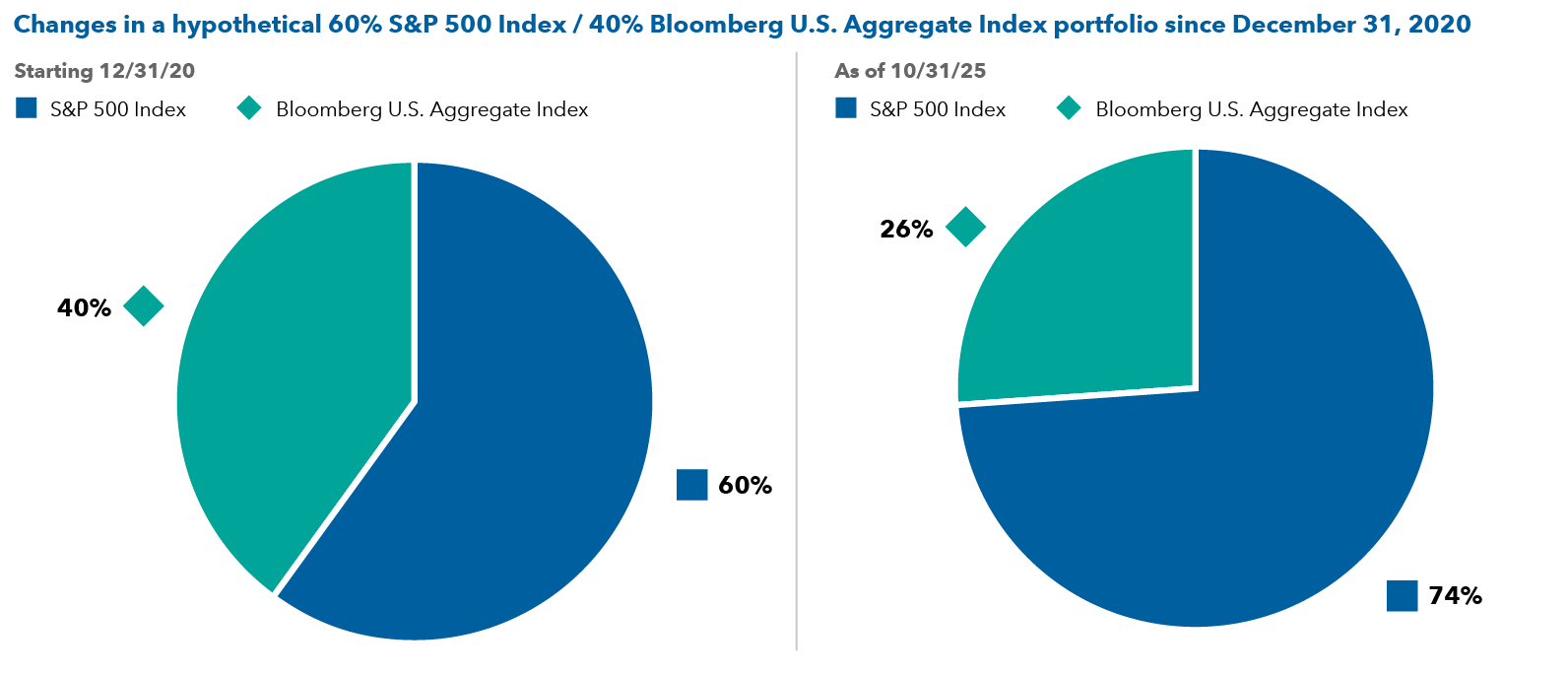

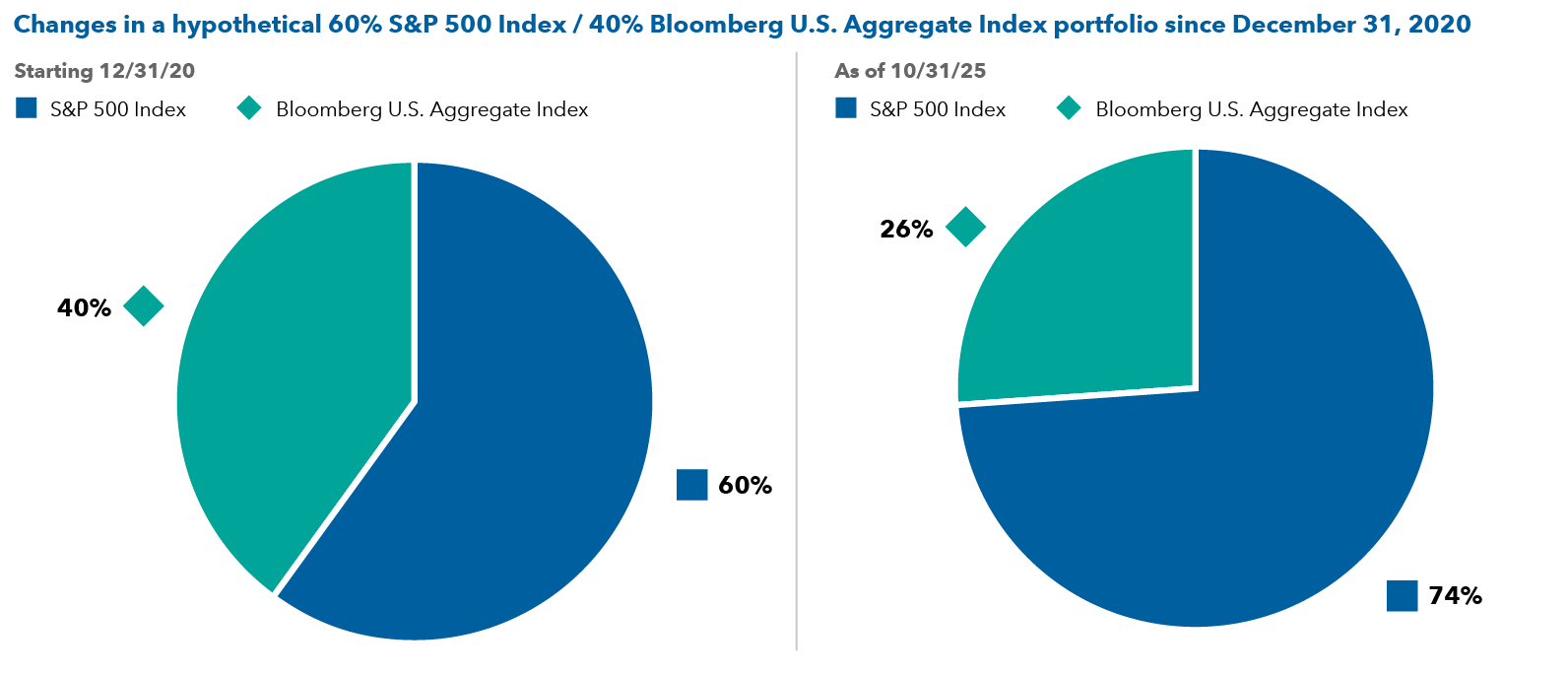

What’s behind this evolution? In many cases, the dramatic increase in U.S. stock prices since October 2022 may have pushed investors’ asset class allocations away from their long-term percentage targets, and as a result, investors’ portfolios may now contain more risk than they expect. As the chart below illustrates, without rebalancing, a hypothetical 60% S&P 500 Index/40% Bloomberg U.S. Aggregate Index portfolio that began on December 31, 2020 would contain 74% equities as of October 31, 2025.

Investors’ portfolios may have become imbalanced

Source: Bloomberg. As of 10/31/25. Changes in a hypothetical 60% S&P 500 Index/40% Bloomberg U.S. Aggregate Index portfolio since December 31, 2020. Assumes no rebalancing.

In addition, elevated valuations in the equity markets suggest more moderate returns in these markets in the years ahead. On the other hand, with starting bond yields generally indicating higher returns going forward, we believe that investors should consider increasing their fixed income allocations relative to past allocation percentages. Taken together, these dynamics appear to reinforce the likelihood of continued flows into fixed income and may provide a general tailwind for the asset class.

Inflows may reflect market trends

Given the recent capital flows into fixed income, a few possible trends stand out in the broader market. On one hand, some investors may have been willing to take more risk along the fixed income maturity spectrum, moving assets from money markets to short-term bond funds. At the same time, the flows into intermediate core and core-plus bonds may indicate that some investors now have a greater level of comfort with interest rate sensitivity, and that they’ve begun to rebalance into fixed income in an effort to reduce overall portfolio risk. But perhaps this should be no surprise: Over the past 24 months, forward U.S. equity price-to-earnings (P/E) ratios have remained above their long-term historical average.2

Fixed income can provide essential balance

Given this backdrop, it makes sense that capital is flowing into intermediate core and core-plus bonds as investors can potentially use these credits to balance equity risk in their portfolios. In our view, core bonds now appear to offer very compelling return potential given that starting yields are among the highest in decades. In addition, these bonds’ potential to add diversification may be particularly strong given the room that the Fed has to cut rates in the event of an economic slowdown. This potential for higher returns and stronger diversification is likely contributing to higher fixed income allocations, especially at a time when generally high valuations in many risk assets could result in lower returns going forward.

In evaluating core bond allocations, we believe investors should be aware of different asset manager profiles. The degree of credit risk in core bond funds can vary, and our emphasis on diversification and ballast within fixed income suggests that in our view, a more conservative approach may be prudent.

Capital Group’s core bond portfolios generally seek to be positioned with meaningfully lower sensitivity to credit markets than their peers. Over time, this profile should provide greater potential to diversify equity allocations, particularly when equity markets are falling. For example, our flagship fixed income mutual fund, The Bond Fund of America®, has generated strong long-term results while maintaining a risk profile similar to the Morningstar Intermediate Core Bond category average.3 In particular, the fund has stood out from its peers during periods of market stress, offering resilience in negative equity market environments.4

This profile is a function of Capital Group’s differentiated investment approach. Our core portfolios emphasize balance and diversification among risk exposures. We believe in embedding multiple drivers of returns, which can potentially lead to a more consistent pattern of returns over time. The Bond Fund of America’s high efficiency − attractive returns within its peer group and with similar or less potential risk than passive offerings − encapsulates the value that Capital Group’s investment approach seeks to offer.5

Current investment themes

Our current investment themes reflect Capital Group’s structural emphasis on diversification. As valuations of riskier assets have risen meaningfully, forward return potential in fixed income has compressed between opportunities with more risk and those with less. In fact, some lower rated corporate bonds currently have lower starting yields than those rated AAA/AA. Our core bond managers view this market environment as one where they can seek similar returns but with a more moderate risk profile as compared to periods in which we have taken more credit risk – thereby leaning into the diversification role that is a key characteristic of Capital Group’s fixed income investment approach.

Pramod Atluri, the principal investment officer for The Bond Fund of America, says, “We view this dynamic as relatively rare and as a great opportunity to reduce risk and pick up yield without affecting return potential. We’ve emphasized an up-in-quality bias, and we expect to maintain attractive return potential while building resilience if markets get more volatile. We also have room to add to our positions should risk assets cheapen, as we did in April.”

Our core bond portfolios today reflect a tilt toward higher quality. On a risk basis, our core portfolios are slightly underweight investment-grade (BBB/Baa and above) corporate credits in favor of senior securitized bonds. We are leaning into security selection across different sectors – from agency mortgage-backed securities to corporates to securitized credits – and deemphasizing generic sector overweights. We pair our diversified risk exposures with a yield curve steepener, favoring shorter dated bonds versus longer dated ones. (In this context, a yield curve steepener refers to portfolio positioning in which the fund’s managers anticipate that the Treasury yield curve will steepen over time through a relative decrease in short-term Treasury yields and/or a relative increase in long-term Treasury yields.)

This posture should offer benefits if front-end yields fall more than expected in the event of an economic slowdown, as well as in scenarios where longer dated yields are adversely affected relative to shorter dated ones due to fiscal deficits or “Fed capture” concerns. We believe this balance of exposures should provide our portfolios with some resilience while maintaining attractive yield and return potential.

Amid uncertainty, a tilt toward less risk

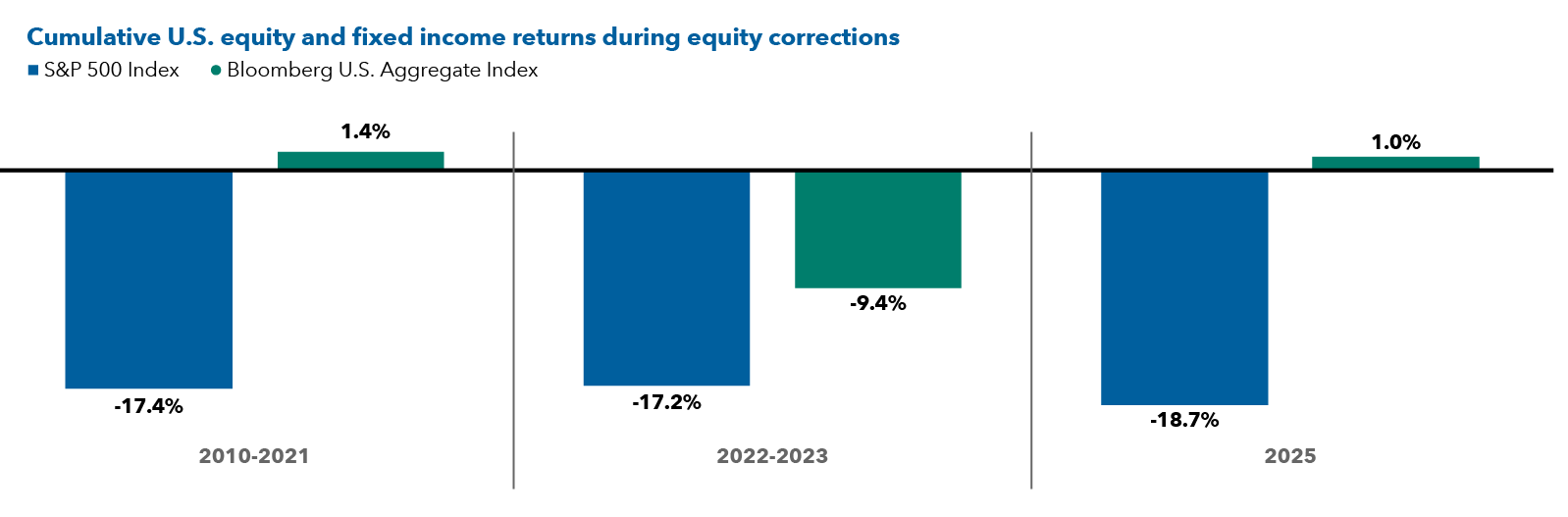

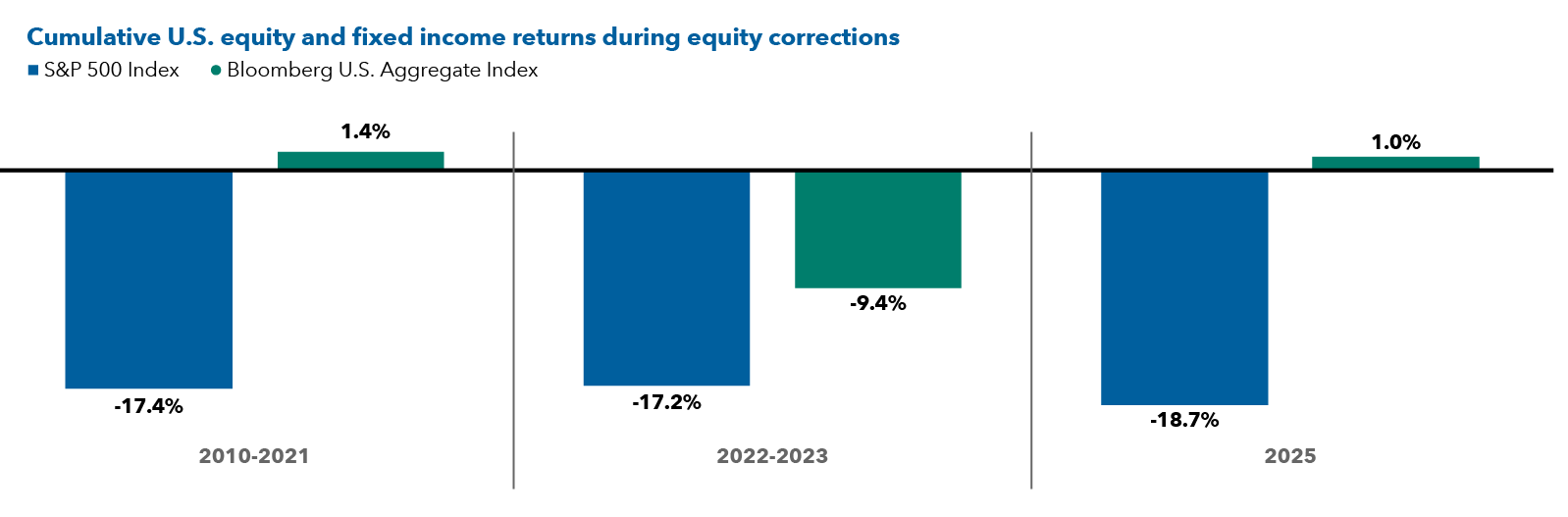

The recent increase in capital flows to core and core-plus bonds may reflect both rebalancing and asset allocation trends, as well as a tilt toward reducing risk on the part of many investors. Historically, U.S. fixed income has served as an effective diversifier for investors who are concerned about the possibility of falling equity markets. For example, in all U.S. equity corrections since 2010, U.S. fixed income (as measured by the Bloomberg U.S. Aggregate Index) has provided diversification and a measure of downside protection versus the S&P 500 Index.

During equity downturns, fixed income can provide diversification

Sources: Capital Group, Morningstar, Bloomberg. Data as of 9/30/25. For equity correction periods in 2010-2023, figures were calculated by using the average cumulative returns of the indexes during the nine equity market correction periods since 2010. Corrections are based on price declines of 10% or more (without dividends reinvested) in the unmanaged S&P 500 Index with at least 75% recovery. The cumulative returns are based on total returns.

With the U.S. and global economic outlook still uncertain, and with equity markets toward the higher end of their average historical P/E range, the risk of a potential downturn may be daunting. From that perspective, rebalancing toward fixed income may be a smart move for investors who seek attractive total returns with a more balanced risk profile.

Footnotes:

1 According to Morningstar mutual fund and ETF data. As of October 31, 2025.

2 Source: Capital Group, FactSet. As of 10/31/25.

3 Source: Morningstar. As of 10/31/25. During all equity corrections since 2010, The Bond Fund of America (F-2 share class) has generated an average of 63 basis points of excess returns over the Morningstar Intermediate Core Bond category. Equity corrections are defined as a peak-to-trough decline in the value of the S&P 500 Index of 10% or more.

4 Source: Morningstar. As of 9/30/25. Over the previous 10 years, The Bond Fund of America (F-2 share class) had an annualized return of 2.29%, while the Morningstar Core Passive category had an annualized return of 1.70%. Over the same period, The Bond Fund of America’s standard deviation of returns was 5.02%, while the standard deviation of the Morningstar Core Passive category was 5.11%.

5 Source: Morningstar. As of 9/30/25. Over the previous 10 years, The Bond Fund of America (F-2 share class) had an annualized return of 2.29%, while its core passive category average had an annualized return of 1.70%. Over the same period, The Bond Fund of America’s standard deviation of returns was 5.02%, while the standard deviation of its core passive category average was 5.11%.

Anmol Sinha is a fixed income investment director with 17 years of investment industry experience (as of 12/31/2024). He holds an MBA from Columbia, a master's degree in economics from New York University and a bachelor's degree in economics from University of California, Berkeley.