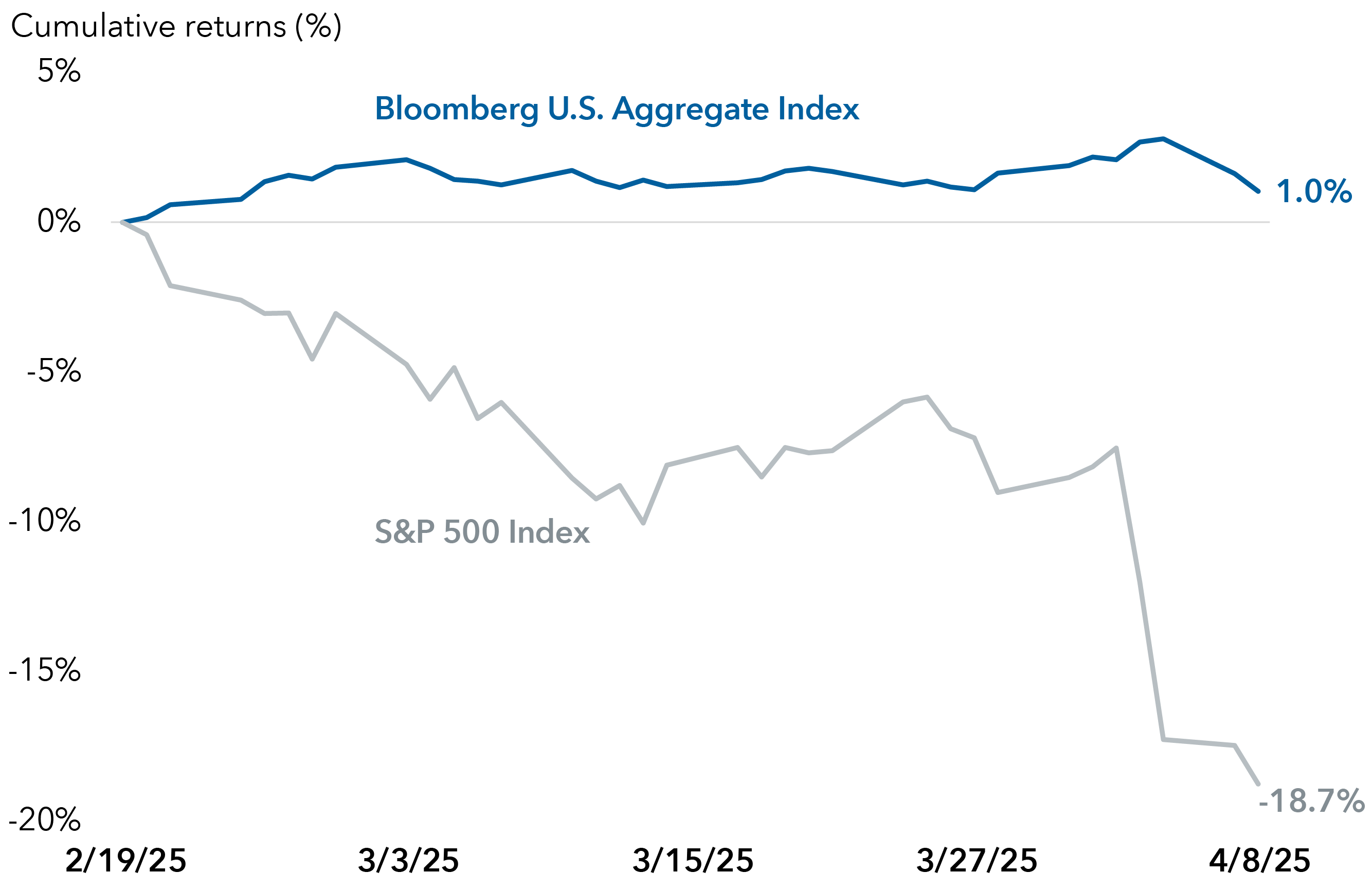

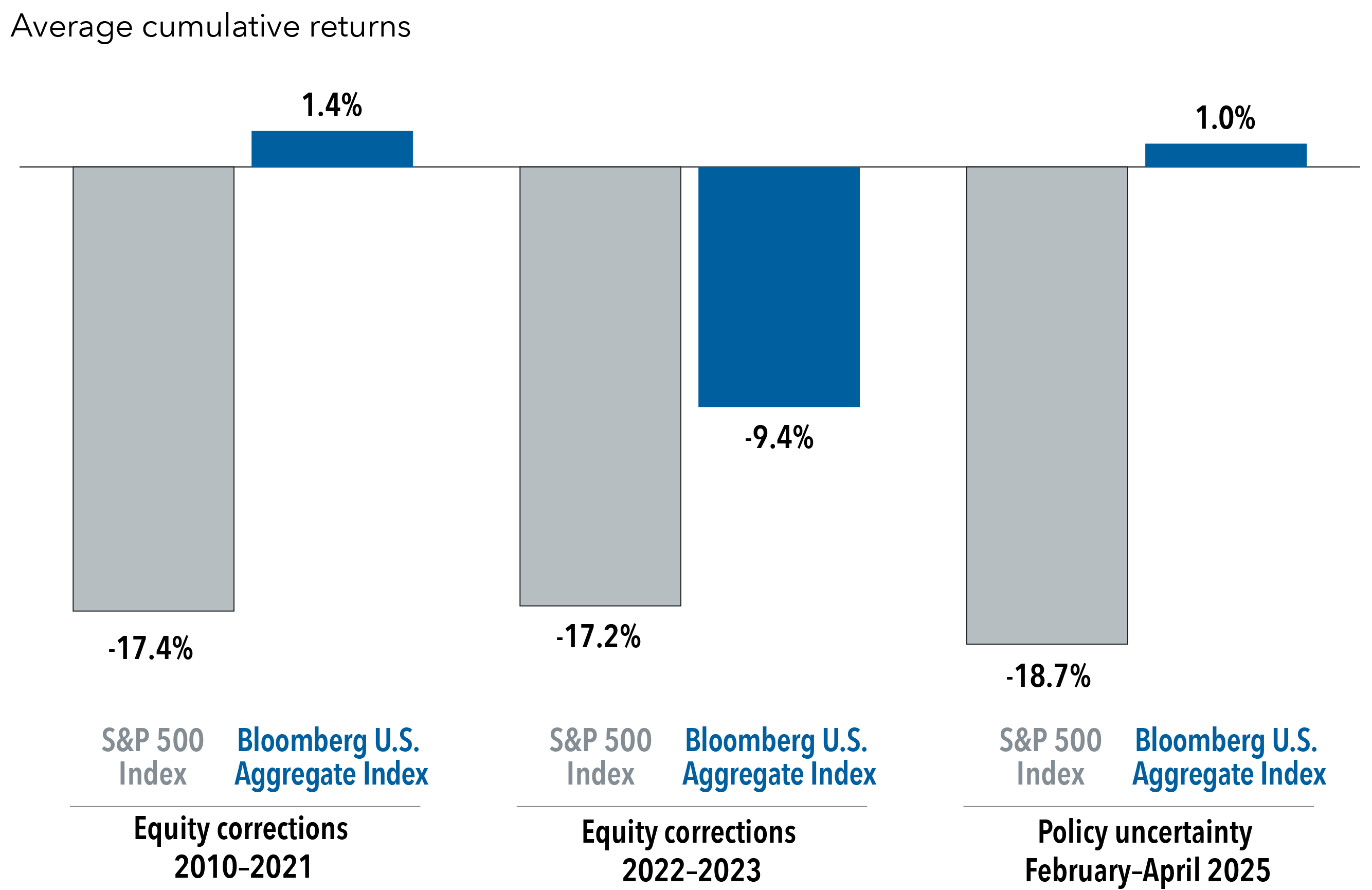

With the latest correction, investors may now be seeing the return of the traditional, negative correlation between stocks and bonds. Inflation has been tamed, with the Consumer Price Index dropping from 9.1% in June 2022 to 2.3% in April, following the Fed’s rate hiking campaign — a major driver behind the breakdown in bond diversification. While markets are watching for any uptick in inflation from tariffs, the Fed’s response will likely be influenced by whether those increases are transitory and the potential hit to economic growth.

A silver lining of the Fed’s rate hikes was to lift bond yields off their near rock-bottom lows. Yields on the Agg Index have reached about 4.7% as of May 30, compared with roughly 2% prior to the Fed’s hikes and a 10-year average of about 3%. Those elevated yields are now serving as a cushion, helping bonds weather interest rate volatility.

Bonds remained resilient even as the Fed remained on pause following its latest rate reduction in December 2024. Investors are wagering that the Fed’s next move will be to resume rate cuts, which could help further boost bond returns. As of May 30, futures markets indicate a 66% probability of a Fed rate cut in 2025, compared with a 4% chance of a rate hike and a 30% likelihood of an extended pause. The Fed is projecting two more 25 basis point cuts later this year, according to its most recent March projections, with Fed chairman Jerome Powell stating that the Fed “can afford to be patient as things unfold,” at a press conference on May 7, 2025.

Not everyone is on the bond bandwagon. The recent equity selloff caused some portions of the bond market to come under pressure. Risk premiums, especially for longer term Treasuries, were impacted by the unwinding of trades by hedge funds and speculation that foreign investors might diversify out of U.S. assets. Moody’s downgrade of U.S. sovereign debt, from Aaa to Aa1 in mid-May, also added to investor qualms.

Despite these concerns, the narrative of a vast exodus from U.S. Treasuries appears to be overstated. The Treasury market remains the largest and most liquid government bond market in the world, with a lack of large, liquid alternatives elsewhere. The Fed also has several tools at its disposal to provide liquidity and support market functioning. While the Moody’s downgrade may inject fresh urgency into the discussion around the federal deficit, forced selling of Treasuries is unlikely as Moody’s is the third ratings agency to downgrade the U.S. and investors have had ample time to digest the implications.

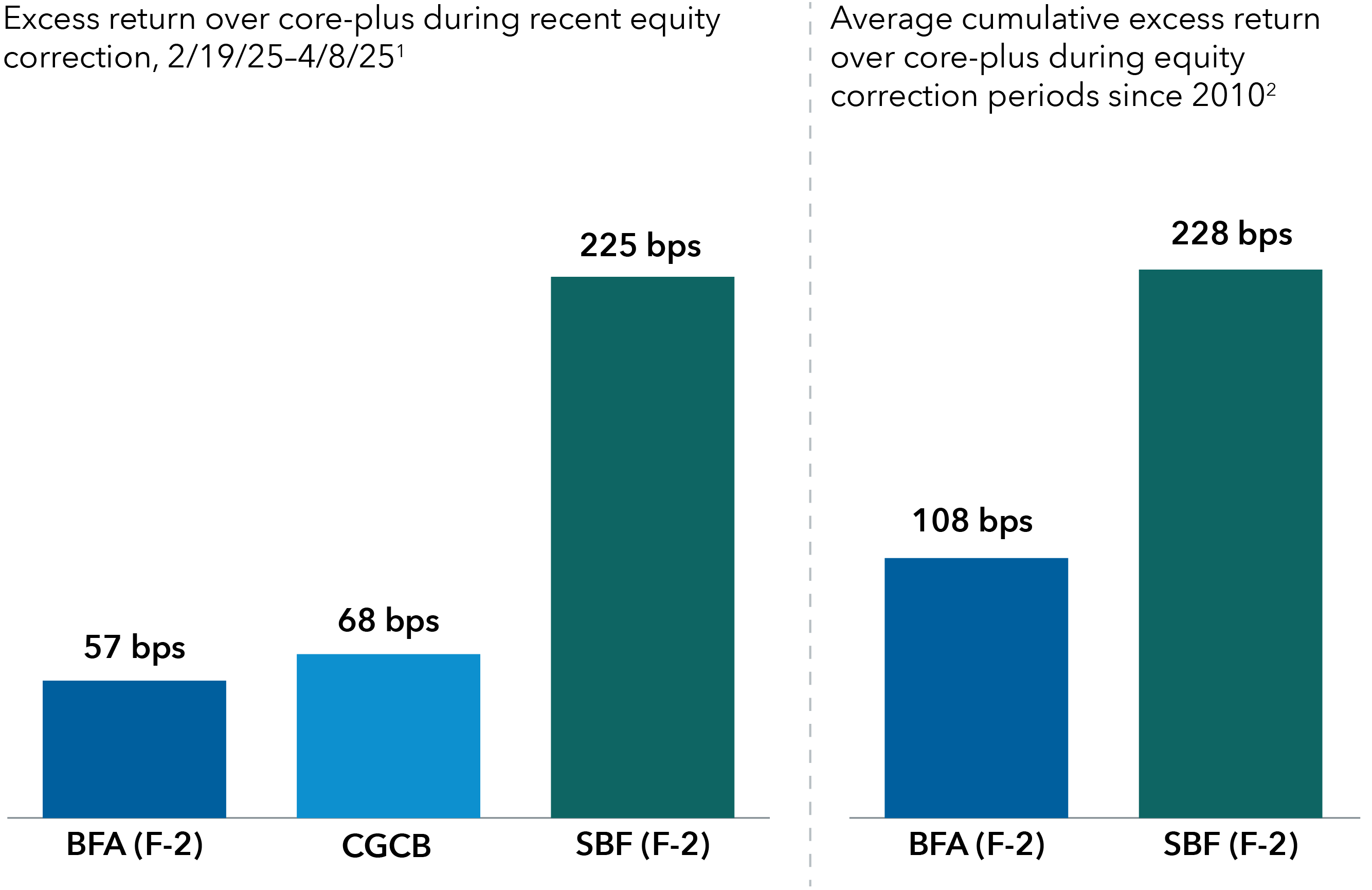

Amid these various crosswinds, a focus on quality and interest rate positioning appears key for bond investors. The Bond Fund of America® (BFA), our true core bond offering, and American Funds® Strategic Bond Fund (SBF), part of our core-plus suite, have posted positive returns and outperformed the Morningstar Intermediate Core-Plus bond category in the latest volatility period. The category is comprised of some core plus funds which may take on additional credit risk in the hopes of boosting returns.

As equities fell from their mid-February peak to their early April low, BFA and SBF posted returns that outstripped average returns on the core-plus category by 57 and 225 basis points (bps), respectively. Meanwhile CGCB - Capital Group Core Bond ETF, an active ETF launched in 2023, posted excess returns relative to the core-plus category of 68 bps during that timeframe. When looking at equity correction periods since 2010, BFA and SBF also had strong average excess returns over the core-plus category.