A target date fund (TDF) is arguably the most important investment on a retirement plan menu. It allows all investors regardless of their level of sophistication to have a diversified investment that’s appropriate for their age and career timeline. Furthermore, a TDF takes a complex investment challenge and presents it in a simple solution that plan participants can more easily understand.

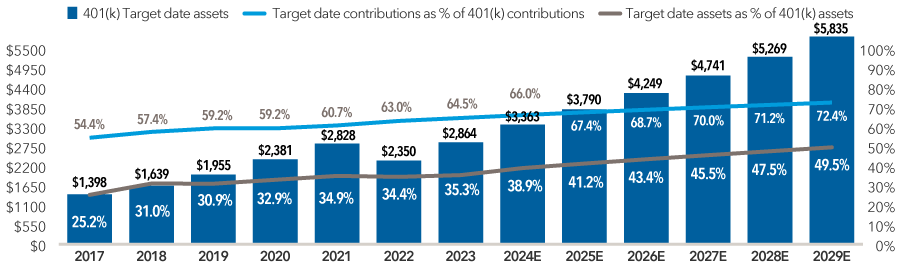

As a result, TDFs have become the dominant investment trend in 401(k) and other defined contribution plans. However, they may still be underutilized by participants. According to a 2024 report from the Employee Benefit Research Institute, TDFs comprised only 38% of 401(k) assets.