Creating a sustainable retirement income plan isn’t always easy, especially when clients are grappling with how to make a lifetime of accumulated savings last, well, a lifetime. Not only can these plans be complex to create and explain, but investors’ own behavior can derail them through overspending or impulsive reactions to market volatility.

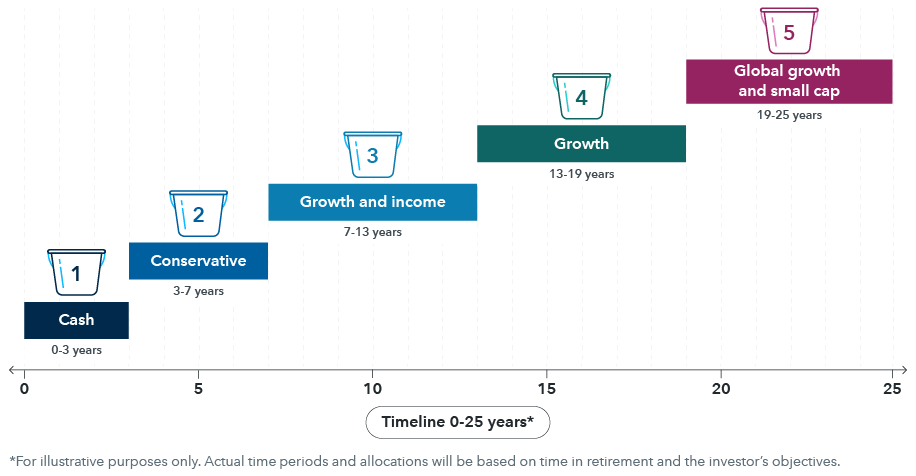

That’s where the bucket system comes in. As our Senior Retirement Income Strategist Kate Beattie, CFP, RICP, recently discussed, the bucket system is an adaptable “now versus later” strategy first developed by wealth manager Harold Evensky in the mid-1980s.