With the S&P 500 Index near record highs, have we moved past peak dominance for the Magnificent Seven ("Mag 7") group of stocks? It appears so, and it represents a healthy move away from the extreme concentration that raised concerns about risks to investor portfolios.

After three years of the Mag 7 accounting for a majority of the S&P 500’s annual return, more companies are now contributing; by September 30, non-Mag 7 stocks represented 59% of this year's return.

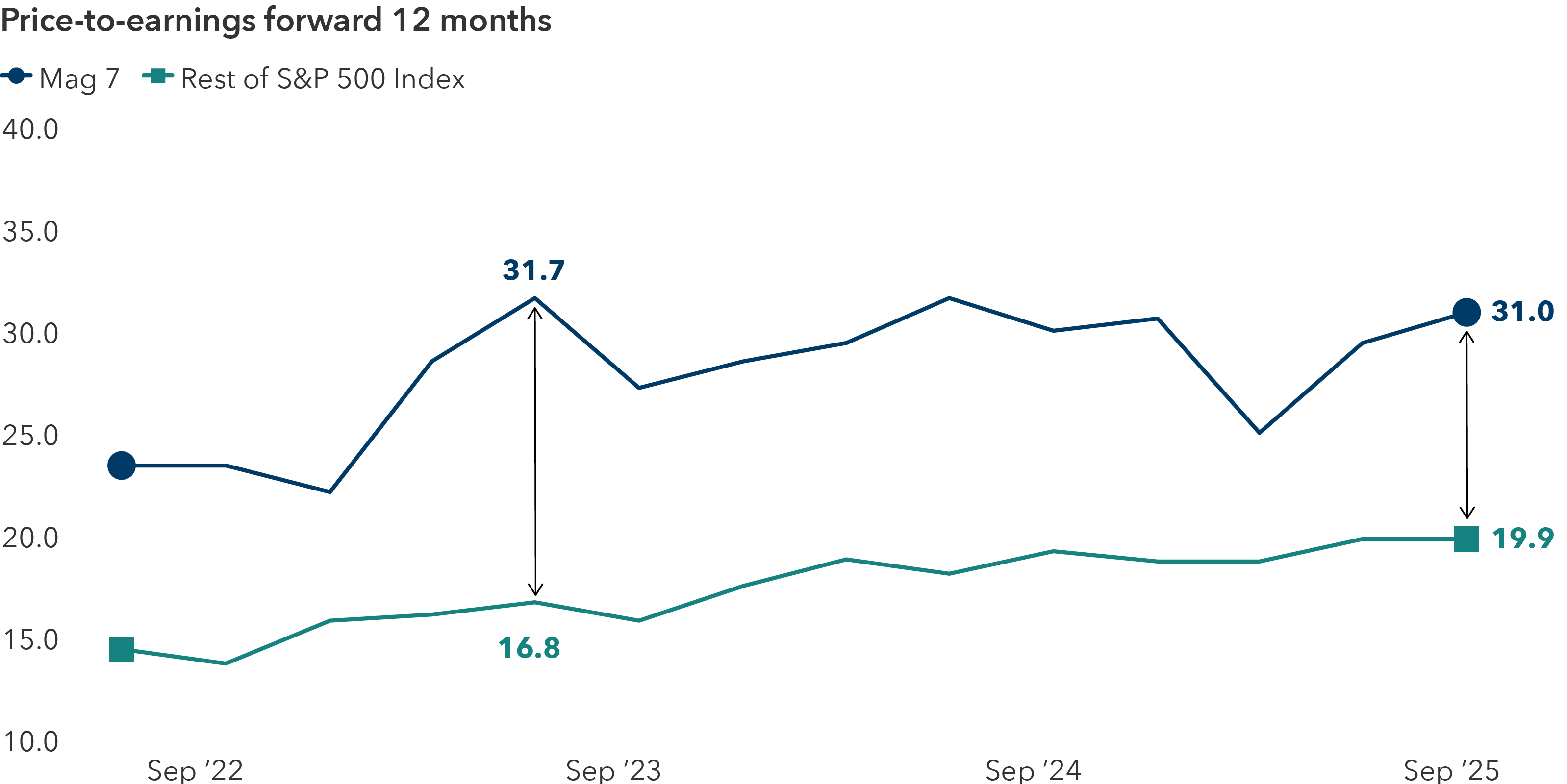

Fresh breadth may support the S&P 500’s rebound after its early 2025 selloff. The index has surged 36% since hitting an April 8 low. Rising valuations among companies in the index and more clarity on tariffs and interest rate cuts could help lift the U.S. equities market, which has trailed those in Europe and elsewhere.

“Heading into 2026, I think there are tailwinds that should drive earnings growth and support the market, such as stimulus from the tax bill and more policy certainty,” says Diana Wagner, equity portfolio manager at Capital Group. “There’s plenty of opportunity outside the Mag 7, and I think the broadening that we have started to see this year is going to continue.”