In the ever-evolving world of investing, thematic exchange-traded funds (ETFs) have emerged as a compelling option for investors seeking targeted exposure to specific trends, industries or innovations. Unlike traditional passive ETFs that track broad indices such as the S&P/TSX and S&P 500, thematic ETFs focus on narrower areas of the market such as artificial intelligence, clean energy, cybersecurity and space exploration. But as their popularity grows, so do questions about their long-term value when it comes to wealth creation.

“Investors are drawn to the idea of putting their money behind transformative trends, but there are three factors worth considering before jumping in,” says Capital Group Canada’s senior product specialist Warner Wen, whose focus is ETFs.

1. Performance: A mixed bag

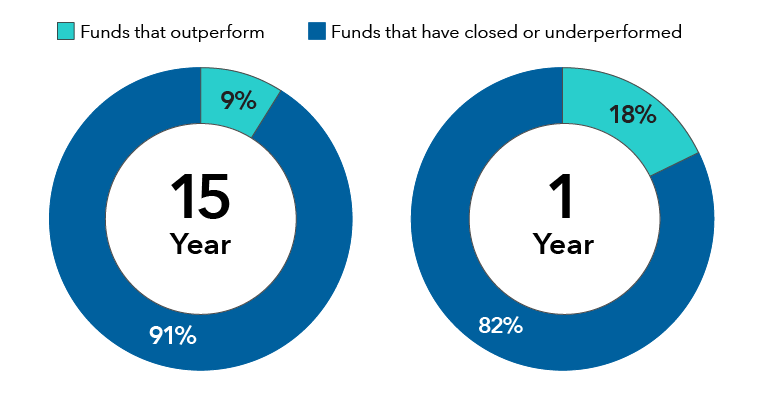

While some thematic ETFs have delivered impressive short-term returns, the broader picture is more nuanced. According to a Morningstar study of global thematic funds, as shown in the donut chart below, only 9% — fewer than one in 10 — of the funds were able to survive and outperform a broad-based global equity index over a 15-year period to mid-2024. Across several time horizons studied ranging from one year to 15 years, the success rate was highest for the one-year period, which came in at 18%. Put simply, the odds are stacked against investors who wish to pick a thematic fund that prevails.

Global thematic fund survival and success rates

Source: Morningstar Research. Fund performance is measured against the Morningstar Global Target Market Exposure Index, which tracks the performance of large- and mid-cap stocks in developed and emerging markets, representing the top 85% of the investable universe by float-adjusted market capitalization. Trailing period returns are calculated as of end of June 2024.

The underperformance of thematic funds as a whole reflects the challenges these strategies face, particularly in volatile or shifting market environments where broad-based diversification tends to outperform concentrated thematic bets.

“Many thematic funds are launched at the peak of hype cycles, only to falter as interest waned or the underlying companies failed to deliver,” says Wen.

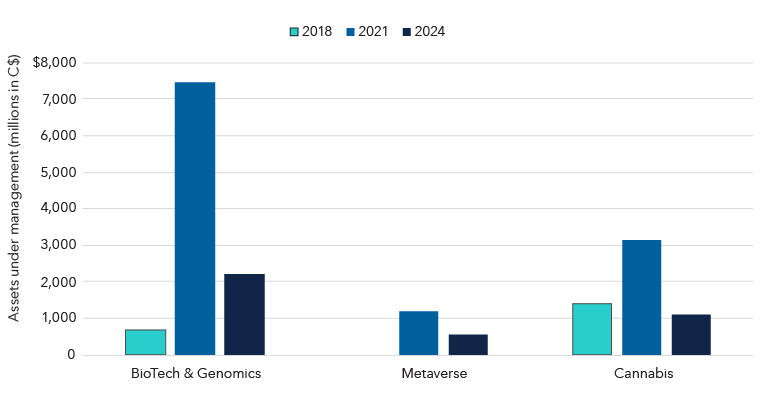

Some of the more noteworthy themes that have witnessed a relatively short boom-and-bust cycle in recent memory include biotech & genomics (fueled by the COVID-19 pandemic), the metaverse and cannabis. The three themes are shown in the bar chart with the amount of assets invested in each during the years 2018, 2021 and 2024. As illustrated, each of the themes show the amount of invested assets initially rising fast from a small base, peaking, and then dropping fast.

Boom and bust: Aggregate AUM of thematic ETFs by theme

Sources: Capital Group, Bloomberg. Thematic ETFs in each category include both US- and Canadian-listed ETFs. Total AUM is expressed in Canadian dollars. “Metaverse” had zero AUM as of 2018, as all ETFs in the category launched after 2018.

As a result, it’s important for investors to familiarize themselves with the risks of thematic ETF investing, says Wen.

2. Understand the risks

Concentration risk

Many thematic ETFs are heavily concentrated in a small number of securities. This lack of diversification can lead to significant volatility. For instance, a clean energy ETF might be dominated by just a handful of solar or battery companies, making it vulnerable to sector-specific downturns.

Timing risk

Investors often pile into thematic ETFs after a theme has already gained traction, leading to inflated valuations. This “buy high” behaviour can result in poor long-term returns if the theme cools off or fails to materialize as expected.

Liquidity and size

Some thematic ETFs are relatively small and thinly traded. Looking through to the portfolio securities in these ETFs, there may also be notably more small- or mid-cap companies because of the early-stage nature of the targeted theme. The result is potentially wider bid-ask spreads and higher trading costs on these ETFs. Additionally, smaller funds are more likely to be shut down if they fail to attract sufficient assets.

Marketing over substance

Critics argue that some thematic ETFs are more about storytelling than sound investment strategy. With catchy names and slick marketing, they can lure investors into speculative bets that lack fundamental support.

Are thematic ETFs worth it over the long term?

The answer depends on how they are used. For investors with a strong conviction in a particular trend and approach them tactically, thematic ETFs can offer targeted exposure without the need to pick individual stocks.

“However, picking themes might just be as hard as picking stocks. Some investors may benefit more from professionally managed active strategies that take into account long-term trends in the fundamental research process,” suggests Wen.

3. Build from the core

For long-term investors, a core, actively managed ETF may offer more consistent value and resilience compared to a passive thematic ETF. While thematic ETFs are designed to capitalize on specific trends, they often come with higher volatility, concentration risk and uncertain long-term viability. In contrast, core active ETFs are typically diversified across sectors and regions, and are managed by professionals who can adapt to changing market conditions.

At the same time, active managers who can conduct deep fundamental research on a global scale may be able to capture investment tailwinds arising from structural long-term trends. Take artificial intelligence (AI) for example: beyond the few well-publicized AI stocks, unique opportunities can be uncovered across the data centre value chain and AI infrastructure at large.

“A well-crafted active core strategy should already have some exposure to themes that the active manager believes to have long-term staying power,” says Wen.

On the other hand, the myriad thematic ETFs could offer investors a valuable tool to build on top of a strong core foundation, allowing them to follow up on personal investing beliefs and interests. As long as they're aware of the risks.

At Capital Group Canada, we offer four active ETFs that deliver our distinctive investment approach rooted in three pillars: collaborative research, diverse perspectives and long-term view. These ETFs are designed to strengthen the core of a portfolio: Capital Group Global Equity Select ETFTM (Canada) — CAPG, Capital Group International Equity Select ETFTM (Canada) — CAPI, Capital Group World Bond Select ETFTM (Canada) — CAPW and Capital Group Multi-Sector Select ETFTM (Canada) — CAPM.