Global Equities

Politics

In a year full of uncertainty over tariffs and trade, financial markets took another curveball on Wednesday as the U.S. government shut down amid an ongoing dispute between Republicans and Democrats over spending priorities.

There is no indication how long the impasse might last, but a long history of past government shutdowns suggests that, regardless of length, it will have little impact on the financial markets and the U.S. economy. Even during extended shutdowns of two weeks or longer, stocks and bonds have generally weathered the storm with only small ripple effects, followed by a strong rebound.

“My message for investors is to stay calm and carry on,” says Capital Group political economist Matt Miller, a former senior advisor in the White House Office of Management and Budget. “If history is any guide, the negotiations will be tense, there will be a great deal of political drama, and eventually a compromise will be reached.”

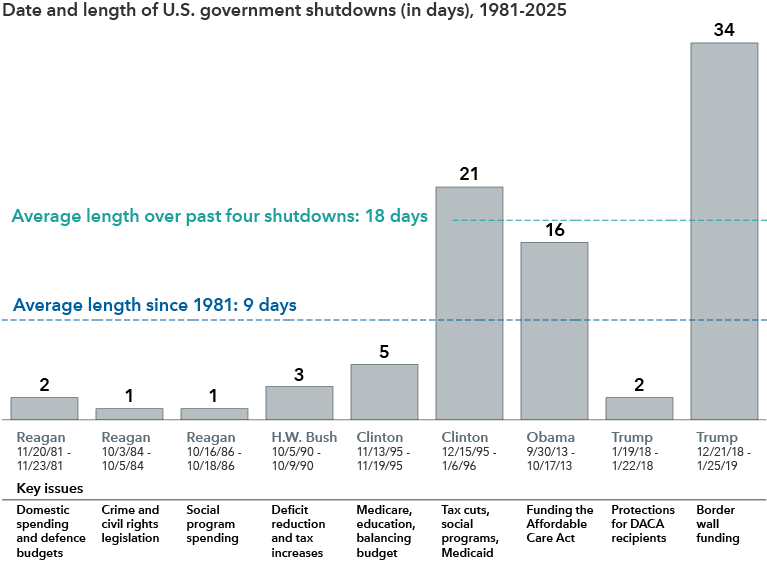

U.S. government shutdowns can get ugly but tend to be brief

Sources: Capital Group, U.S. Congressional Research Service: "Federal Funding Gaps: A Brief Overview." Length of government shutdowns are defined as the number of days during which no budget authority was available, starting from the first day without budget authority and ending the day before new budget authority was enacted. DACA is the Deferred Action for Childhood Arrivals policy. As of September 30, 2025.

Over the past four decades, U.S. government shutdowns have lasted an average of nine days, with some ending in as little as one or two days. However, more recently, an increasingly confrontational political environment has produced much longer conflicts, including a 34-day shutdown during President Trump’s first term in office.

Health care spending in the spotlight

The current dispute revolves around a Republican-crafted bill to continue funding the federal government for the next seven weeks while a full-year spending bill is hammered out. Senate Democrats have so far refused to advance the so-called “continuing resolution” unless Republicans agree to extend certain health care subsidies under the Affordable Care Act (ACA) that are due to expire soon and to reverse Medicaid cuts made earlier this year.

“An agreement to maintain the ACA subsidies is likely to be reached in the weeks ahead,” Miller says. "Democrats are pushing hard for it, and many Republicans leaders also want it to happen to help minimize the issue ahead of the 2026 midterm elections.”

Another issue that sets this shutdown apart are statements from Trump Administration officials that some non-essential workers could be permanently let go, rather than just temporarily furloughed. If this approach is followed, it could have more lasting effects on the U.S. labour market. Permanent job losses are likely to push up the unemployment rate and could dampen consumer confidence.

For financial markets, the direct reaction to a shutdown is usually muted. Historically, risk assets dip slightly during a shutdown’s immediate aftermath, but these moves are often small and tend to reverse once the government resumes normal operations.

This time, the bigger concern is the interruption of key economic data releases, which can complicate decision-making for the U.S. Federal Reserve and other policymakers if the shutdown drags on.

Bond investors still anticipating a Fed rate cut

The shutdown arrives at a crucial time for the U.S. economy and for the Fed, which relies on a steady stream of data to set monetary policy. Investors are anticipating a rate cut at the next Fed meeting in late October, unless a surprisingly strong jobs report shifts the outlook. This shutdown could cause delays to the release of key data from the U.S. Bureau of Labor Statistics, which would force the Fed to act without that information.

“The obstacle to a rate cut would be a blowout monthly jobs report,” says Capital Group fixed income portfolio manager Tom Hollenberg. “If that data doesn’t come in time, I think the Fed moves forward with a rate cut.”

Hollenberg otherwise views a government shutdown as a “non-event for bond markets.” Nonetheless, the dispute comes amid ongoing worries about the Fed’s independence and the federal government’s ability to gather and report crucial economic data.

Stock investors taking it in stride

With U.S. stocks hitting record highs in recent weeks, a relatively short government shutdown also isn’t likely to cause much disruption in equity markets, says portfolio manager Mark Casey.

“We may need to weather some short-term volatility, but the stock market usually takes these events with a grain of salt,” Casey says. “Investors have seen enough shutdowns to know that it probably won’t be long until the government is back in action.”

Our latest insights

-

-

Demographics & Culture

-

-

Economic Indicators

-

U.S. Equities

RELATED INSIGHTS

-

-

Global Equities

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Matt Miller

Matt Miller

Tom Hollenberg

Tom Hollenberg

Mark Casey

Mark Casey