Global Equities

Aerospace

Every two years, the commercial aerospace industry gathers at the Paris Air Show, where flashy aerial exhibitions, the unveiling of multibillion-dollar plane orders and the latest tech wizardry are on display. We attended the June event, which was a good reminder of the secular growth, wide moats and good management teams this sector possesses.

We believe global aerospace is a well-positioned industry for a decade-long cycle of growth, absent a major geopolitical crisis or a deep recession.

Commercial aerospace firms are riding multiple tailwinds that could help boost earnings, margin power and cash flows. The setup is favourable, and one any industry would covet: There’s strong demand, tight supply, great pricing power and growth visibility over a long cycle. These dynamics may support the group moving forward — even after a multi-year run for many stocks and an increase in valuations.

Here are three takeaways from our conversations with industry executives at the Paris Air Show that underscore why we think the outlook is attractive for commercial aerospace.

- Business is booming for aftermarket services. When COVID hit, travel ground to a halt and airlines canceled orders for new planes. Global air travel has recovered. However, due to supply chain challenges, airlines have relied on existing fleets and retired fewer aircraft, creating vibrant demand for the maintenance and repair of engines and components — the most profitable slice of an aerospace company’s business. It is also an area with pricing power. Aerospace firms have raised prices for many years and appear to be in a position of strength.

- Supply chain issues are improving. The industry underwent layoffs and retirements during the pandemic, a factor that has led to longer delivery lead times for new aircraft. While the situation is improving, deliveries of new planes have been pushed out and will take several years to ramp up, in turn helping the profitable aftermarket service business.

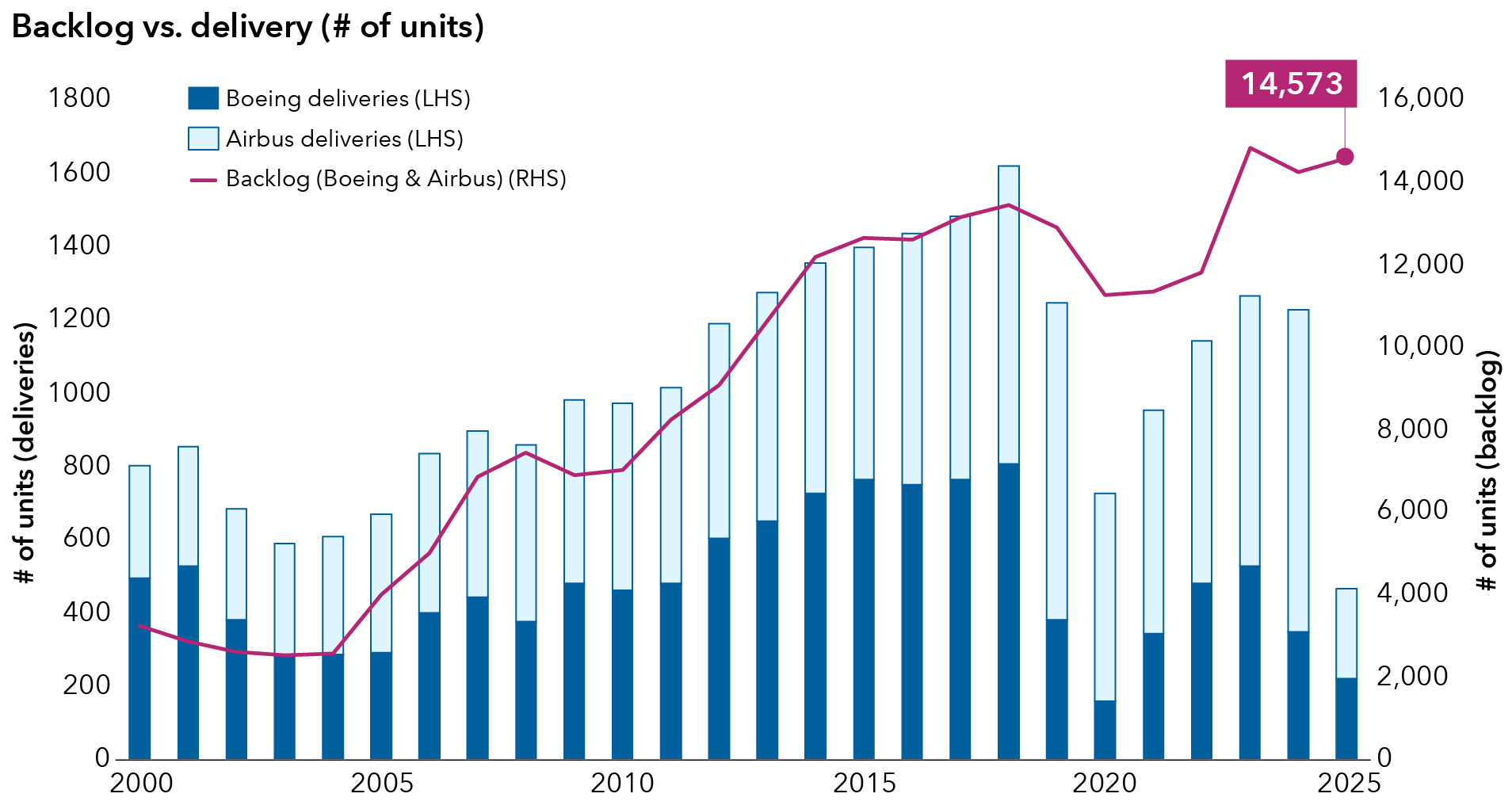

- The delivery cycle is likely to grow into the next decade. Long-term demand looks bright for new aircraft (narrow and widebody), engines and related components. Backlogs for aerospace companies are growing with the resurgence of travel, the need to replace older planes and an increase in middle-class income in certain emerging markets. One example is India, where rising wealth has spurred demand for air travel inside and outside the country.

Commercial airplane backlogs have rebounded

Sources: Airbus, Boeing, Goldman Sachs. As of May 31, 2025. The bar and backlog for 2025 shows data through May 31, 2025.

Bottom line

The Paris Air Show reinforced our view that the aerospace industry is poised to enjoy a favourable business environment, driven by improving volumes, strong pricing, an improving supply chain and low levels of capital expenditures, which may translate into higher cash flows.

The situation is appealing because the aerospace business is essentially an oligopoly. Airbus and Boeing, for instance, dominate global airplane manufacturing, while the likes of Safran, Rolls-Royce and GE Aerospace command significant market share in aircraft engines and components.

And lastly, amid some concerns about too much exposure to a concentrated U.S. equity market in technology-oriented stocks, we find commercial aerospace is an attractive investment opportunity that will provide broader international exposure in both growth- and dividend-oriented portfolios.

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets.

The MSCI USA Index is a free float-adjusted, market capitalization-weighted index that is designed to measure the U.S. portion of the world market.

The MSCI World Aerospace and Defense Index is composed of large and mid-cap stocks across 23 Developed Markets countries.

Our latest insights

-

-

Demographics & Culture

-

-

Economic Indicators

-

U.S. Equities

RELATED INSIGHTS

-

Economic Indicators

-

-

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Renaud Samyn

Renaud Samyn

Johnny Chan

Johnny Chan