Global Equities

China

In the early 2000s, a small cell phone battery manufacturer in China, known as BYD, made what the market believed was an unusual acquisition of a troubled domestic car manufacturer. BYD shares sold off on the news. Little did investors know that BYD’s leadership was laying the groundwork for what it saw as the company’s future.

Today, BYD is the world’s leading maker of electric vehicles (EV) and second-largest manufacturer of EV batteries, behind fellow Chinese company CATL.

China's dominance in this industry is a reminder of how the country has moved up the technology curve and can build massive scale when entrepreneurs are supported by favourable industrial policies. It’s not the first instance, and I believe it won’t be the last.

Having closely followed companies in China for 26 years, I’ve learned not to underestimate what businesses can achieve when it comes to making technological leaps. With AI marking the next competitive frontier, especially between the U.S. and China, here are a few of my observations on innovation in China.

1. DeepSeek marked pivotal moment in global AI race

Out of nowhere in January, little-known Chinese startup DeepSeek stunned global markets with the release of its open source artificial intelligence (AI) training model, shifting the narrative from the U.S. as the leader in the AI race. Within days, DeepSeek overtook ChatGPT in downloads in Apple’s app store. It marked a pivotal moment.

DeepSeek demonstrated that China can innovate even under tight constraints — without relying on state-of-the-art semiconductors. I would argue its AI model, while not surpassing U.S. competitors, holds its own. Importantly, it’s become a beacon of national pride. In February, President Xi Jinping and top party leaders seized the moment to host a rare meeting in Beijing with the country’s most prominent entrepreneurs. The underlying message: It’s time for the tech sector to make its mark.

Since DeepSeek’s emergence, there is a renewed sense of confidence among government officials and companies, giving hope to what China can accomplish to differentiate itself as an industrial complex. Many are now more willing to embrace AI and explore its use cases.

China’s tech leaders gain on Mag 7

Source: FactSet. P/E: price-to-earnings. Mag 7: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. China’s innovation leaders: Alibaba, BYD, JD.com, Meituan, NetEase, PDD Holdings and Trip.com. Data from December 31, 2024, to June 17, 2025.

This is important because over the past 15 years, China leapfrogged in many ways.

A prominent example would be mobile internet services, as smartphones, not personal computers, were the first computing device for millions of people. Companies like Tencent and Alibaba built the world’s leading super apps — digital platforms that offer a range of everyday services, such as financial payments and e-commerce, within a single application.

Some of my investment colleagues and I have noticed the accelerated digitization of China since the country reopened after COVID. The use of cash has become an anomaly, making it hard to buy food, pay for a cab or conduct other daily transactions without apps like Tencent’s WeChat.

E-commerce and social media are other areas where companies have driven global innovation, ranging from group buying to live streaming and short videos to sell products and offer experiences not seen on other platforms or in traditional retail stores. TikTok, for instance, is a worldwide phenomenon.

2. Chinese companies excel at improving existing technologies

That brings me to my next point. China excels at taking existing technologies and improving them at a rapid pace and low cost, both at the manufacturing and application level. I call this going from one to 10, rather than inventing a new product from scratch.

China’s growing dominance in the global EV market exemplifies this. For example, Xiaomi, the world’s third-largest smartphone maker, built both an impressive EV from scratch (where Apple fell short) and set up a highly automated EV manufacturing plant, all within three years.

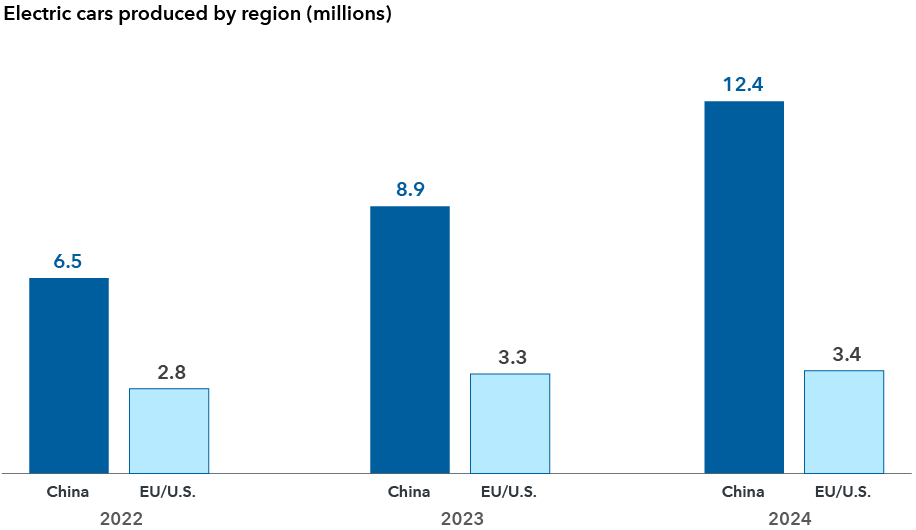

China has accelerated electric car production

Sources: Capital Group, based on data from International Energy Agency, Global Electric Vehicle Outlook 2025.

Elsewhere, growth has been astonishing in China’s biopharmaceuticals industry, which barely existed a decade ago. Large numbers of Chinese scientists who were educated or employed in the U.S. and Europe have returned to help create companies involved in drug development, testing and manufacturing. Momentum is building. This year alone AstraZeneca, Pfizer and Bristol-Myers Squibb announced multibillion dollar licensing deals with Chinese firms for potential cancer drug treatments.

Humanoid robots are another targeted growth area. Many industrial companies are exploring the possibilities, though development is still in the early stages.

EVs and biopharmaceuticals are examples of industries closely aligned with the government’s industrial policy that aim to enhance the competitiveness of China’s companies relative to the rest of the world. The initiative involves billions of dollars in government subsidies over a multiyear period. The practice has drawn the ire of some countries that lament such policies create an uneven playing field, unfair trade and excess capacity. The rise of China in solar is a past example.

3. China has the potential to overcome technology restrictions

The U.S. has curbed exports of high-end technology to China in hopes of slowing down the country’s technological development. Given the time, companies in China have shown a penchant for catching up. I have more confidence in the long term than the short term.

Restrictions have fueled the determination of the government and businesses to become more self-sufficient.

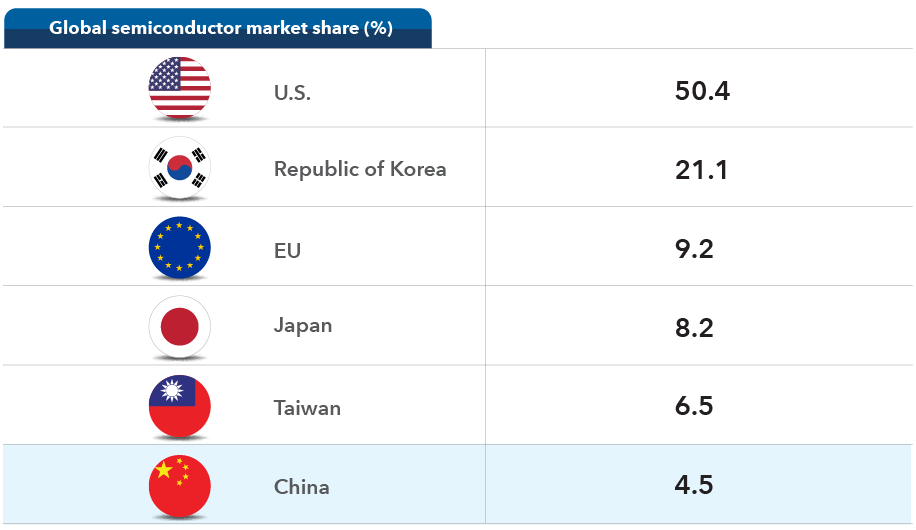

The country’s semiconductor industry illustrates this drive. Unlike mobile internet services or e-commerce, China has not produced a formidable competitor to companies in the U.S., Europe or other parts of Asia. While China is a producer of lower end chips used in consumer electronics, household products and communications equipment, its commercial semiconductor industry is relatively small and lags in producing advanced chips.

China could gain ground in chipmaking

Source: Semiconductor Industry Association. Data as of May 2025. Market share is the percentage of global chip sales by where a company is headquartered.

The industry fell behind, largely because Chinese companies depended heavily on international suppliers. Without production volume or design wins, scaling up and advancing technologically proved difficult. However, U.S. export controls are giving Chinese semiconductor companies a foot in the door with major Chinese customers.

Another factor I’m watching in semiconductors and other advanced areas of technology is the impact of tightening U.S. immigration policies. Chinese scientists and engineers have been returning home, potentially enhancing China’s innovation capabilities.

4. Innovation can come at a cost

China is an incredibly competitive market for developing new technologies, and investors must be mindful of high-growth areas in the economy. They are often flooded with too much capital and capacity, while facing grueling competition and intense margin pressure. Take the EV industry. Despite amazing strides in innovation, the industry is oversupplied with cars and has endured brutal price wars, both of which have limited profitability.

China’s specific industrial policies, both at the national and local levels, invite heightened competition since the government’s strategic planning is long term (10 years or more) and backed by substantial subsidies. National champions often emerge within certain sectors, but it takes time to determine what might be the better investment opportunities.

5. Fast-growing sectors have matured

That is one reason I’m focused on good capital allocators with dependable profit margins and that operate in fields with higher barriers to entry. My main focus is the broader internet and e-commerce space, which had an amazing period of growth from 2012 to 2020, with annual revenue climbing at rates north of 20%.

Growth rates have slowed due to market saturation. Some companies have demonstrated more discipline in terms of capital allocation strategies, while others have also initiated or increased dividends and share buybacks. This is an attractive development from an investment standpoint.

Don’t underestimate China’s future innovations

China’s technology industry has and will continue to rapidly evolve, marked by fierce domestic competition and an intense rivalry with the U.S. The combination of robust government support, a large domestic market to test ideas, the return of western-trained scientists and entrepreneurs, and a strong work ethic positions China as a formidable player in global innovation. As an investor, I’m watching closely for select opportunities.

The S&P 500 Index is a market-capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The MSCI China Index captures large- and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs).

Our latest insights

-

-

Demographics & Culture

-

-

Economic Indicators

-

U.S. Equities

RELATED INSIGHTS

-

Economic Indicators

-

-

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Johnny Chan

Johnny Chan