Global Equities

Economic Indicators

The United States economy is at a crossroads. Cracks are forming and growth is slowing as tariff policies weigh on hiring and curb consumer spending. On the other hand, generative artificial intelligence (AI) is driving a surge in productivity. The question is: Can AI fill the cracks in the U.S. economy?

My view is that headwinds from trade restrictions are real, but tailwinds from AI could be even more powerful. I expect GDP growth to slow to 1% or lower in the second half of 2025, but I don’t foresee a recession. In fact, the AI megatrend could become a structural tailwind and accelerate growth in 2026 and 2027.

Here are four charts to help explain why the U.S. economy may continue to show resilience.

1. Investments in AI have surpassed dot-com era

Tech companies have poured hundreds of billions of dollars into AI, despite concerns about future returns on their investment.

Most of that spending has been directed at building electricity intensive data centres. The boom has benefited certain U.S. based semiconductor, industrial and power generation companies. For example, Modine Manufacturing, which builds temperature management systems used in these centres, has seen its stock rise 22.1% this year as of August 26. Constellation Energy’s deals with tech giants Meta and Microsoft to supply data centres with nuclear power have helped propel its stock 41.5% over the same period.

Of course, all that spending begs the question: Is the U.S. headed for a bust that rivals the tech wreck in 2000? I wouldn’t rule out an “AI winter,” but the 1990s PC and internet revolution is different from today’s tech story. The former was about hardware, connectivity, networks and information, whereas AI is about extracting accumulated knowledge. And unlike the dot-com bubble, today’s companies are flush with cash and have robust earnings. Valuations vary widely, so deep, fundamental research can help separate the winners from the losers.

Ultimately, the biggest winners of the AI spending cycle may not yet exist. Early pioneers like Cisco built the internet infrastructure that gave rise to companies like Netflix, Amazon and Google. Today’s AI-infrastructure buildout could similarly pave the way for a new generation of businesses to flourish.

AI powers new tech investment cycle

Sources: Capital Group, U.S. Census Bureau, Bureau of Economic Analysis, Haver Analytics. R&D is research and development. As of August 20, 2025.

2. Productivity surges are rare — and this is one of them

Big surges in productivity are rare for developed economies. In the U.S., it took years for the personal computer and internet to deliver substantial productivity gains. I believe AI may have already ushered in a new era of exceptional productivity.

Producing more per hour allows companies to maintain or grow profits, even as wages and expenses rise. A high rate of productivity growth has long given the U.S. a structural advantage and contributes to its status as an economic leader. Compared to many developed economies, the U.S. leads in productivity.

I think U.S. productivity could nearly double to an annual rate of 4% per year over the next five years. This increase is constructive for GDP and may even help moderate inflation.

While I am concerned AI bottlenecks may dampen productivity potential, I’m hopeful advances could help solve these problems. Deployment costs for large language models (LLM) are 90% cheaper than they were two years ago.

I’m seeing the impact firsthand in my recent travels. At this summer’s annual conference for economists in Dublin, I noticed a significant increase in the number of people applying AI to their workflow. This story rhymes with Capital Group’s own AI usage: It’s widespread and has had cost and time-saving benefits beyond initial expectations. As a result, we’re putting more resources into employee training and agentic AI, which requires minimal human oversight.

U.S. widens lead in labour productivity

Sources: Capital Group, U.S. Bureau of Labor Statistics, European Central Bank, Japan Cabinet Office, U.K. Office for National Statistics, Haver Analytics. As of August 20, 2025.

3. Labour markets are rewiring for the future

From sewing machines to cars, new technologies have transformed labour markets. The personal computer’s impact on labour markets serves as a good reminder that tech innovations have created new, more numerous, and often higher paying jobs after an initial period of job displacement.

From 1970 to 2015, PCs destroyed 3.5 million U.S.-based jobs, largely related to typewriting, bookkeeping and auditing, according to a McKinsey & Company report. Over that same time frame, PCs also created 19.3 million jobs for a net gain of 15.8 million.

AI is likely no different, and the U.S. is witnessing some AI-related job displacement. It’s no coincidence layoffs are concentrated in tech companies heavily investing in AI. Many are focused on preserving profit margins, and several over hired during the pandemic. At the same time, they’re in bidding wars to hire AI researchers and developers.

Economists are beginning to include AI in economic models, and they’ve homed in on efficiency gains to understand AI’s impact on labour markets. Efficiency gains are higher for tasks with vast documentation such as law or coding, standardized tasks usually associated with entry-level positions, and high wage tasks ripe for cost cutting.

But it’s important to separate tasks from jobs. From my perspective, AI ultimately allows workers to focus on other, higher value activities and expand their current roles.

Of course, we can’t ignore the fact that tariffs and the uncertainty around them have led to layoffs and hiring freezes. The next few months could shed more light on the trajectory of job markets, but for now, I don’t see evidence of widespread pain.

U.S. jobs are shifting amid AI and tariffs

Sources: Capital Group, U.S. Bureau of Labor Statistics, European Central Bank, Japan Cabinet Office, U.K. Office for National Statistics, Haver Analytics. As of August 20, 2025.

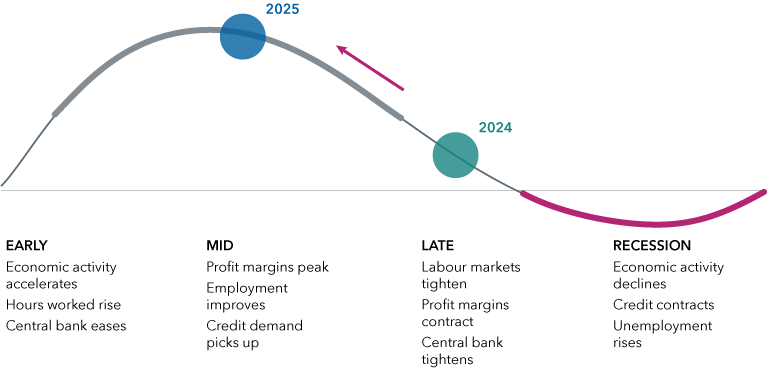

4. Signs point to a slowdown, not a recession

There are many reasons to worry about the U.S. economy. Inflation has ticked higher, job creation is down, and GDP is weakening. I believe these are signs of a mid-cycle economic slowdown rather than a recession.

That doesn’t mean there won’t be pain, particularly since the full effects of President Trump’s tariffs have yet to be realized. Additionally, equity market valuations are high, so any shock could change the narrative. An economic slowdown typically leaves little room for error.

Nevertheless, I believe tailwinds from AI will continue to drive investments and fill cracks in the U.S. economy. Company earnings have also generally held up, with some reporting healthy consumer spending, particularly among higher income customers. Disney CFO Hugh Johnston recently declared their consumers were doing very well. Finally, the U.S. Federal Reserve may soon restart its rate-cutting cycle, which could lower borrowing costs and help steer the economy out of a rough patch.

U.S. economy appears to be mid cycle

Source: Capital Group. Positions within the business cycle are estimates by Capital Group economists as of December 2023 (2024 bubble) and August 2025 (2025 bubble). The views of individual portfolio managers and analysts may differ.

Our latest insights

-

-

Demographics & Culture

-

-

Economic Indicators

-

U.S. Equities

RELATED INSIGHTS

-

Emerging Markets

-

Global Equities

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Jared Franz

Jared Franz